Fixed-rate loans provide stability with consistent interest payments, making budgeting easier and protecting borrowers from market fluctuations. Variable-rate loans offer potential savings through lower initial rates but carry the risk of rising payments as interest rates change. Choosing between fixed and variable rates depends on risk tolerance, financial goals, and market conditions.

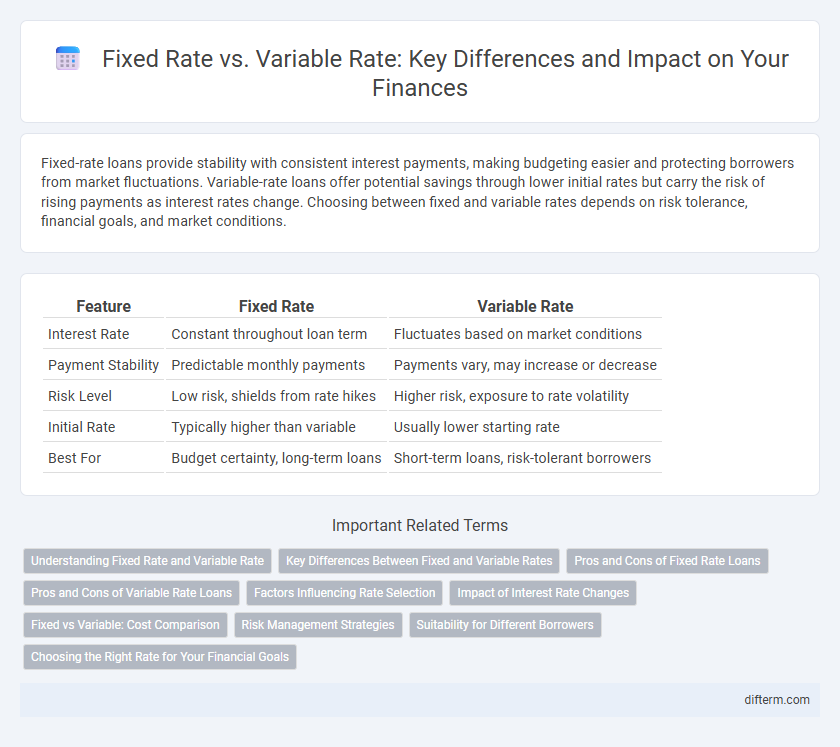

Table of Comparison

| Feature | Fixed Rate | Variable Rate |

|---|---|---|

| Interest Rate | Constant throughout loan term | Fluctuates based on market conditions |

| Payment Stability | Predictable monthly payments | Payments vary, may increase or decrease |

| Risk Level | Low risk, shields from rate hikes | Higher risk, exposure to rate volatility |

| Initial Rate | Typically higher than variable | Usually lower starting rate |

| Best For | Budget certainty, long-term loans | Short-term loans, risk-tolerant borrowers |

Understanding Fixed Rate and Variable Rate

Fixed rate loans maintain a constant interest rate throughout the loan term, providing predictable monthly payments and shielding borrowers from market fluctuations. Variable rate loans have interest rates that fluctuate based on benchmark indices like the LIBOR or prime rate, which can lead to lower initial rates but increased payment uncertainty. Understanding the trade-offs between fixed and variable rates helps borrowers align their financing choices with risk tolerance and market conditions.

Key Differences Between Fixed and Variable Rates

Fixed rate loans offer consistent interest payments over the loan term, providing budget stability and protection against market fluctuations. Variable rate loans feature interest rates that adjust periodically based on index benchmarks, which can result in lower initial rates but increased uncertainty and potential cost increases. Key differences include payment predictability, interest rate risk exposure, and suitability depending on an individual's risk tolerance and financial planning preferences.

Pros and Cons of Fixed Rate Loans

Fixed rate loans provide borrowers with consistent monthly payments, ensuring budget stability and protection against interest rate fluctuations. Their primary disadvantage is the typically higher initial interest rates compared to variable rate loans, which can lead to increased overall costs if market rates remain low. Fixed rate loans are ideal for long-term financial planning when predictability outweighs potential savings from future rate decreases.

Pros and Cons of Variable Rate Loans

Variable rate loans offer borrowers lower initial interest rates and potential savings when market rates decline, making them attractive for those expecting stable or falling rates. However, the key risk lies in rate fluctuations, which can lead to unpredictable and potentially higher monthly payments, impacting financial stability. Borrowers must carefully assess market trends and their risk tolerance before opting for variable rate loans due to inherent payment volatility.

Factors Influencing Rate Selection

Borrowers often consider credit score, loan term, and current market conditions when choosing between fixed and variable rates. Fixed rates provide predictable payments and are favored during rising interest rate environments, while variable rates may offer lower initial costs but fluctuate based on benchmark indexes like the LIBOR or SOFR. Economic factors such as inflation trends and Federal Reserve policies also heavily influence the decision-making process.

Impact of Interest Rate Changes

Fixed rate loans provide borrowers with consistent payments unaffected by market fluctuations, offering budget stability even if interest rates rise. Variable rate loans adjust periodically based on benchmark rates, which can lower initial costs but expose borrowers to potential payment increases when interest rates climb. Understanding the impact of interest rate volatility is crucial for choosing between fixed and variable rate financing options to manage long-term financial risk effectively.

Fixed vs Variable: Cost Comparison

Fixed rate loans provide predictable monthly payments by locking in an interest rate over the loan term, ensuring stability despite market fluctuations. Variable rate loans often start with lower interest rates but can increase or decrease based on benchmark rates, potentially leading to higher overall costs in rising rate environments. Borrowers must weigh the certainty of fixed costs against the initial savings and risk exposure associated with variable rates when evaluating total loan expenses.

Risk Management Strategies

Fixed rate loans provide predictable payments, enabling precise budget planning and minimizing exposure to interest rate fluctuations. Variable rate loans, while potentially lower in cost, carry the risk of rising rates, requiring robust risk management strategies such as interest rate caps or swaps to hedge against volatility. Effective risk management balances cost efficiency with protection, aligning loan structures to an organization's cash flow stability and risk tolerance.

Suitability for Different Borrowers

Fixed rate loans offer predictable monthly payments, making them ideal for borrowers who prioritize budget stability and long-term financial planning. Variable rate loans may benefit borrowers who expect interest rates to remain low or who have the flexibility to handle fluctuating payments, often suited for those with strong income growth potential. Risk-averse individuals typically prefer fixed rates, while those seeking potential cost savings and willing to accept market fluctuations might choose variable rates.

Choosing the Right Rate for Your Financial Goals

Selecting between fixed rate and variable rate loans depends on your financial goals, risk tolerance, and market conditions. Fixed rates provide stability with predictable monthly payments, ideal for long-term budgeting and protection against interest fluctuations. Variable rates often start lower but can change with market trends, suited for borrowers willing to take advantage of potential decreases while accepting payment variability.

Fixed Rate vs Variable Rate Infographic

difterm.com

difterm.com