The prime rate is the interest rate that commercial banks charge their most creditworthy customers, often used as a benchmark for various loans, while LIBOR (London Interbank Offered Rate) represents the average interest rate at which major global banks lend to one another. LIBOR is widely utilized as a reference rate for adjustable-rate loans and financial derivatives across international markets. Differences between these rates affect borrowing costs and financial contracts, making it essential to understand their distinct roles in the finance and pet industry lending landscape.

Table of Comparison

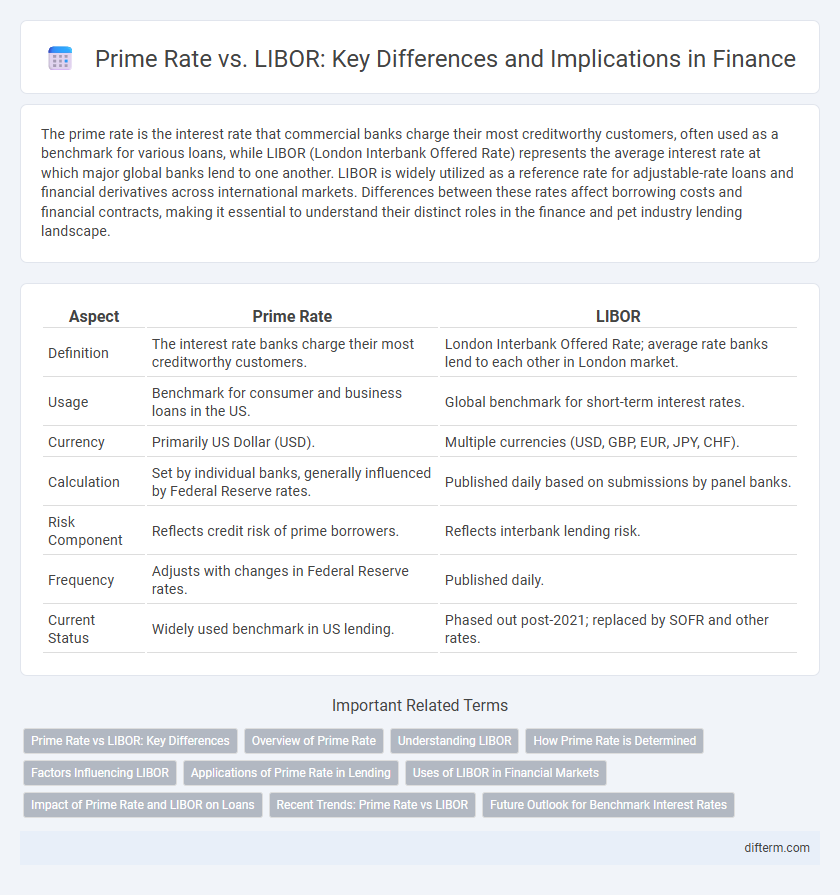

| Aspect | Prime Rate | LIBOR |

|---|---|---|

| Definition | The interest rate banks charge their most creditworthy customers. | London Interbank Offered Rate; average rate banks lend to each other in London market. |

| Usage | Benchmark for consumer and business loans in the US. | Global benchmark for short-term interest rates. |

| Currency | Primarily US Dollar (USD). | Multiple currencies (USD, GBP, EUR, JPY, CHF). |

| Calculation | Set by individual banks, generally influenced by Federal Reserve rates. | Published daily based on submissions by panel banks. |

| Risk Component | Reflects credit risk of prime borrowers. | Reflects interbank lending risk. |

| Frequency | Adjusts with changes in Federal Reserve rates. | Published daily. |

| Current Status | Widely used benchmark in US lending. | Phased out post-2021; replaced by SOFR and other rates. |

Prime Rate vs LIBOR: Key Differences

The Prime Rate is the interest rate banks charge their most creditworthy customers, typically influenced by the federal funds rate, while LIBOR (London Interbank Offered Rate) represents the average rate at which major global banks lend to one another on the London market. Prime Rate is primarily used for consumer and small business loans in the U.S., whereas LIBOR serves as a benchmark for a wide range of international financial instruments, including derivatives and syndicated loans. Differences in calculation methods and usage impact the risk, pricing, and accessibility of credit worldwide.

Overview of Prime Rate

The prime rate is the interest rate commercial banks charge their most creditworthy customers, typically large corporations, and serves as a benchmark for various loan products, including small business and consumer loans. It is influenced primarily by the federal funds rate set by the Federal Reserve, reflecting overall U.S. monetary policy and economic conditions. The prime rate usually remains about 3 percentage points above the federal funds rate, providing a standardized reference point for loan interest rates in the financial industry.

Understanding LIBOR

LIBOR, or the London Interbank Offered Rate, serves as a global benchmark interest rate used by banks to lend to one another in the short-term money markets. Unlike the Prime Rate, which reflects the rate commercial banks charge their most creditworthy customers, LIBOR is derived from submissions by a panel of major banks, indicating the average rate at which they can borrow unsecured funds. Understanding LIBOR's calculation and its role as a reference rate in derivatives, loans, and mortgages is critical for assessing financial contracts and market risk exposure.

How Prime Rate is Determined

The prime rate is determined primarily by the federal funds target rate set by the Federal Reserve, reflecting the cost banks pay to borrow from each other overnight. Large commercial banks establish the prime rate as a benchmark for short-term loans to their most creditworthy customers, typically adding a markup of about 3 percentage points above the federal funds rate. Changes in the prime rate closely track shifts in monetary policy, influencing lending rates for mortgages, credit cards, and business loans.

Factors Influencing LIBOR

LIBOR is influenced by factors such as interbank lending demand, central bank monetary policies, and overall market liquidity conditions. Changes in credit risk perceptions and regulatory reforms also significantly impact LIBOR rates. Unlike the Prime rate, which is set by individual banks, LIBOR reflects the average borrowing costs among major global banks in the London market.

Applications of Prime Rate in Lending

The prime rate serves as a benchmark for various lending products, including adjustable-rate mortgages, home equity lines of credit, and small business loans, directly influencing the interest rates borrowers pay. Financial institutions often set loan interest rates by adding a margin to the prime rate, ensuring flexibility in credit pricing based on market conditions. Unlike LIBOR, which primarily guides international and large-scale financial transactions, the prime rate is more commonly applied to consumer and commercial loans within domestic banking systems.

Uses of LIBOR in Financial Markets

LIBOR serves as a critical benchmark interest rate used to price a wide range of financial instruments, including derivatives, mortgages, and corporate loans. Its influence extends to adjusting floating-rate loans and determining cash-settled payments in interest rate swaps. Financial markets rely on LIBOR for liquidity management and risk assessment across global banking sectors.

Impact of Prime Rate and LIBOR on Loans

The Prime Rate directly influences the interest rates on consumer loans such as credit cards, home equity lines, and small business loans, often serving as a benchmark for variable-rate loans. LIBOR (London Interbank Offered Rate), historically used as a global reference rate for short-term loans and derivatives, impacts international lending costs and financial contracts, affecting large-scale corporate and interbank loans. Changes in the Prime Rate typically result in immediate adjustments in consumer borrowing costs, while shifts in LIBOR affect a broader range of financial products, influencing global interest rates and loan pricing strategies.

Recent Trends: Prime Rate vs LIBOR

The prime rate has experienced moderate increases recently due to central bank tightening, reflecting rising short-term borrowing costs for consumers and businesses. In contrast, LIBOR rates have shown heightened volatility amid regulatory reforms and the transition to alternative benchmarks like SOFR, impacting financial contracts tied to LIBOR. Market participants are closely monitoring these trends to adjust loan pricing and risk management strategies in response to evolving interest rate benchmarks.

Future Outlook for Benchmark Interest Rates

Prime rate remains closely tied to the Federal Reserve's policy decisions, serving as a critical benchmark for consumer and business loans in the U.S. LIBOR, despite its gradual phase-out, still influences a wide range of global financial instruments but is being replaced by alternative reference rates like SOFR. Future outlook indicates increased reliance on risk-free rates for transparency and stability, with regulators emphasizing the transition to more robust benchmarks amid evolving market conditions.

Prime rate vs LIBOR Infographic

difterm.com

difterm.com