Internal Rate of Return (IRR) calculates the profitability of an investment by finding the discount rate that sets the net present value (NPV) to zero, but it assumes reinvestment at the same IRR which may not be realistic. Modified Internal Rate of Return (MIRR) addresses this limitation by assuming reinvestment at the firm's cost of capital, providing a more accurate measure of investment performance. MIRR offers a clearer comparison between projects by reflecting true profitability and capital efficiency more effectively than IRR.

Table of Comparison

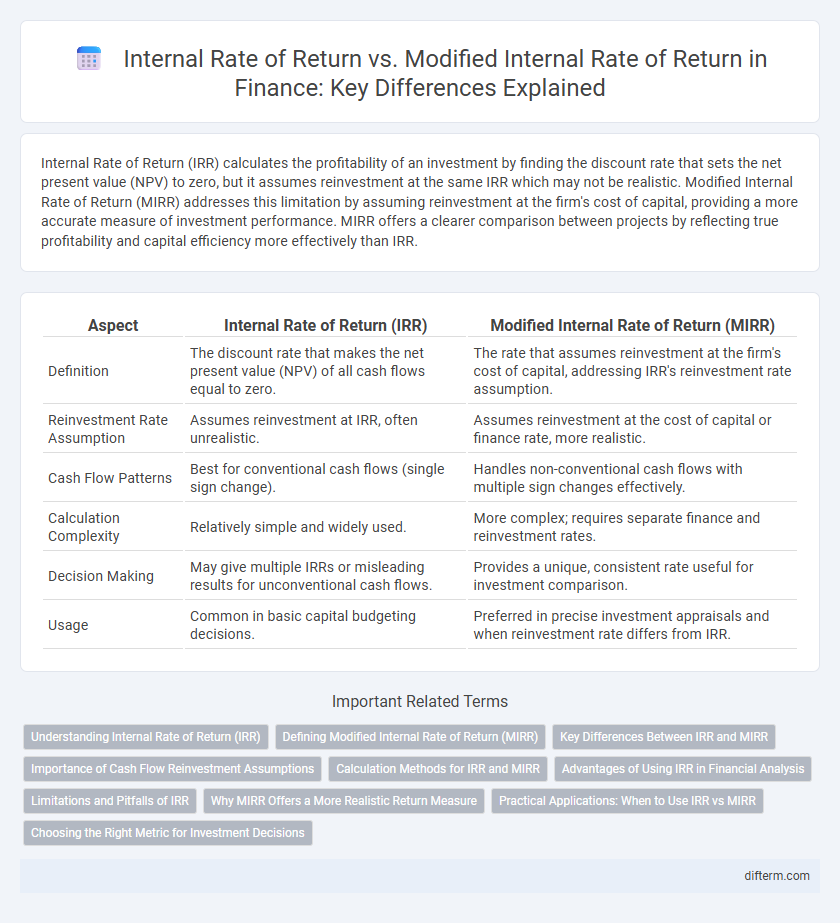

| Aspect | Internal Rate of Return (IRR) | Modified Internal Rate of Return (MIRR) |

|---|---|---|

| Definition | The discount rate that makes the net present value (NPV) of all cash flows equal to zero. | The rate that assumes reinvestment at the firm's cost of capital, addressing IRR's reinvestment rate assumption. |

| Reinvestment Rate Assumption | Assumes reinvestment at IRR, often unrealistic. | Assumes reinvestment at the cost of capital or finance rate, more realistic. |

| Cash Flow Patterns | Best for conventional cash flows (single sign change). | Handles non-conventional cash flows with multiple sign changes effectively. |

| Calculation Complexity | Relatively simple and widely used. | More complex; requires separate finance and reinvestment rates. |

| Decision Making | May give multiple IRRs or misleading results for unconventional cash flows. | Provides a unique, consistent rate useful for investment comparison. |

| Usage | Common in basic capital budgeting decisions. | Preferred in precise investment appraisals and when reinvestment rate differs from IRR. |

Understanding Internal Rate of Return (IRR)

Internal Rate of Return (IRR) calculates the discount rate that makes the net present value (NPV) of a project's cash flows equal to zero, serving as a key metric for assessing investment profitability. IRR assumes reinvestment of interim cash flows at the same rate, which can lead to overestimation of returns when compared to Modified Internal Rate of Return (MIRR). Understanding IRR's limitations in reflecting realistic reinvestment rates is crucial for accurate capital budgeting decisions.

Defining Modified Internal Rate of Return (MIRR)

Modified Internal Rate of Return (MIRR) refines the traditional Internal Rate of Return (IRR) by incorporating both the cost of investment and the reinvestment rate of cash flows, providing a more accurate measure of a project's profitability. MIRR assumes positive cash flows are reinvested at the firm's cost of capital rather than the IRR itself, addressing the unrealistic reinvestment rate assumption in standard IRR calculations. This adjustment makes MIRR a more reliable metric for comparing mutually exclusive projects and capital budgeting decisions.

Key Differences Between IRR and MIRR

Internal Rate of Return (IRR) calculates the discount rate that sets the net present value of cash flows to zero, assuming reinvestment at the IRR itself, while Modified Internal Rate of Return (MIRR) uses a more realistic reinvestment rate, typically the firm's cost of capital or finance rate. MIRR addresses IRR's multiple rate problem by incorporating both finance costs and reinvestment returns, providing a more accurate measure of project profitability. Comparing IRR and MIRR clarifies investment decisions by adjusting for the reinvestment assumption and resolving ambiguity in projects with non-normal cash flows.

Importance of Cash Flow Reinvestment Assumptions

Internal Rate of Return (IRR) assumes reinvestment of cash flows at the IRR itself, potentially leading to overestimated project profitability. Modified Internal Rate of Return (MIRR) provides a more realistic evaluation by assuming reinvestment at the firm's cost of capital, reflecting actual reinvestment opportunities. Understanding these cash flow reinvestment assumptions is crucial for accurate investment appraisal and better capital budgeting decisions.

Calculation Methods for IRR and MIRR

The Internal Rate of Return (IRR) calculates the discount rate where the net present value (NPV) of cash flows equals zero, relying solely on the project's inflows and outflows without reinvestment assumptions. Modified Internal Rate of Return (MIRR) improves on IRR by incorporating the cost of capital for financing and the reinvestment rate for positive cash flows, providing a more realistic measure of profitability. MIRR uses separate rates for borrowing costs and reinvestment, making it a superior calculation method for evaluating project efficiency compared to the traditional IRR formula.

Advantages of Using IRR in Financial Analysis

Internal Rate of Return (IRR) offers a clear metric for evaluating the profitability of investments by identifying the exact discount rate that makes the net present value (NPV) of cash flows zero, simplifying decision-making in capital budgeting. IRR's straightforward percentage format enables easy comparison across multiple projects, facilitating quick prioritization based on expected returns. Its widespread acceptance in financial analysis supports consistent communication among investors and stakeholders, enhancing transparency and strategic alignment.

Limitations and Pitfalls of IRR

Internal Rate of Return (IRR) often presents limitations such as assuming reinvestment of cash flows at the same IRR, which may lead to overestimating project profitability. IRR can produce multiple values or no value for non-conventional cash flows, complicating decision-making processes. Modified Internal Rate of Return (MIRR) addresses these pitfalls by factoring in realistic reinvestment rates and providing a single, more accurate measure of investment performance.

Why MIRR Offers a More Realistic Return Measure

The Modified Internal Rate of Return (MIRR) offers a more realistic return measure by addressing the reinvestment rate assumption shortcoming of the Internal Rate of Return (IRR). MIRR assumes reinvestment at the project's cost of capital rather than the IRR itself, providing a clearer picture of investment profitability and risk. This adjustment makes MIRR particularly valuable in evaluating projects with multiple cash flow sign changes or varied reinvestment opportunities, enhancing decision-making accuracy.

Practical Applications: When to Use IRR vs MIRR

Internal Rate of Return (IRR) is commonly used for evaluating the profitability of individual projects with consistent reinvestment assumptions, making it ideal for straightforward capital budgeting decisions. Modified Internal Rate of Return (MIRR) provides a more accurate reflection of project value by assuming reinvestment at the firm's cost of capital, which is particularly useful for comparing projects with different risk profiles or cash flow patterns. Financial analysts prefer MIRR when assessing complex investments or portfolios because it avoids the multiple IRR problem and better aligns with real-world financial assumptions.

Choosing the Right Metric for Investment Decisions

Internal Rate of Return (IRR) measures the profitability of potential investments by calculating the discount rate that sets net present value (NPV) to zero, while Modified Internal Rate of Return (MIRR) addresses IRR's reinvestment rate assumptions and provides a more realistic profitability measure by incorporating cost of capital and reinvestment rate. Choosing the right metric depends on project characteristics; IRR is useful for standard cash flows with consistent reinvestment assumptions, whereas MIRR gives a more accurate evaluation for projects with non-conventional cash flows or varying reinvestment rates. Investors seeking precise valuation and comparison of mutually exclusive projects often prefer MIRR for its ability to overcome IRR's limitations in capital budgeting decisions.

Internal rate of return vs Modified internal rate of return Infographic

difterm.com

difterm.com