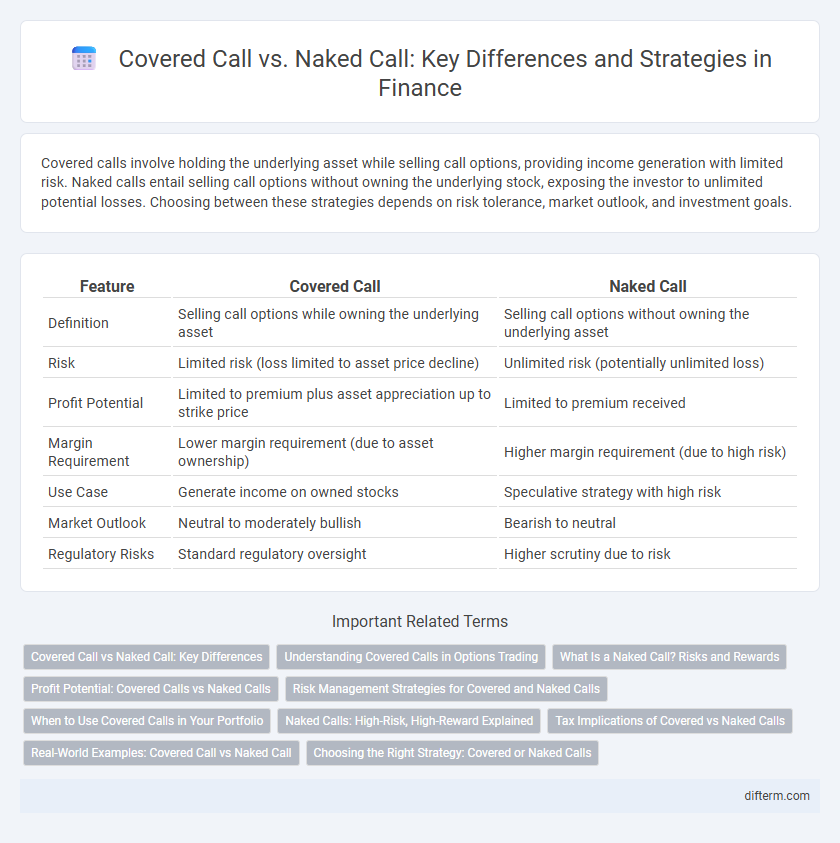

Covered calls involve holding the underlying asset while selling call options, providing income generation with limited risk. Naked calls entail selling call options without owning the underlying stock, exposing the investor to unlimited potential losses. Choosing between these strategies depends on risk tolerance, market outlook, and investment goals.

Table of Comparison

| Feature | Covered Call | Naked Call |

|---|---|---|

| Definition | Selling call options while owning the underlying asset | Selling call options without owning the underlying asset |

| Risk | Limited risk (loss limited to asset price decline) | Unlimited risk (potentially unlimited loss) |

| Profit Potential | Limited to premium plus asset appreciation up to strike price | Limited to premium received |

| Margin Requirement | Lower margin requirement (due to asset ownership) | Higher margin requirement (due to high risk) |

| Use Case | Generate income on owned stocks | Speculative strategy with high risk |

| Market Outlook | Neutral to moderately bullish | Bearish to neutral |

| Regulatory Risks | Standard regulatory oversight | Higher scrutiny due to risk |

Covered Call vs Naked Call: Key Differences

Covered calls involve holding the underlying stock while selling call options, providing income through premiums and limited risk due to stock ownership. Naked calls are selling call options without owning the underlying asset, exposing traders to unlimited risk if the stock price rises sharply. The key difference lies in risk exposure: covered calls offer downside protection by stock ownership, whereas naked calls carry significant risk from potential unlimited losses.

Understanding Covered Calls in Options Trading

Covered calls involve holding a long position in a stock while simultaneously selling call options on the same asset, generating premium income and providing downside protection. This strategy limits upside potential but enhances returns in a neutral to moderately bullish market by collecting option premiums. Understanding covered calls is crucial for managing risk and improving income streams in options trading portfolios.

What Is a Naked Call? Risks and Rewards

A naked call is an options strategy where the seller writes call options without owning the underlying asset, exposing them to unlimited risk if the asset's price rises significantly. The primary risk involves potentially unlimited losses, as the seller must purchase the asset at a high market price to fulfill the option contract. The reward is limited to the premium received from selling the call, making this strategy highly speculative and suitable only for experienced traders with risk tolerance.

Profit Potential: Covered Calls vs Naked Calls

Covered calls generate limited profit by capping the upside potential at the strike price plus premium received, providing steady income while reducing risk through stock ownership. Naked calls offer unlimited profit potential as sellers collect the premium without holding the underlying stock but face unlimited risk if the stock price rises significantly. Investors prioritize covered calls for stable returns and risk management, whereas naked calls appeal to those seeking higher returns with elevated risk exposure.

Risk Management Strategies for Covered and Naked Calls

Covered call strategies mitigate risk by combining long stock ownership with selling call options, limiting downside exposure while generating income from option premiums. Naked calls pose significant risk since the seller holds no offsetting stock position, exposing them to unlimited losses if the underlying asset's price rises sharply. Effective risk management for naked calls involves maintaining sufficient margin and employing stop-loss orders to prevent catastrophic financial exposure.

When to Use Covered Calls in Your Portfolio

Covered calls are ideal for investors seeking to generate income from their existing stock holdings while reducing downside risk through premium collection. This strategy is most effective in neutral to moderately bullish markets where the underlying stock price is expected to remain stable or rise slightly. Employing covered calls helps enhance portfolio returns by providing a steady cash flow without relinquishing the long-term ownership benefits of the equity.

Naked Calls: High-Risk, High-Reward Explained

Naked calls involve selling call options without owning the underlying asset, exposing traders to unlimited loss potential if the stock price rises sharply. This high-risk strategy offers significant profit from premiums but demands careful risk management and market monitoring. Investors should understand volatility and leverage implications before engaging in naked call selling to avoid catastrophic financial outcomes.

Tax Implications of Covered vs Naked Calls

Covered calls generate tax obligations based on the premium received, which is typically treated as short-term capital gains and taxed at ordinary income rates. Naked calls expose investors to potentially unlimited losses, with the premium also taxed as short-term gains, but any resulting losses carry significant implications for tax reporting and can offset other income. Understanding the distinct tax treatments and reporting requirements of covered versus naked call strategies is crucial for optimizing after-tax returns in options trading.

Real-World Examples: Covered Call vs Naked Call

A covered call involves owning the underlying stock while selling call options, as seen when investors hold 100 shares of Apple and sell call options to generate income, reducing potential downside risk. In contrast, a naked call lacks stock ownership, such as a trader selling Tesla call options without holding shares, posing unlimited risk if the stock price rises sharply. Real-world examples highlight that covered calls provide income with limited risk, whereas naked calls expose traders to substantial losses in volatile markets.

Choosing the Right Strategy: Covered or Naked Calls

Selecting the appropriate options strategy requires analyzing risk tolerance, market outlook, and investment goals. Covered calls provide income with limited risk by holding the underlying stock, while naked calls entail unlimited risk without owning the asset, suitable only for advanced traders. Assessing volatility, margin requirements, and potential losses ensures an informed decision between conservative income generation and high-risk speculation.

Covered Call vs Naked Call Infographic

difterm.com

difterm.com