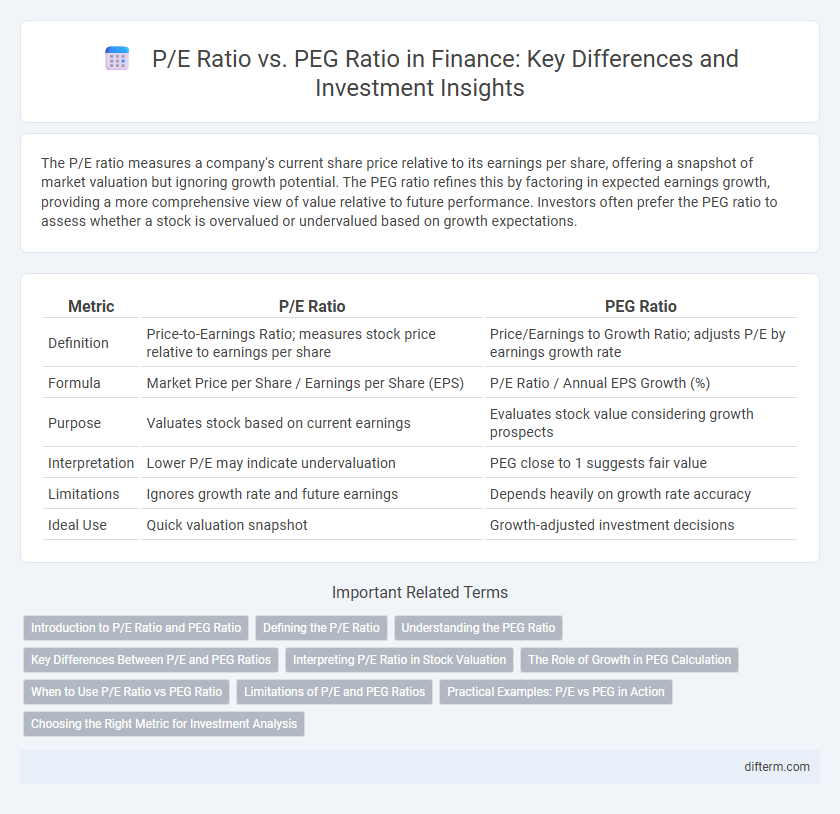

The P/E ratio measures a company's current share price relative to its earnings per share, offering a snapshot of market valuation but ignoring growth potential. The PEG ratio refines this by factoring in expected earnings growth, providing a more comprehensive view of value relative to future performance. Investors often prefer the PEG ratio to assess whether a stock is overvalued or undervalued based on growth expectations.

Table of Comparison

| Metric | P/E Ratio | PEG Ratio |

|---|---|---|

| Definition | Price-to-Earnings Ratio; measures stock price relative to earnings per share | Price/Earnings to Growth Ratio; adjusts P/E by earnings growth rate |

| Formula | Market Price per Share / Earnings per Share (EPS) | P/E Ratio / Annual EPS Growth (%) |

| Purpose | Valuates stock based on current earnings | Evaluates stock value considering growth prospects |

| Interpretation | Lower P/E may indicate undervaluation | PEG close to 1 suggests fair value |

| Limitations | Ignores growth rate and future earnings | Depends heavily on growth rate accuracy |

| Ideal Use | Quick valuation snapshot | Growth-adjusted investment decisions |

Introduction to P/E Ratio and PEG Ratio

The Price-to-Earnings (P/E) ratio measures a company's current share price relative to its earnings per share, providing a snapshot of valuation based on profitability. The Price/Earnings-to-Growth (PEG) ratio refines this by incorporating expected earnings growth, offering a more dynamic assessment of value relative to growth potential. Investors use both metrics to evaluate stock attractiveness, with PEG often favored for growth-oriented analysis.

Defining the P/E Ratio

The Price-to-Earnings (P/E) ratio measures a company's current share price relative to its earnings per share (EPS), indicating how much investors are willing to pay for each dollar of earnings. This widely used metric helps assess whether a stock is overvalued or undervalued compared to its profits. Investors use the P/E ratio to compare companies within the same industry, guiding investment decisions based on relative valuation.

Understanding the PEG Ratio

The PEG ratio refines the P/E ratio by incorporating a company's expected earnings growth rate, providing a more comprehensive valuation metric. A lower PEG ratio generally indicates that a stock may be undervalued relative to its growth potential, making it a crucial tool for investors seeking growth at a reasonable price. Unlike the P/E ratio, which only considers current earnings, the PEG ratio accounts for future earnings growth, enhancing investment decision accuracy in dynamic market conditions.

Key Differences Between P/E and PEG Ratios

The P/E ratio measures a company's current share price relative to its earnings per share, providing insight into valuation based on present earnings. The PEG ratio adjusts the P/E ratio by incorporating expected earnings growth, offering a more dynamic valuation metric that accounts for future profitability. Key differences include the P/E ratio's emphasis on current valuation versus the PEG ratio's integration of growth potential, making PEG more useful for comparing companies with varying growth rates.

Interpreting P/E Ratio in Stock Valuation

The Price-to-Earnings (P/E) ratio measures a stock's current price relative to its earnings per share, serving as a key indicator of market expectations for a company's profitability. A high P/E ratio often signals investor confidence in future growth but may also indicate overvaluation, while a low P/E ratio can suggest undervaluation or concerns about earnings sustainability. Interpreting the P/E ratio alongside other metrics such as growth rates and industry averages provides a more comprehensive understanding of a stock's true value.

The Role of Growth in PEG Calculation

The Price-to-Earnings (P/E) ratio measures a company's current share price relative to its earnings per share, but it does not account for growth potential. The Price/Earnings to Growth (PEG) ratio incorporates earnings growth rate, providing a more nuanced valuation by dividing the P/E ratio by the projected annual earnings growth. This adjustment helps investors assess whether a stock is undervalued or overvalued based on its expected growth trajectory, making the PEG ratio a critical metric for growth-focused investment decisions.

When to Use P/E Ratio vs PEG Ratio

Use the P/E ratio to evaluate a stock's current valuation relative to its earnings, especially for mature companies with stable growth rates. The PEG ratio is more appropriate when assessing companies with high or variable growth, as it adjusts the P/E ratio by the expected earnings growth rate, offering a more nuanced valuation metric. Investors seeking to compare growth potential alongside valuation will find the PEG ratio more insightful for dynamic industries or emerging companies.

Limitations of P/E and PEG Ratios

The P/E ratio often fails to account for growth rates, leading to misleading valuations for high-growth companies, while the PEG ratio attempts to incorporate growth by dividing the P/E by earnings growth but can be inaccurate when growth estimates are volatile or subjective. Both ratios rely heavily on earnings figures, which may be affected by accounting practices or one-time events, thus limiting their reliability. Investors should consider complementary metrics and qualitative factors to achieve a comprehensive valuation analysis.

Practical Examples: P/E vs PEG in Action

The P/E ratio measures a company's current share price relative to its earnings per share, providing a snapshot of valuation, while the PEG ratio adjusts this by factoring in earnings growth, offering a more dynamic perspective. For example, a tech firm with a high P/E ratio but rapid earnings growth may have a low PEG ratio, indicating potential undervaluation compared to a slow-growing company with a similarly high P/E. Investors use these ratios together to balance price and growth, selecting stocks that appear reasonably priced when future earnings are considered.

Choosing the Right Metric for Investment Analysis

The P/E ratio measures a company's current share price relative to its earnings per share, offering a snapshot of valuation but can be misleading for high-growth firms. The PEG ratio adjusts the P/E ratio by factoring in earnings growth, providing a more comprehensive view for assessing growth potential and valuation simultaneously. Investors seeking sustainable long-term opportunities often prefer the PEG ratio to better gauge whether a stock is undervalued relative to its expected growth trajectory.

P/E Ratio vs PEG Ratio Infographic

difterm.com

difterm.com