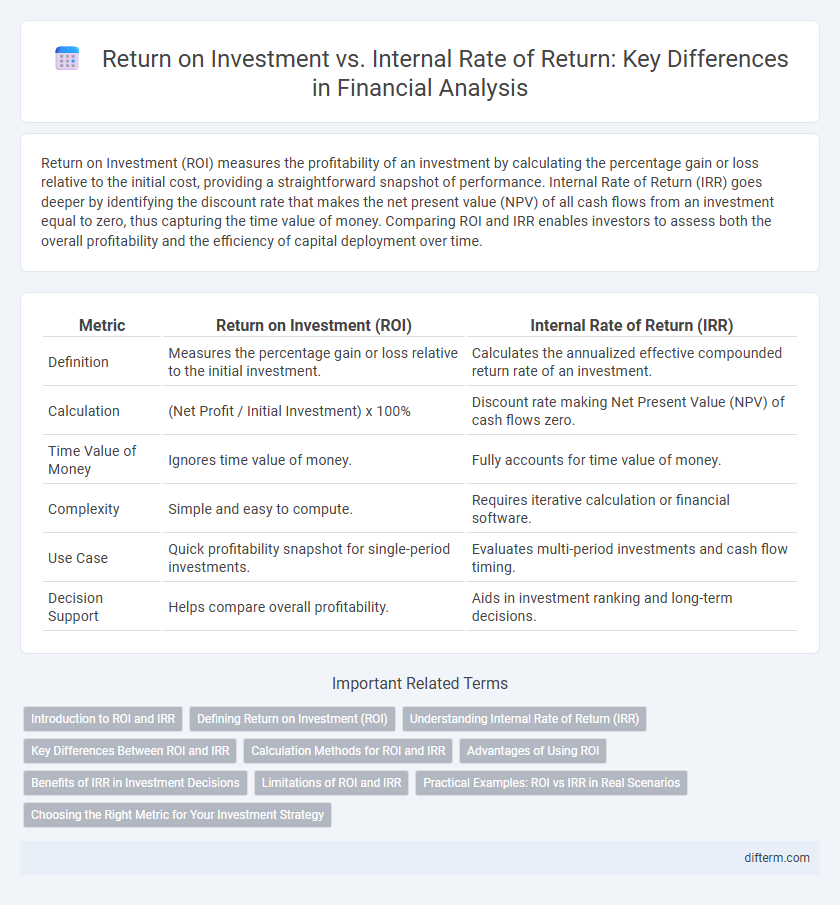

Return on Investment (ROI) measures the profitability of an investment by calculating the percentage gain or loss relative to the initial cost, providing a straightforward snapshot of performance. Internal Rate of Return (IRR) goes deeper by identifying the discount rate that makes the net present value (NPV) of all cash flows from an investment equal to zero, thus capturing the time value of money. Comparing ROI and IRR enables investors to assess both the overall profitability and the efficiency of capital deployment over time.

Table of Comparison

| Metric | Return on Investment (ROI) | Internal Rate of Return (IRR) |

|---|---|---|

| Definition | Measures the percentage gain or loss relative to the initial investment. | Calculates the annualized effective compounded return rate of an investment. |

| Calculation | (Net Profit / Initial Investment) x 100% | Discount rate making Net Present Value (NPV) of cash flows zero. |

| Time Value of Money | Ignores time value of money. | Fully accounts for time value of money. |

| Complexity | Simple and easy to compute. | Requires iterative calculation or financial software. |

| Use Case | Quick profitability snapshot for single-period investments. | Evaluates multi-period investments and cash flow timing. |

| Decision Support | Helps compare overall profitability. | Aids in investment ranking and long-term decisions. |

Introduction to ROI and IRR

Return on Investment (ROI) measures the profitability of an investment by comparing net profit to the initial cost, expressed as a percentage. Internal Rate of Return (IRR) calculates the discount rate at which the net present value (NPV) of cash flows equals zero, reflecting the investment's expected annualized return. While ROI provides a straightforward snapshot of profitability, IRR incorporates the time value of money and cash flow timing, offering a more comprehensive investment evaluation.

Defining Return on Investment (ROI)

Return on Investment (ROI) quantifies the profitability of an investment by expressing net gains as a percentage of the initial cost, serving as a straightforward metric for evaluating investment efficiency. This financial ratio is calculated by dividing the net profit from an investment by the original investment amount, then multiplying by 100 to yield a percentage. ROI enables investors and businesses to compare the relative performance of various investments without considering the time value of money, which distinguishes it from more complex measures like Internal Rate of Return (IRR).

Understanding Internal Rate of Return (IRR)

Internal Rate of Return (IRR) represents the discount rate that makes the net present value (NPV) of all cash flows from a particular investment equal to zero, serving as a critical metric for assessing investment profitability. Unlike Return on Investment (ROI), which provides a simple percentage gain relative to cost, IRR accounts for the timing and magnitude of cash flows, offering a more comprehensive evaluation of project viability. Investors and financial analysts rely on IRR to compare the efficiency and potential returns of various investments, ensuring informed decision-making aligned with long-term financial goals.

Key Differences Between ROI and IRR

Return on Investment (ROI) measures the overall profitability of an investment as a simple percentage, while Internal Rate of Return (IRR) calculates the annualized effective compounded return considering the time value of money. ROI provides a straightforward metric for comparing total gains relative to initial costs, but IRR offers a more dynamic assessment by incorporating cash flow timing and frequency. Investors prioritize IRR when evaluating projects with multiple cash flows over time, whereas ROI is favored for quick, high-level performance analysis.

Calculation Methods for ROI and IRR

Return on Investment (ROI) is calculated by dividing net profit by the initial investment cost, providing a straightforward percentage that measures profitability. Internal Rate of Return (IRR) involves finding the discount rate that makes the net present value (NPV) of all cash flows from an investment equal to zero, which requires iterative trial-and-error or financial software for precise determination. While ROI offers a snapshot of overall return, IRR accounts for the time value of money, making it essential for comparing projects with varying cash flow timings.

Advantages of Using ROI

Return on Investment (ROI) offers a straightforward metric for evaluating the profitability of an investment by expressing gains as a percentage of the initial cost, simplifying comparison across diverse projects. ROI's simplicity and ease of calculation make it accessible to investors and managers who need quick decision-making tools without complex financial modeling. This metric provides clear insight into the efficiency of capital allocation, facilitating budget prioritization and performance benchmarking within financial portfolios.

Benefits of IRR in Investment Decisions

Internal Rate of Return (IRR) provides a clear percentage that measures an investment's profitability, enabling straightforward comparison across projects with varying sizes and durations. IRR accounts for the time value of money by discounting future cash flows, offering a more accurate reflection of an investment's potential returns than Return on Investment (ROI). This makes IRR particularly valuable for evaluating complex investments with multiple cash flows, guiding investors in maximizing long-term financial gains.

Limitations of ROI and IRR

Return on Investment (ROI) lacks consideration for the time value of money, making it less reliable for projects with varying cash flows over multiple periods. Internal Rate of Return (IRR) can produce multiple or misleading rates when cash flows are non-conventional or when comparing mutually exclusive projects, complicating decision-making. Both metrics are limited in capturing the full scope of investment risk and capital costs, necessitating supplemental analysis such as Net Present Value (NPV) for comprehensive evaluation.

Practical Examples: ROI vs IRR in Real Scenarios

Return on Investment (ROI) provides a straightforward percentage indicating the total profit relative to the initial investment, such as earning a 20% ROI on a $10,000 stock purchase that grows to $12,000. Internal Rate of Return (IRR) accounts for the timing and magnitude of cash flows, for example, evaluating a real estate project with annual cash inflows over five years to determine a 15% IRR, reflecting the true annualized yield. Comparing these metrics in practical scenarios helps investors choose between projects by balancing simple profitability (ROI) against cash flow timing and investment duration (IRR).

Choosing the Right Metric for Your Investment Strategy

Return on Investment (ROI) measures the overall profitability of an investment by comparing net gains to initial costs, providing a straightforward snapshot of performance. Internal Rate of Return (IRR) calculates the annualized effective compounded return, factoring in the timing of cash flows for a more dynamic assessment of investment efficiency. Selecting the right metric hinges on your investment horizon and cash flow structure, with ROI suitable for quick evaluations and IRR preferred for projects with multiple or irregular cash inflows and outflows.

Return on Investment vs Internal Rate of Return Infographic

difterm.com

difterm.com