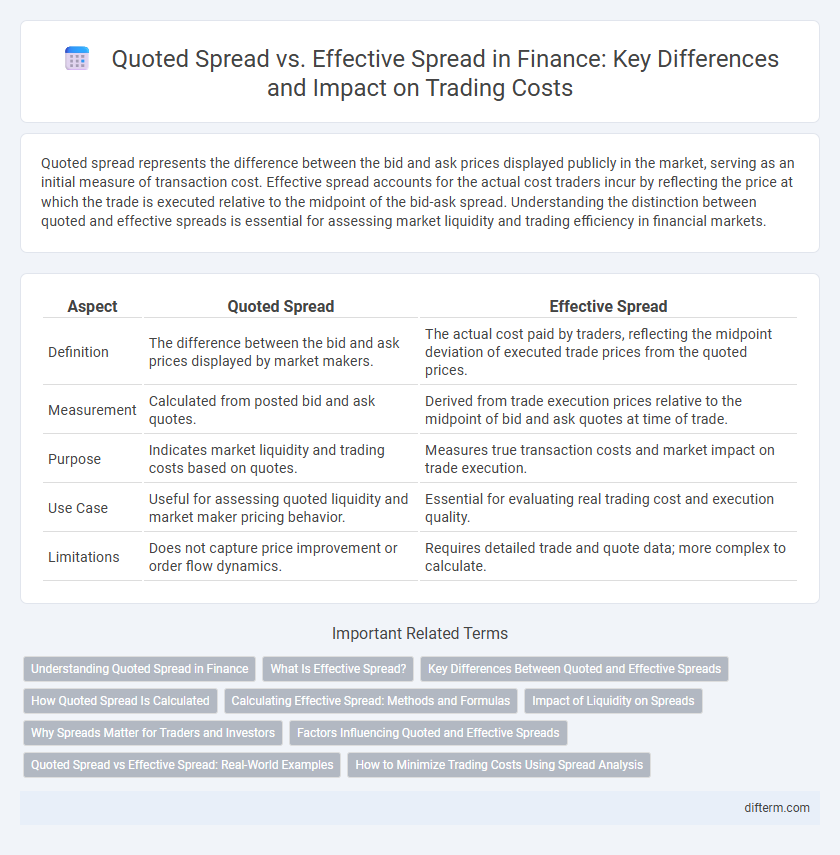

Quoted spread represents the difference between the bid and ask prices displayed publicly in the market, serving as an initial measure of transaction cost. Effective spread accounts for the actual cost traders incur by reflecting the price at which the trade is executed relative to the midpoint of the bid-ask spread. Understanding the distinction between quoted and effective spreads is essential for assessing market liquidity and trading efficiency in financial markets.

Table of Comparison

| Aspect | Quoted Spread | Effective Spread |

|---|---|---|

| Definition | The difference between the bid and ask prices displayed by market makers. | The actual cost paid by traders, reflecting the midpoint deviation of executed trade prices from the quoted prices. |

| Measurement | Calculated from posted bid and ask quotes. | Derived from trade execution prices relative to the midpoint of bid and ask quotes at time of trade. |

| Purpose | Indicates market liquidity and trading costs based on quotes. | Measures true transaction costs and market impact on trade execution. |

| Use Case | Useful for assessing quoted liquidity and market maker pricing behavior. | Essential for evaluating real trading cost and execution quality. |

| Limitations | Does not capture price improvement or order flow dynamics. | Requires detailed trade and quote data; more complex to calculate. |

Understanding Quoted Spread in Finance

The quoted spread in finance represents the difference between the bid price and the ask price of a security as displayed by market makers, reflecting the cost of liquidity and market efficiency. It serves as an important indicator of market depth and transaction costs, helping traders assess the competitiveness of quotes before executing trades. Understanding the quoted spread enables investors to evaluate potential price impact and optimize trade execution strategies in various market conditions.

What Is Effective Spread?

Effective spread measures the actual cost investors incur when executing trades by capturing the price difference between the trade price and the midpoint of the bid-ask spread at the time of the trade. Unlike quoted spread, which represents the posted difference between the bid and ask prices, effective spread reflects real market conditions and the price improvement or slippage experienced during trade execution. It provides a more accurate assessment of trading costs and market liquidity for investors and market analysts.

Key Differences Between Quoted and Effective Spreads

Quoted spread represents the difference between the bid and ask prices displayed by market makers, reflecting the theoretical transaction cost before execution. Effective spread measures the actual cost incurred by investors, calculated as twice the absolute difference between the trade price and the midpoint of the quoted spread. Key differences include that quoted spread is a static figure based on posted prices, while effective spread captures real trading costs influenced by order execution and market impact.

How Quoted Spread Is Calculated

Quoted spread is calculated by taking the difference between the best ask price and the best bid price in the order book, divided by the midpoint of these two prices to express the spread as a percentage. This measure reflects the cost faced by traders to immediately buy and sell a security based on displayed prices, excluding any hidden or market impact costs. Unlike effective spread, which is derived from actual trade prices and execution quality, the quoted spread relies solely on the public quotes available at a given time.

Calculating Effective Spread: Methods and Formulas

Effective spread is calculated by doubling the absolute difference between the trade price and the midpoint of the quoted bid-ask spread, representing the true transaction cost. The formula is Effective Spread = 2 x |Trade Price - Midpoint of Bid and Ask Prices|, which captures the actual price impact on trades. This measure provides a more accurate reflection of trading costs compared to quoted spread, especially in volatile or illiquid markets.

Impact of Liquidity on Spreads

Liquidity significantly influences quoted spread and effective spread by determining the ease with which assets can be traded without causing large price changes. In highly liquid markets, narrower quoted spreads reflect lower transaction costs and tighter bid-ask differences, while effective spreads capture the actual costs incurred after trade execution, which may widen in less liquid conditions due to market impact. Understanding the nuances between these spreads helps investors assess the true cost of trading and market efficiency under varying liquidity scenarios.

Why Spreads Matter for Traders and Investors

Spreads, including quoted and effective spreads, represent the cost of trading securities and directly impact trading profitability and investment returns. Quoted spreads reflect the difference between the best bid and ask prices, while effective spreads measure the actual transaction cost investors incur, accounting for price improvements or delays. Understanding these spreads enables traders and investors to evaluate market liquidity, minimize transaction costs, and optimize their asset allocation strategies.

Factors Influencing Quoted and Effective Spreads

Quoted spread and effective spread in finance are influenced by factors such as market liquidity, order size, and volatility. Higher liquidity generally narrows both spreads, while larger order sizes can widen the effective spread due to market impact costs not reflected in the quoted spread. Market volatility increases uncertainty and risk, leading to wider spreads as market makers adjust their prices to compensate for potential losses.

Quoted Spread vs Effective Spread: Real-World Examples

Quoted spread represents the difference between the best available bid and ask prices at a given moment, reflecting market makers' posted prices, while effective spread measures the actual execution cost of a trade relative to the midquote price, capturing price improvement or market impact. For example, in highly liquid stocks like Apple Inc., the quoted spread may be as low as one cent, yet the effective spread often turns out smaller due to frequent price improvements during trade execution. Conversely, in less liquid securities such as small-cap stocks, the effective spread frequently exceeds the quoted spread because of greater market impact and delayed trade executions.

How to Minimize Trading Costs Using Spread Analysis

Minimizing trading costs involves analyzing the quoted spread, which represents the difference between the bid and ask prices displayed by market makers, and the effective spread, reflecting the actual price execution relative to the mid-quote at trade time. Traders can reduce costs by targeting securities with narrower quoted spreads and executing trades more efficiently to align closely with the effective spread, thus avoiding price slippage. Algorithmic trading strategies and timing orders during periods of higher liquidity also help narrow the effective spread, lowering overall transaction expenses.

Quoted Spread vs Effective Spread Infographic

difterm.com

difterm.com