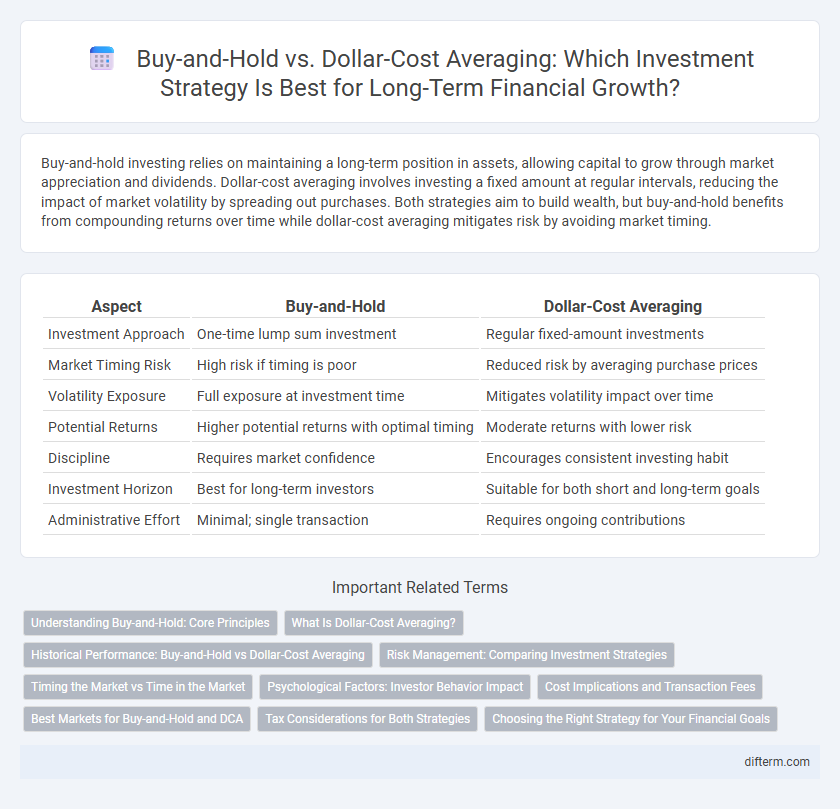

Buy-and-hold investing relies on maintaining a long-term position in assets, allowing capital to grow through market appreciation and dividends. Dollar-cost averaging involves investing a fixed amount at regular intervals, reducing the impact of market volatility by spreading out purchases. Both strategies aim to build wealth, but buy-and-hold benefits from compounding returns over time while dollar-cost averaging mitigates risk by avoiding market timing.

Table of Comparison

| Aspect | Buy-and-Hold | Dollar-Cost Averaging |

|---|---|---|

| Investment Approach | One-time lump sum investment | Regular fixed-amount investments |

| Market Timing Risk | High risk if timing is poor | Reduced risk by averaging purchase prices |

| Volatility Exposure | Full exposure at investment time | Mitigates volatility impact over time |

| Potential Returns | Higher potential returns with optimal timing | Moderate returns with lower risk |

| Discipline | Requires market confidence | Encourages consistent investing habit |

| Investment Horizon | Best for long-term investors | Suitable for both short and long-term goals |

| Administrative Effort | Minimal; single transaction | Requires ongoing contributions |

Understanding Buy-and-Hold: Core Principles

Buy-and-hold investing involves purchasing securities and maintaining the position over an extended period regardless of market fluctuations, emphasizing long-term growth potential and minimizing transaction costs. This strategy relies on the principle that markets tend to increase in value over time despite volatility, benefiting from compounding returns and dividend reinvestments. Core to buy-and-hold is patience and discipline, reducing the impact of market timing risks and behavioral biases on investment decisions.

What Is Dollar-Cost Averaging?

Dollar-cost averaging is an investment strategy where investors consistently purchase a fixed dollar amount of a security at regular intervals, regardless of its price. This method reduces the impact of market volatility by spreading out purchases over time, potentially lowering the average cost per share. By avoiding lump-sum investments, dollar-cost averaging helps manage risk and encourages disciplined investing.

Historical Performance: Buy-and-Hold vs Dollar-Cost Averaging

Historical performance data reveals that buy-and-hold investing has generally outperformed dollar-cost averaging during prolonged bull markets by capitalizing on cumulative market gains. However, dollar-cost averaging provides downside protection and reduces the impact of market volatility by spreading investment purchases over time. Academically-backed studies indicate that while buy-and-hold offers higher returns in stable growth periods, dollar-cost averaging mitigates risk during market downturns, making it a strategic choice for conservative investors.

Risk Management: Comparing Investment Strategies

Buy-and-Hold minimizes transaction costs and benefits from long-term market growth, but exposes investors to higher volatility during downturns. Dollar-Cost Averaging reduces the impact of market timing risk by spreading investments over time, smoothing purchase prices, and lowering exposure to short-term market fluctuations. Both strategies offer unique risk management advantages, where Buy-and-Hold suits investors with higher risk tolerance, while Dollar-Cost Averaging appeals to those seeking gradual market entry and reduced downside risk.

Timing the Market vs Time in the Market

Buy-and-Hold strategies emphasize maximizing time in the market to benefit from long-term compounding and reduced transaction costs, minimizing risks associated with market timing. Dollar-Cost Averaging mitigates volatility by investing fixed amounts periodically, reducing the impact of short-term market fluctuations but potentially limiting gains during strong bull markets. Empirical studies demonstrate that consistent time in the market often outperforms attempts to time entry and exit points, highlighting the importance of disciplined investing over speculative timing.

Psychological Factors: Investor Behavior Impact

Buy-and-hold strategies minimize emotional trading by encouraging patience and long-term discipline, while dollar-cost averaging reduces anxiety by spreading investment risk over time. Investors using dollar-cost averaging are less likely to react impulsively to market volatility, promoting steadier psychological resilience. Understanding cognitive biases such as loss aversion and herd behavior is crucial in selecting an approach aligned with individual risk tolerance and emotional control.

Cost Implications and Transaction Fees

Buy-and-hold investing minimizes transaction fees by executing fewer trades, which can lead to lower overall costs compared to dollar-cost averaging (DCA), where regular periodic purchases incur repeated transaction fees. Dollar-cost averaging helps mitigate market volatility risk but may increase cumulative costs due to frequent brokerage commissions and bid-ask spreads. Investors should analyze broker fee structures and expected holding periods to determine which strategy offers the most cost-efficient approach for their portfolio.

Best Markets for Buy-and-Hold and DCA

Buy-and-hold strategies perform best in steadily growing markets with long-term upward trends, such as the U.S. stock market, where compounding returns maximize wealth over decades. Dollar-cost averaging excels in volatile or sideways markets, effectively reducing the impact of market timing by spreading investment purchases across different price points. Emerging markets with high volatility and unpredictable cycles often benefit from DCA, while developed markets with consistent growth favor buy-and-hold investors aiming for long-term capital appreciation.

Tax Considerations for Both Strategies

Buy-and-hold strategies often result in lower taxable events because investors primarily incur capital gains taxes only upon selling assets, allowing long-term gains to benefit from favorable tax rates. Dollar-cost averaging, involving regular purchases, may generate more frequent taxable transactions, especially if dividends or partial sales occur, potentially leading to higher annual tax liabilities. Investors should evaluate their tax bracket and timing to optimize after-tax returns when choosing between these two approaches.

Choosing the Right Strategy for Your Financial Goals

Selecting between Buy-and-Hold and Dollar-Cost Averaging depends on your risk tolerance, investment horizon, and market outlook. Buy-and-Hold suits investors seeking long-term growth with minimal transaction costs, while Dollar-Cost Averaging mitigates market volatility by spreading investments over time. Aligning your strategy with financial goals ensures optimized portfolio performance and effective risk management.

Buy-and-Hold vs Dollar-Cost Averaging Infographic

difterm.com

difterm.com