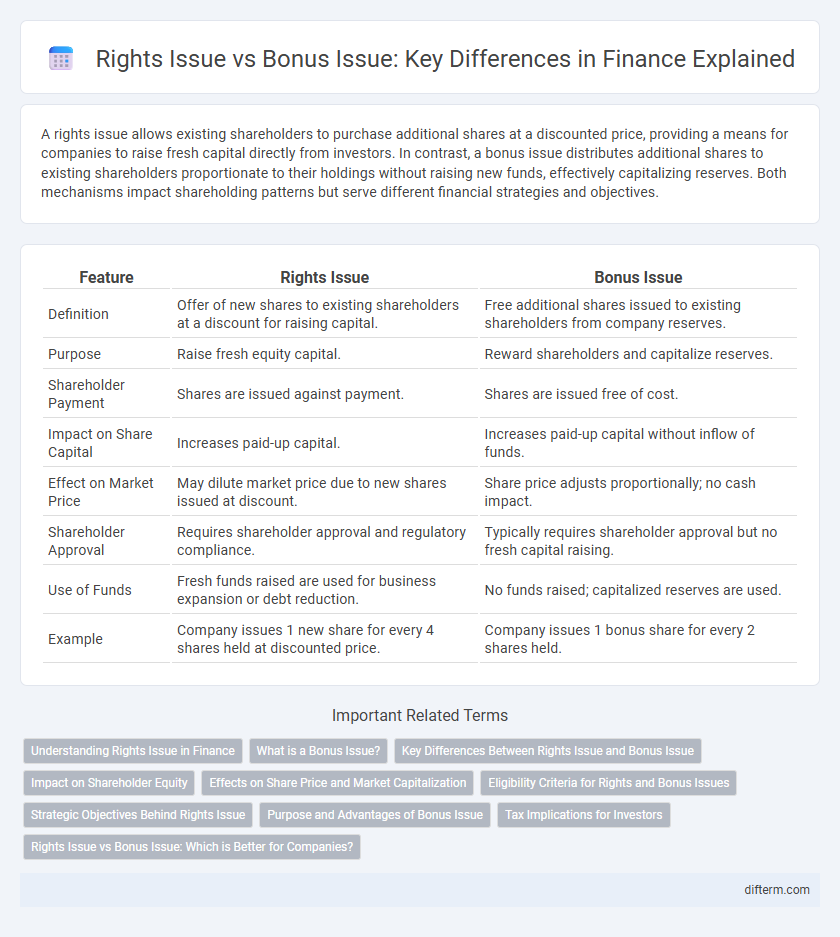

A rights issue allows existing shareholders to purchase additional shares at a discounted price, providing a means for companies to raise fresh capital directly from investors. In contrast, a bonus issue distributes additional shares to existing shareholders proportionate to their holdings without raising new funds, effectively capitalizing reserves. Both mechanisms impact shareholding patterns but serve different financial strategies and objectives.

Table of Comparison

| Feature | Rights Issue | Bonus Issue |

|---|---|---|

| Definition | Offer of new shares to existing shareholders at a discount for raising capital. | Free additional shares issued to existing shareholders from company reserves. |

| Purpose | Raise fresh equity capital. | Reward shareholders and capitalize reserves. |

| Shareholder Payment | Shares are issued against payment. | Shares are issued free of cost. |

| Impact on Share Capital | Increases paid-up capital. | Increases paid-up capital without inflow of funds. |

| Effect on Market Price | May dilute market price due to new shares issued at discount. | Share price adjusts proportionally; no cash impact. |

| Shareholder Approval | Requires shareholder approval and regulatory compliance. | Typically requires shareholder approval but no fresh capital raising. |

| Use of Funds | Fresh funds raised are used for business expansion or debt reduction. | No funds raised; capitalized reserves are used. |

| Example | Company issues 1 new share for every 4 shares held at discounted price. | Company issues 1 bonus share for every 2 shares held. |

Understanding Rights Issue in Finance

A Rights Issue in finance allows existing shareholders to purchase additional shares at a discounted price before the company offers them to the public, helping raise capital while maintaining shareholder control. This mechanism prevents dilution of ownership by giving shareholders the opportunity to retain their proportional equity. Rights Issues are often used by companies to finance expansion, reduce debt, or improve working capital without increasing leverage.

What is a Bonus Issue?

A bonus issue, also known as a scrip issue or capitalization issue, involves the company distributing additional shares to existing shareholders without any extra cost, proportional to their current holdings. This method increases the total number of shares outstanding while reallocating reserves into issued share capital, without impacting the company's market capitalization. Bonus issues enhance liquidity and signal management's confidence in future earnings, often strengthening shareholder value.

Key Differences Between Rights Issue and Bonus Issue

Rights issues involve offering existing shareholders the option to purchase additional shares at a discounted price, enabling companies to raise fresh capital by issuing new equity. Bonus issues, also called scrip dividends, distribute additional shares to existing shareholders for free by capitalizing retained earnings, increasing shareholding without raising new funds. The primary differences lie in capital infusion through rights issues versus share capital restructuring in bonus issues, affecting shareholder wealth and company reserves distinctly.

Impact on Shareholder Equity

A rights issue increases shareholder equity by raising new capital through the sale of additional shares to existing shareholders, thus expanding the company's equity base and potentially diluting ownership percentages. A bonus issue reallocates retained earnings to share capital by issuing free shares, increasing the number of shares held without changing the total shareholder equity value. Both impact shareholder equity differently: rights issues raise funds and alter equity composition, while bonus issues maintain equity value but adjust the share distribution.

Effects on Share Price and Market Capitalization

Rights issues typically lead to a temporary dilution of share price due to the discounted price offered to existing shareholders, while the overall market capitalization remains relatively stable as new equity is raised. Bonus issues increase the number of shares held by shareholders without altering market capitalization, often resulting in a proportional decrease in share price to reflect the higher share count. Both mechanisms impact investor perception and liquidity but affect share price and market capitalization through distinct processes.

Eligibility Criteria for Rights and Bonus Issues

Rights issues require shareholders to be on the company's register of members by a specified record date, ensuring eligibility to purchase additional shares at a discounted price. Bonus issues are distributed to existing shareholders based on the number of shares held on the record date, rewarding investors proportionally without any payment required. Eligibility for both rights and bonus issues depends on holding shares before the declared record date, as verified by the company's share registry.

Strategic Objectives Behind Rights Issue

Rights issues serve as a strategic tool for companies to raise fresh capital by offering existing shareholders the opportunity to purchase additional shares at a discounted price, enabling the firm to fund expansion projects, reduce debt, or improve working capital. This method maintains shareholder ownership proportionally while signaling confidence in future growth prospects, which can positively influence market perception. Unlike bonus issues that redistribute retained earnings without generating new funds, rights issues provide essential financing aligned with specific corporate objectives and long-term value creation.

Purpose and Advantages of Bonus Issue

Bonus issues distribute additional shares to existing shareholders without extra cost, enhancing liquidity and marketability. They signal company confidence by capitalizing reserves, which may increase investor trust and stock demand. Unlike rights issues, bonus shares do not require shareholder capital infusion, avoiding dilution of ownership stakes.

Tax Implications for Investors

Rights issues generally lead to taxable events since investors pay to acquire additional shares, potentially impacting capital gains tax calculations. Bonus issues, being free shares allocated from the company's reserves, typically do not trigger immediate tax liabilities, though the cost base for future capital gains tax is adjusted. Investors must consider how these tax implications affect their overall portfolio strategy and potential returns.

Rights Issue vs Bonus Issue: Which is Better for Companies?

Rights issues allow companies to raise fresh capital by offering shares to existing shareholders at a discounted price, helping to fund expansion or reduce debt without diluting ownership significantly. Bonus issues reward shareholders by converting reserves into additional shares, enhancing liquidity but not providing new funds for the company. For companies seeking immediate capital infusion, rights issues are more advantageous, while bonus issues are preferred to maintain shareholder goodwill without altering the capital base.

Rights Issue vs Bonus Issue Infographic

difterm.com

difterm.com