Capital gains arise from the profit earned when an investment is sold at a higher price than its purchase price, often subject to favorable tax rates if held long-term. Dividend income consists of periodic payments made to shareholders from a company's profits, usually taxed at a different, often higher, rate than capital gains. Investors must consider the tax implications and income stability when choosing between capital gains and dividend-focused strategies in their portfolios.

Table of Comparison

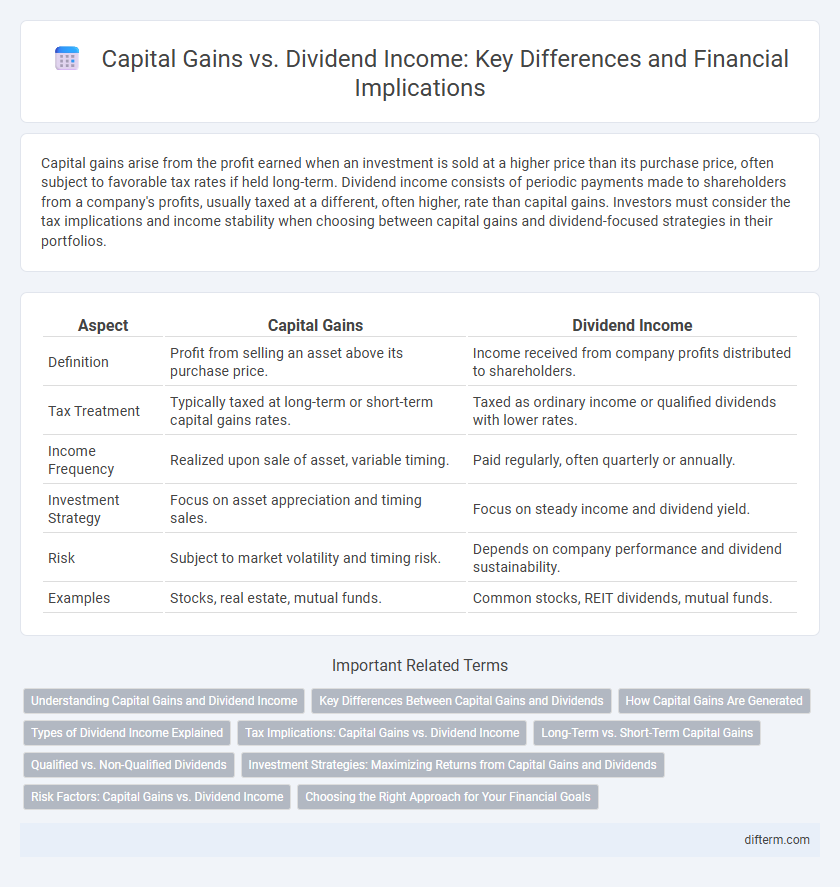

| Aspect | Capital Gains | Dividend Income |

|---|---|---|

| Definition | Profit from selling an asset above its purchase price. | Income received from company profits distributed to shareholders. |

| Tax Treatment | Typically taxed at long-term or short-term capital gains rates. | Taxed as ordinary income or qualified dividends with lower rates. |

| Income Frequency | Realized upon sale of asset, variable timing. | Paid regularly, often quarterly or annually. |

| Investment Strategy | Focus on asset appreciation and timing sales. | Focus on steady income and dividend yield. |

| Risk | Subject to market volatility and timing risk. | Depends on company performance and dividend sustainability. |

| Examples | Stocks, real estate, mutual funds. | Common stocks, REIT dividends, mutual funds. |

Understanding Capital Gains and Dividend Income

Capital gains arise from the profit earned when an asset is sold for a price higher than its purchase cost, often resulting in a one-time taxable event. Dividend income represents regular payments made to shareholders from a company's profits, providing a consistent income stream with different tax implications. Understanding the distinction between capital gains and dividend income is crucial for optimizing investment strategies and tax planning in personal finance.

Key Differences Between Capital Gains and Dividends

Capital gains represent the profit earned from selling an asset at a higher price than its purchase cost, typically taxed when the asset is sold, whereas dividend income is earned from a company's distribution of profits to shareholders and is usually taxed when received. Capital gains vary based on holding periods, with short-term gains taxed as ordinary income and long-term gains benefiting from lower rates, while dividends can be qualified or non-qualified, influencing their tax rates. Investors prioritize capital gains for growth-oriented strategies and dividends for steady income, reflecting distinct implications for portfolio management and cash flow planning.

How Capital Gains Are Generated

Capital gains are generated when an investment asset, such as stocks or real estate, is sold for a higher price than its original purchase cost, reflecting the appreciation in market value. This gain represents the profit realized from the increase in the asset's worth over time, and it is typically subject to capital gains tax based on the holding period and tax laws. Unlike dividend income, which is earned regularly as a portion of a company's profits, capital gains occur only upon the sale or disposition of the asset.

Types of Dividend Income Explained

Dividend income primarily includes three types: qualified dividends, ordinary dividends, and return of capital distributions. Qualified dividends are taxed at the lower long-term capital gains rates, benefiting investors with more favorable tax treatment. Ordinary dividends are taxed as regular income, while return of capital distributions reduce the investor's cost basis and are not immediately taxable.

Tax Implications: Capital Gains vs. Dividend Income

Capital gains are typically taxed at lower rates than ordinary income, with distinctions between short-term gains, taxed as regular income, and long-term gains, which benefit from preferential rates up to 20% plus a 3.8% Net Investment Income Tax for high earners. Dividend income can be classified as qualified or non-qualified, where qualified dividends receive favorable tax rates similar to long-term capital gains, while non-qualified dividends are taxed at higher ordinary income rates. Tax planning strategies often leverage these differences to optimize after-tax returns for investors in various tax brackets.

Long-Term vs. Short-Term Capital Gains

Long-term capital gains are taxed at lower rates compared to short-term capital gains, which are taxed as ordinary income based on the investor's tax bracket. Dividend income is typically classified as either qualified dividends, taxed at the long-term capital gains rate, or non-qualified dividends, taxed at ordinary income rates. Understanding the distinctions between these income types allows investors to optimize tax liabilities and maximize after-tax returns.

Qualified vs. Non-Qualified Dividends

Qualified dividends are taxed at the lower long-term capital gains rates, which range from 0% to 20% depending on income level, providing a tax-efficient income stream compared to non-qualified dividends taxed at ordinary income rates. Capital gains arise from the sale of assets and benefit from favorable tax treatment when held for more than one year, similar to qualified dividends. Understanding the distinctions between qualified and non-qualified dividends is essential for optimizing tax planning strategies in investment portfolios.

Investment Strategies: Maximizing Returns from Capital Gains and Dividends

Investment strategies that balance capital gains and dividend income optimize portfolio returns by leveraging market appreciation and steady cash flow. Targeting growth stocks can enhance capital gains, while dividend-paying stocks provide consistent income and potential tax advantages. A diversified approach combining both focuses on long-term wealth accumulation and risk management in fluctuating markets.

Risk Factors: Capital Gains vs. Dividend Income

Capital gains involve higher risk due to market volatility and asset price fluctuations, making returns less predictable over short periods. Dividend income offers more stability with regular payouts, but is subject to the company's profitability and dividend policy changes, which can reduce expected income. Investors seeking lower risk may prefer dividend income for steady cash flow, while those with higher risk tolerance might pursue capital gains for potential larger returns.

Choosing the Right Approach for Your Financial Goals

Capital gains offer the potential for significant growth through asset appreciation, making them suitable for investors aiming for long-term wealth accumulation and tax-efficient strategies. Dividend income provides a steady cash flow, appealing to those seeking regular income, especially retirees or conservative investors prioritizing stability. Evaluating your financial goals, risk tolerance, and tax implications helps determine whether capital gains or dividend income aligns best with your portfolio strategy.

Capital Gains vs Dividend Income Infographic

difterm.com

difterm.com