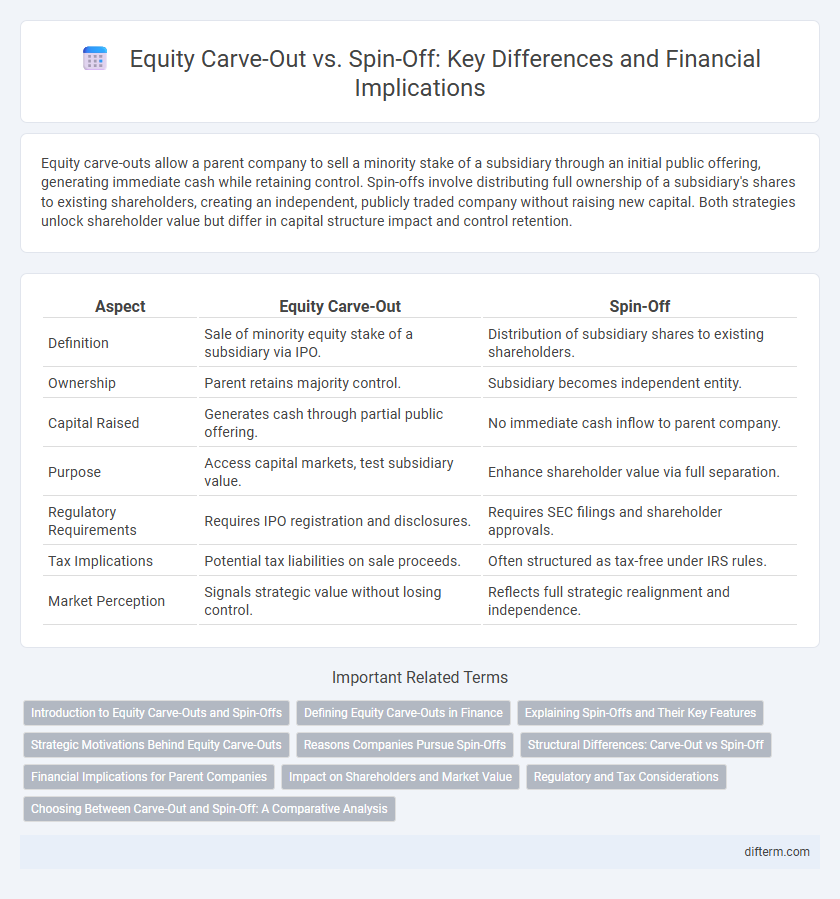

Equity carve-outs allow a parent company to sell a minority stake of a subsidiary through an initial public offering, generating immediate cash while retaining control. Spin-offs involve distributing full ownership of a subsidiary's shares to existing shareholders, creating an independent, publicly traded company without raising new capital. Both strategies unlock shareholder value but differ in capital structure impact and control retention.

Table of Comparison

| Aspect | Equity Carve-Out | Spin-Off |

|---|---|---|

| Definition | Sale of minority equity stake of a subsidiary via IPO. | Distribution of subsidiary shares to existing shareholders. |

| Ownership | Parent retains majority control. | Subsidiary becomes independent entity. |

| Capital Raised | Generates cash through partial public offering. | No immediate cash inflow to parent company. |

| Purpose | Access capital markets, test subsidiary value. | Enhance shareholder value via full separation. |

| Regulatory Requirements | Requires IPO registration and disclosures. | Requires SEC filings and shareholder approvals. |

| Tax Implications | Potential tax liabilities on sale proceeds. | Often structured as tax-free under IRS rules. |

| Market Perception | Signals strategic value without losing control. | Reflects full strategic realignment and independence. |

Introduction to Equity Carve-Outs and Spin-Offs

Equity carve-outs and spin-offs are strategic corporate restructuring techniques used to unlock shareholder value by separating a subsidiary or division from the parent company. An equity carve-out involves selling a minority stake in the subsidiary through an initial public offering (IPO), providing immediate capital and market valuation while maintaining parent control. A spin-off entails distributing full ownership of the subsidiary's shares directly to existing shareholders, creating an independent entity with separate management and operational focus.

Defining Equity Carve-Outs in Finance

An equity carve-out in finance involves a parent company selling a minority stake, typically between 10% to 20%, in a subsidiary through an initial public offering (IPO) while retaining majority ownership. This strategy allows the parent company to raise capital, achieve market valuation for the subsidiary, and maintain strategic control. Equity carve-outs differ from spin-offs, where the parent fully distributes shares of the subsidiary to existing shareholders, resulting in complete separation.

Explaining Spin-Offs and Their Key Features

Spin-offs involve a parent company creating an independent company by distributing new shares of a subsidiary to existing shareholders, allowing both entities to operate separately. Key features include the retention of ownership by original shareholders, improved management focus on core operations, and potential unlocking of shareholder value through clearer business strategies. This restructuring method enhances market valuation by providing distinct financial identities and operational autonomy to the spun-off entity.

Strategic Motivations Behind Equity Carve-Outs

Equity carve-outs enable parent companies to unlock value by partially selling a subsidiary's shares to public investors while retaining control, providing access to capital without full divestiture. This strategic move enhances market valuation and liquidity for the carved-out entity, facilitating growth and investment opportunities. Firms often pursue carve-outs to strategically reposition their portfolios, focus on core operations, and improve shareholder returns by tapping into subsidiary-specific investor interest.

Reasons Companies Pursue Spin-Offs

Companies pursue spin-offs to enhance shareholder value by creating more focused management teams and unlocking hidden market value of individual business units. Spin-offs often improve operational efficiency as the separated entities can implement tailored strategies without corporate constraints. Investors benefit from increased transparency and clearer investment choices, often leading to better stock performance post-spin-off.

Structural Differences: Carve-Out vs Spin-Off

Equity carve-outs involve a parent company selling a partial stake of a subsidiary through an initial public offering (IPO), maintaining control while raising capital and enhancing market valuation. Spin-offs distribute 100% ownership of a subsidiary's shares to existing shareholders, resulting in a fully independent company with separate management and board of directors. The key structural difference lies in control retention and ownership transfer, with carve-outs offering partial divestment and spin-offs achieving complete separation.

Financial Implications for Parent Companies

Equity carve-outs provide parent companies with immediate capital infusion through partial asset sales while maintaining partial ownership, impacting balance sheets by recognizing new minority interests and potential tax liabilities. Spin-offs result in complete separation of the subsidiary, leading to a reduction in consolidated assets and liabilities but potentially improving focus and unlocking shareholder value without generating immediate cash proceeds. Both approaches influence parent companies' financial statements differently, affecting metrics such as earnings per share, debt ratios, and tax obligations.

Impact on Shareholders and Market Value

Equity carve-outs allow parent companies to raise capital by selling a minority stake in a subsidiary, often resulting in immediate liquidity for shareholders and a clearer market valuation for the carved-out entity, which can enhance overall market value. Spin-offs distribute subsidiary shares directly to existing shareholders, maintaining their proportional ownership while potentially unlocking hidden value by allowing the subsidiary to operate independently and be valued distinctly by the market. Both strategies influence shareholder wealth and market perception, but carve-outs provide capital infusion and market discipline, whereas spin-offs focus on strategic realignment and shareholder empowerment.

Regulatory and Tax Considerations

Equity carve-outs involve the partial sale of a subsidiary's shares through an initial public offering, triggering regulatory scrutiny under securities laws and potential tax liabilities on gains realized. Spin-offs distribute existing shares of a subsidiary to the parent company's shareholders, often qualifying for tax-free treatment under IRS Code Section 355, provided strict operational and timing criteria are met. Regulatory compliance for both transactions requires detailed disclosure and adherence to stock exchange rules, with tax consequences heavily influenced by corporate structure and jurisdiction.

Choosing Between Carve-Out and Spin-Off: A Comparative Analysis

Choosing between an equity carve-out and a spin-off depends on the company's strategic goals, capital needs, and market conditions. Equity carve-outs allow parent companies to raise capital by selling a minority stake while retaining control, often benefiting from market valuation without losing operational oversight. Spin-offs create independent entities by distributing shares to existing shareholders, enabling focused management teams and potentially unlocking shareholder value through separate market listings.

Equity Carve-Out vs Spin-Off Infographic

difterm.com

difterm.com