Recourse debt allows lenders to pursue the borrower's personal assets if the loan defaults, offering greater security for creditors compared to nonrecourse debt. Nonrecourse debt limits the lender's recovery to the collateral securing the loan, protecting the borrower's other assets from seizure. Understanding the differences between recourse and nonrecourse debt is crucial for managing financial risk and making informed borrowing decisions.

Table of Comparison

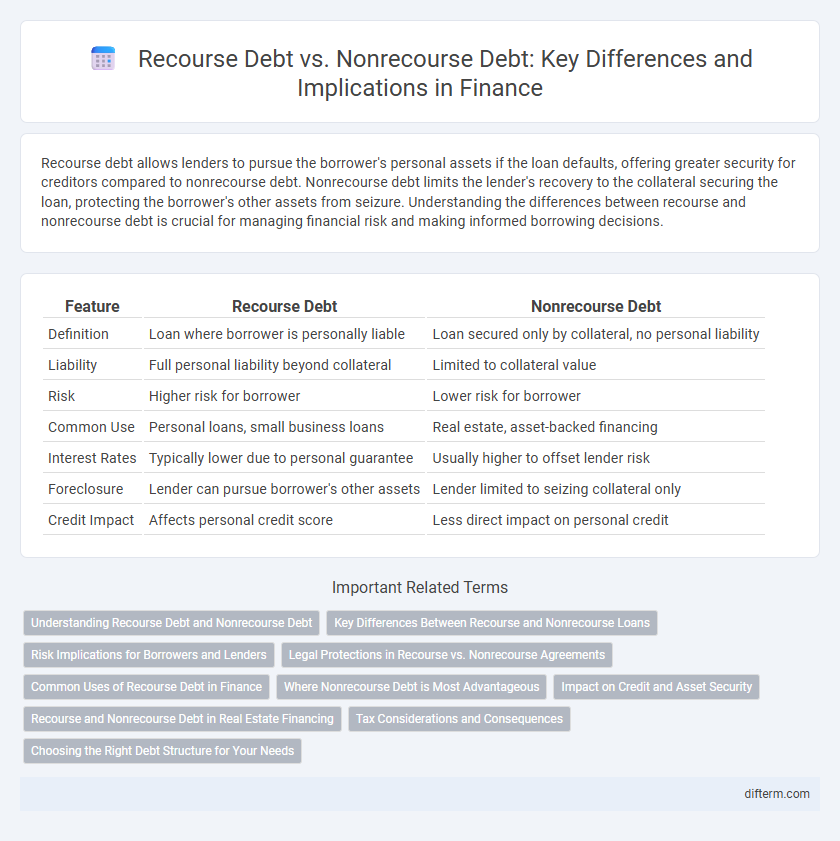

| Feature | Recourse Debt | Nonrecourse Debt |

|---|---|---|

| Definition | Loan where borrower is personally liable | Loan secured only by collateral, no personal liability |

| Liability | Full personal liability beyond collateral | Limited to collateral value |

| Risk | Higher risk for borrower | Lower risk for borrower |

| Common Use | Personal loans, small business loans | Real estate, asset-backed financing |

| Interest Rates | Typically lower due to personal guarantee | Usually higher to offset lender risk |

| Foreclosure | Lender can pursue borrower's other assets | Lender limited to seizing collateral only |

| Credit Impact | Affects personal credit score | Less direct impact on personal credit |

Understanding Recourse Debt and Nonrecourse Debt

Recourse debt obligates the borrower to repay the full loan amount, allowing lenders to pursue personal assets beyond collateral if the borrower defaults. Nonrecourse debt limits lender claims to the secured collateral only, protecting the borrower's other assets from seizure. Understanding the distinctions between these debt types is crucial for assessing financial risk and liability exposure in lending agreements.

Key Differences Between Recourse and Nonrecourse Loans

Recourse debt allows lenders to claim the borrower's personal assets beyond the collateral if the loan defaults, increasing the borrower's risk exposure. Nonrecourse debt limits the lender's recovery strictly to the collateral pledged, protecting the borrower's other assets from seizure. Key differences include the level of borrower liability, with recourse loans posing higher personal financial risk compared to the limited liability in nonrecourse loans.

Risk Implications for Borrowers and Lenders

Recourse debt exposes borrowers to personal liability, increasing their risk as lenders can pursue personal assets beyond collateral if the loan defaults, while nonrecourse debt limits lender recovery to the collateral only, reducing borrower risk but increasing lender risk. Lenders typically face higher risk with nonrecourse debt, often demanding higher interest rates or stricter collateral valuations to mitigate potential losses. Borrowers benefit from nonrecourse loans as their financial exposure is confined to the pledged asset, whereas recourse loans require stronger creditworthiness due to broader liability.

Legal Protections in Recourse vs. Nonrecourse Agreements

Recourse debt allows lenders to pursue the borrower's personal assets beyond the collateral in case of default, offering stronger legal protections for creditors. Nonrecourse debt limits the lender's recovery to the collateral securing the loan, shielding the borrower's personal assets from further claims. These legal distinctions significantly impact borrower risk and lender security in financing agreements.

Common Uses of Recourse Debt in Finance

Recourse debt is commonly used in mortgage lending, where lenders have the right to pursue the borrower's other assets if the collateral does not cover the outstanding loan balance. It is prevalent in small business loans, providing creditors with greater security and encouraging them to offer financing under stricter terms. Recourse debt is also typical in personal loans and auto financing, where lenders seek assurance of full repayment beyond the asset's value.

Where Nonrecourse Debt is Most Advantageous

Nonrecourse debt is most advantageous in real estate investments and project finance where lenders accept collateral as the sole security, limiting borrower liability to the asset's value. This structure reduces personal risk for investors and encourages higher leverage without exposing personal assets. It is especially beneficial in commercial property acquisitions and infrastructure projects where asset performance directly secures debt repayment.

Impact on Credit and Asset Security

Recourse debt allows lenders to pursue the borrower's personal assets if the collateral value is insufficient, increasing personal credit risk and potentially affecting overall creditworthiness. Nonrecourse debt limits the lender's recovery to the collateral only, minimizing the borrower's personal credit exposure but potentially leading to higher interest rates due to increased lender risk. The choice between recourse and nonrecourse debt significantly impacts asset security, borrowing costs, and credit profile management in financing strategies.

Recourse and Nonrecourse Debt in Real Estate Financing

Recourse debt in real estate financing holds the borrower personally liable, allowing lenders to pursue personal assets beyond the property in case of default. Nonrecourse debt restricts lenders' claims solely to the collateral property, offering borrowers protection from personal liability. Understanding the distinctions affects risk assessment, loan terms, and borrower protections in investment property financing.

Tax Considerations and Consequences

Recourse debt allows lenders to pursue the borrower's other assets if the collateral does not fully cover the loan, impacting tax deductions related to bad debt and foreclosure losses. Nonrecourse debt limits the lender's recovery to the collateral, influencing the borrower's ability to claim losses and depreciation recapture for tax purposes. Understanding these distinctions is crucial for tax planning strategies involving real estate investments and business financing.

Choosing the Right Debt Structure for Your Needs

Recourse debt holds the borrower personally liable, allowing lenders to pursue personal assets beyond the collateral, which can lead to lower interest rates due to reduced lender risk. Nonrecourse debt limits lender claims strictly to the collateral pledged, offering protection to borrowers' other assets but often coming with higher interest rates and stricter qualification criteria. Selecting the right debt structure depends on factors such as risk tolerance, asset protection needs, and cost considerations, ensuring alignment with your financial strategy and long-term goals.

Recourse debt vs Nonrecourse debt Infographic

difterm.com

difterm.com