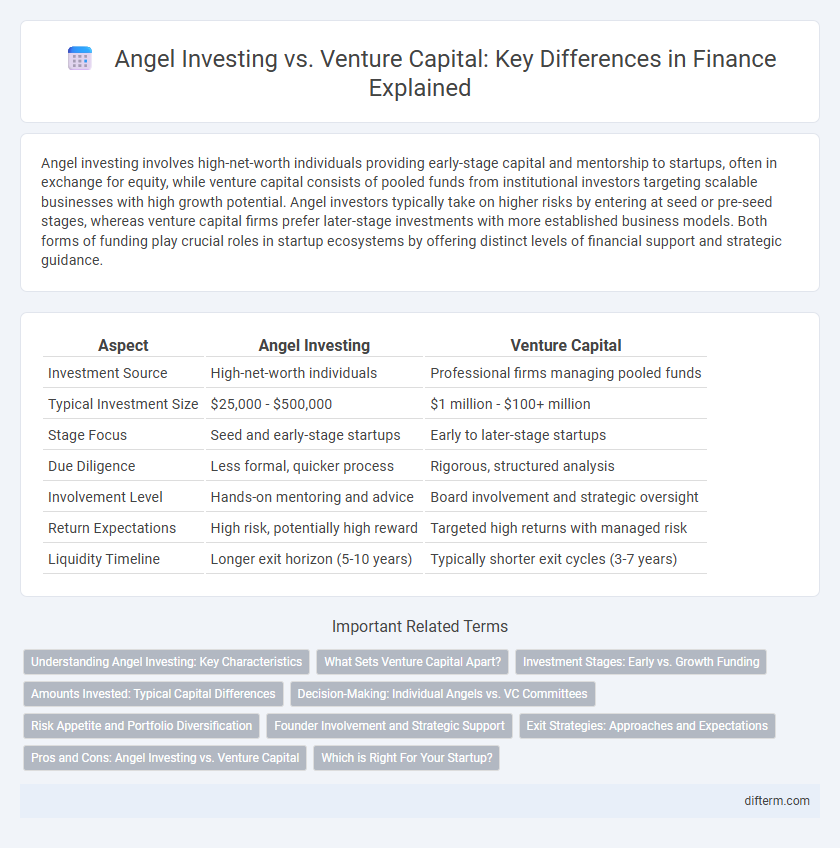

Angel investing involves high-net-worth individuals providing early-stage capital and mentorship to startups, often in exchange for equity, while venture capital consists of pooled funds from institutional investors targeting scalable businesses with high growth potential. Angel investors typically take on higher risks by entering at seed or pre-seed stages, whereas venture capital firms prefer later-stage investments with more established business models. Both forms of funding play crucial roles in startup ecosystems by offering distinct levels of financial support and strategic guidance.

Table of Comparison

| Aspect | Angel Investing | Venture Capital |

|---|---|---|

| Investment Source | High-net-worth individuals | Professional firms managing pooled funds |

| Typical Investment Size | $25,000 - $500,000 | $1 million - $100+ million |

| Stage Focus | Seed and early-stage startups | Early to later-stage startups |

| Due Diligence | Less formal, quicker process | Rigorous, structured analysis |

| Involvement Level | Hands-on mentoring and advice | Board involvement and strategic oversight |

| Return Expectations | High risk, potentially high reward | Targeted high returns with managed risk |

| Liquidity Timeline | Longer exit horizon (5-10 years) | Typically shorter exit cycles (3-7 years) |

Understanding Angel Investing: Key Characteristics

Angel investing involves affluent individuals providing early-stage capital to startups in exchange for equity, often during the seed or pre-seed rounds. These investors typically contribute not only funds but also mentorship, industry expertise, and extensive networks to help startups scale. Unlike venture capital firms, angel investments usually entail smaller amounts of capital, greater risk tolerance, and a more personal approach to investment decisions.

What Sets Venture Capital Apart?

Venture capital distinguishes itself through larger funding amounts, structured investment rounds, and active portfolio management aimed at scaling startups rapidly. Unlike angel investing, venture capital firms offer extensive networks, strategic guidance, and follow-on funding to optimize growth potential. This professionalized approach targets high-growth companies with scalable business models, driving significant returns over a defined investment horizon.

Investment Stages: Early vs. Growth Funding

Angel investing typically targets the earliest stages of a startup, providing seed and pre-seed funding to help entrepreneurs develop prototypes and gain initial market traction. Venture capital focuses on growth funding, investing larger sums during Series A and beyond to scale operations, expand market reach, and accelerate revenue generation. The distinction in investment stages highlights angel investors' role in mitigating early risk, while venture capitalists drive expansion and prepare companies for exit strategies.

Amounts Invested: Typical Capital Differences

Angel investing typically involves individual investors committing between $25,000 and $100,000 per deal, targeting early-stage startups. Venture capital firms, on the other hand, invest significantly larger amounts, often ranging from $1 million to over $10 million, focusing on companies with proven traction. These capital differences reflect the varying levels of risk tolerance and growth expectations associated with angel investors versus venture capitalists.

Decision-Making: Individual Angels vs. VC Committees

Individual angel investors often rely on personal experience, intuition, and quicker decision-making processes to evaluate startups, enabling faster funding rounds. Venture capital committees utilize collective expertise, structured due diligence, and consensus-building, which can prolong decisions but reduce risk through diversified judgment. The difference in decision-making dynamics significantly impacts both the speed and scale of investments.

Risk Appetite and Portfolio Diversification

Angel investors typically exhibit a higher risk appetite by funding early-stage startups with unproven business models, aiming for substantial long-term returns despite potential failures. Venture capitalists pursue a more balanced approach, investing in later-stage companies with validated products to optimize portfolio diversification and mitigate losses. Both investment types enhance portfolio diversification but differ in their risk tolerance and stage focus within the startup ecosystem.

Founder Involvement and Strategic Support

Angel investors typically provide more hands-on founder involvement and personalized strategic support due to their individual investment style and often smaller portfolio size. Venture capital firms offer structured strategic guidance through experienced teams and resources, focusing on scaling the business rapidly with formalized mentorship programs. Founders often find angel investors more flexible for early-stage advisory, while venture capitalists bring extensive networks and operational expertise for growth acceleration.

Exit Strategies: Approaches and Expectations

Exit strategies in angel investing typically emphasize acquisitions or early-stage buyouts, offering investors quicker returns through smaller, seed-funded companies. Venture capital exit approaches often involve initial public offerings (IPOs) or large-scale mergers, aiming for substantial gains from mature startups with high growth potential. The expected timeline for angel investors is generally shorter, around 3-5 years, whereas venture capitalists anticipate 5-10 years for a successful exit.

Pros and Cons: Angel Investing vs. Venture Capital

Angel investing offers early-stage funding with more flexible terms and personal mentorship but carries higher risk and typically smaller capital amounts. Venture capital provides substantial funding and strategic support for scalable startups, though it often demands significant equity and board control. Both forms of investment influence startup growth differently, with angel investing suited for initial phases and venture capital more aligned with expansion.

Which is Right For Your Startup?

Angel investing typically involves high-net-worth individuals providing early-stage capital in exchange for equity, ideal for startups seeking smaller amounts and strategic guidance. Venture capital offers larger funding rounds from institutional investors, best suited for startups with proven traction aiming for rapid growth and scalability. Choosing between angel investing and venture capital depends on your startup's stage, funding needs, and long-term vision for expansion.

Angel Investing vs Venture Capital Infographic

difterm.com

difterm.com