In finance, in-the-money options have intrinsic value as their strike price is favorable compared to the underlying asset's current market price, making them profitable to exercise. Out-of-the-money options lack intrinsic value since their strike prices are not advantageous relative to the market price, resulting in no immediate profit if exercised. These distinctions are crucial for traders assessing option premiums, potential payoff, and risk management strategies.

Table of Comparison

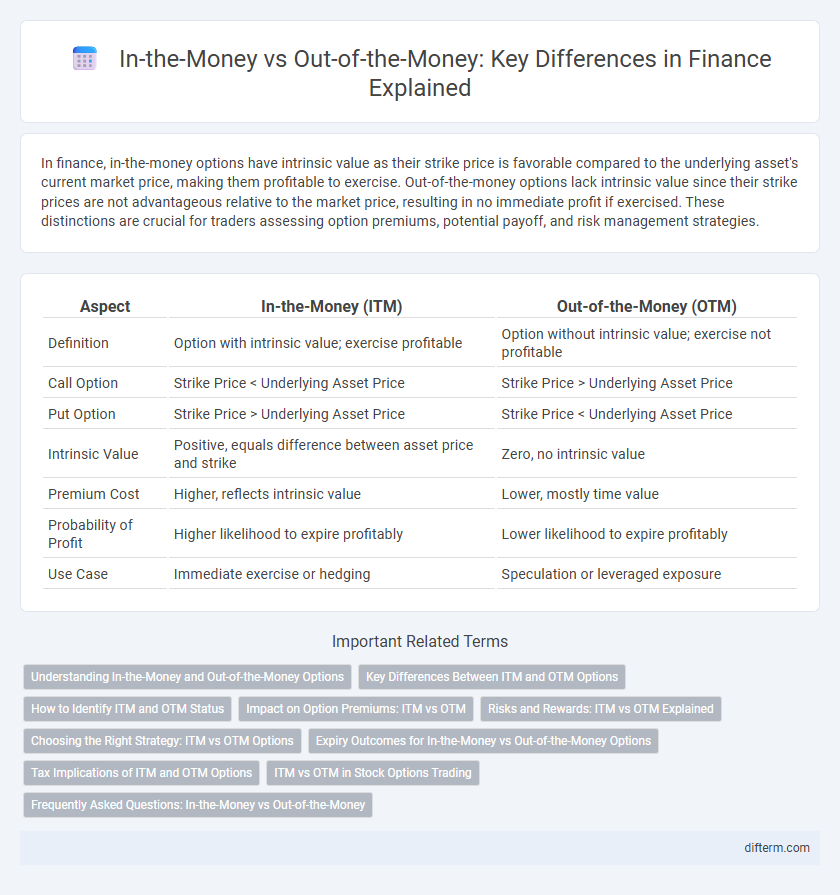

| Aspect | In-the-Money (ITM) | Out-of-the-Money (OTM) |

|---|---|---|

| Definition | Option with intrinsic value; exercise profitable | Option without intrinsic value; exercise not profitable |

| Call Option | Strike Price < Underlying Asset Price | Strike Price > Underlying Asset Price |

| Put Option | Strike Price > Underlying Asset Price | Strike Price < Underlying Asset Price |

| Intrinsic Value | Positive, equals difference between asset price and strike | Zero, no intrinsic value |

| Premium Cost | Higher, reflects intrinsic value | Lower, mostly time value |

| Probability of Profit | Higher likelihood to expire profitably | Lower likelihood to expire profitably |

| Use Case | Immediate exercise or hedging | Speculation or leveraged exposure |

Understanding In-the-Money and Out-of-the-Money Options

In-the-money options have intrinsic value because the underlying asset's market price is favorable compared to the option's strike price, making call options profitable when the market price exceeds the strike price and put options profitable when it is below. Out-of-the-money options lack intrinsic value and expire worthless if the underlying asset's market price does not surpass the strike price for calls or fall below it for puts. Understanding the distinction helps investors evaluate option profitability and risk exposure in options trading strategies.

Key Differences Between ITM and OTM Options

In-the-money (ITM) options have intrinsic value, meaning the underlying asset's price is favorable compared to the strike price, resulting in immediate exercisability profit. Out-of-the-money (OTM) options lack intrinsic value as the underlying asset's price does not favor exercise, relying entirely on potential future price movements for profitability. The key difference lies in ITM options being profitable at expiration, while OTM options require a price shift to become valuable.

How to Identify ITM and OTM Status

Identify in-the-money (ITM) options by comparing the underlying asset's current market price to the option's strike price: a call option is ITM if the market price exceeds the strike price, while a put option is ITM when the market price is below the strike price. Out-of-the-money (OTM) options occur when the strike price is unfavorable relative to the current market price, meaning a call option with a strike price higher than the market price or a put option with a strike price lower than the market price. Monitoring these price relationships helps traders assess intrinsic value and make informed decisions on exercising or trading options contracts.

Impact on Option Premiums: ITM vs OTM

In-the-money (ITM) options have intrinsic value, leading to higher option premiums due to immediate exercise profitability, while out-of-the-money (OTM) options possess only time value, resulting in lower premiums and higher leverage potential. The premium for ITM options incorporates both intrinsic and time value, increasing with the degree the option is ITM, whereas OTM premiums primarily reflect time value and implied volatility. Traders often pay a premium for ITM options to minimize risk, while OTM options offer cheaper speculative opportunities with higher probability but lower intrinsic worth.

Risks and Rewards: ITM vs OTM Explained

In-the-money (ITM) options carry higher premiums but offer greater intrinsic value and lower risk due to their favorable strike prices relative to the underlying asset. Out-of-the-money (OTM) options have lower premiums and higher risk, as they rely solely on potential price movements to become profitable, offering higher reward potential but with a greater chance of expiring worthless. Traders must balance the guaranteed partial value in ITM options against the speculative, leveraged nature of OTM contracts to align with their risk tolerance and investment goals.

Choosing the Right Strategy: ITM vs OTM Options

Choosing between in-the-money (ITM) and out-of-the-money (OTM) options depends on risk tolerance and investment goals. ITM options offer higher intrinsic value and greater likelihood of profitability but come with higher premiums. OTM options are cheaper with higher leverage potential but require significant market movement to become profitable, making them suitable for aggressive, speculative strategies.

Expiry Outcomes for In-the-Money vs Out-of-the-Money Options

In-the-money options expire with intrinsic value, enabling holders to realize profits by executing the option or receiving the difference between the strike price and the underlying asset's market price. Out-of-the-money options expire worthless, resulting in a total loss of the premium paid, as their strike price is unfavorable compared to the current market price. The expiration outcome directly impacts the option holder's payoff and risk management strategies, emphasizing the importance of monitoring underlying asset price movements relative to strike prices before expiry.

Tax Implications of ITM and OTM Options

In-the-money (ITM) options typically generate taxable gains when exercised or sold, often resulting in short-term or long-term capital gains depending on the holding period, while out-of-the-money (OTM) options that expire worthless lead to a capital loss deduction. The IRS treats gains from ITM option exercises as realized income, with the cost basis adjusted accordingly, which influences the calculation for taxes owed. Understanding the distinct tax treatments of ITM and OTM options is crucial for optimizing investment strategies and minimizing tax liabilities in options trading.

ITM vs OTM in Stock Options Trading

In stock options trading, in-the-money (ITM) options have intrinsic value because the stock price is above the strike price for calls or below for puts, making them more favorable for immediate exercise. Out-of-the-money (OTM) options lack intrinsic value since the stock price is below the strike price for calls or above for puts, often resulting in lower premiums but higher leverage potential. Traders choose ITM options for lower risk and higher probability of profit, while OTM options are preferred for speculative strategies due to their cheaper cost and potential for substantial returns.

Frequently Asked Questions: In-the-Money vs Out-of-the-Money

In-the-money (ITM) options have intrinsic value because the underlying asset's price is favorable relative to the strike price, while out-of-the-money (OTM) options have no intrinsic value and rely solely on potential future price movement. Frequently asked questions about ITM vs OTM options often cover how these terms affect option premiums, risk levels, and expiration outcomes. Understanding the distinction helps investors assess profitability, time decay impact, and strategic entry points in options trading.

In-the-money vs Out-of-the-money Infographic

difterm.com

difterm.com