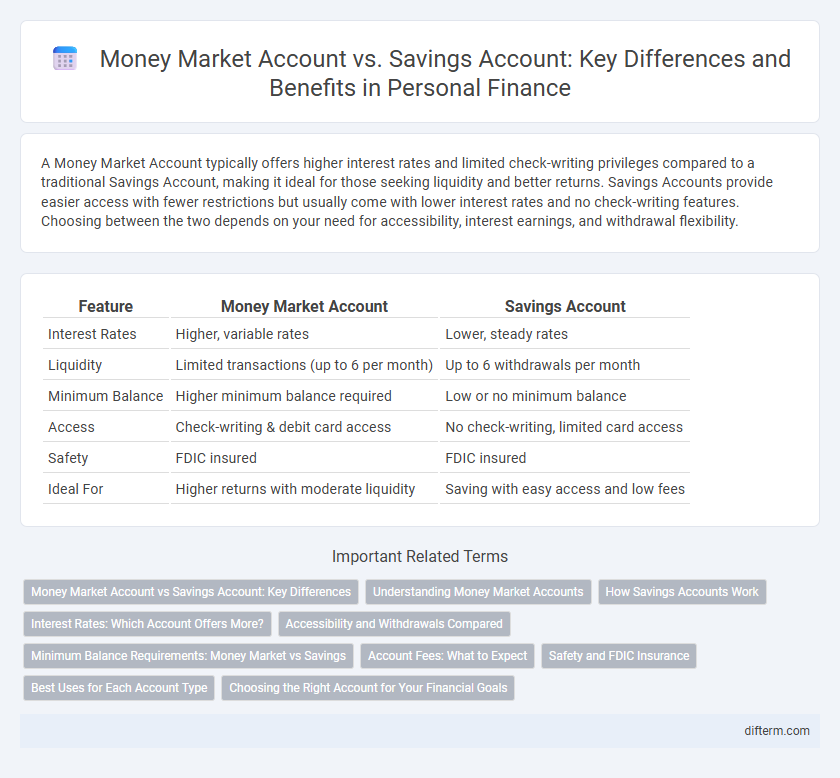

A Money Market Account typically offers higher interest rates and limited check-writing privileges compared to a traditional Savings Account, making it ideal for those seeking liquidity and better returns. Savings Accounts provide easier access with fewer restrictions but usually come with lower interest rates and no check-writing features. Choosing between the two depends on your need for accessibility, interest earnings, and withdrawal flexibility.

Table of Comparison

| Feature | Money Market Account | Savings Account |

|---|---|---|

| Interest Rates | Higher, variable rates | Lower, steady rates |

| Liquidity | Limited transactions (up to 6 per month) | Up to 6 withdrawals per month |

| Minimum Balance | Higher minimum balance required | Low or no minimum balance |

| Access | Check-writing & debit card access | No check-writing, limited card access |

| Safety | FDIC insured | FDIC insured |

| Ideal For | Higher returns with moderate liquidity | Saving with easy access and low fees |

Money Market Account vs Savings Account: Key Differences

Money Market Accounts (MMAs) typically offer higher interest rates compared to traditional Savings Accounts due to their ability to invest in short-term, low-risk securities. MMAs often require higher minimum balances and provide limited check-writing privileges, unlike Savings Accounts which prioritize accessibility with lower minimums but lower returns. Regulatory restrictions such as transaction limits apply to both, but MMAs blend features of checking and savings, making them suitable for investors seeking liquidity alongside better yields.

Understanding Money Market Accounts

Money Market Accounts (MMAs) offer higher interest rates compared to traditional savings accounts by investing in short-term, low-risk securities such as Treasury bills and commercial paper. These accounts often require higher minimum balances but provide limited check-writing and debit card access, bridging features of checking and savings accounts. Understanding the liquidity, interest rate trends, and minimum balance requirements of MMAs is essential for optimizing short-term savings and cash management strategies.

How Savings Accounts Work

Savings accounts function by allowing individuals to deposit money securely while earning interest over time, with interest rates typically determined by financial institutions based on market conditions. Funds in savings accounts remain liquid, enabling easy access for withdrawals or transfers, although some accounts may have limitations on the number of monthly transactions. These accounts are insured by entities such as the FDIC up to regulatory limits, providing safety and encouraging regular savings behavior compared to money market accounts, which often offer higher interest but require larger minimum balances.

Interest Rates: Which Account Offers More?

Money market accounts typically offer higher interest rates compared to traditional savings accounts due to their investment in short-term, low-risk securities. Savings account rates are generally lower but provide easier access to funds and fewer minimum balance requirements. Choosing the right account depends on balancing a higher return from money market accounts against the liquidity and simplicity of savings accounts.

Accessibility and Withdrawals Compared

Money market accounts offer limited check-writing and debit card access, providing greater liquidity compared to traditional savings accounts, which typically restrict withdrawals to six per month due to Regulation D. Savings accounts prioritize ease of deposits but may impose penalties or delays for excessive or early withdrawals, whereas money market accounts often balance higher interest rates with moderate accessibility. Choosing between these accounts depends on the user's need for frequent access versus long-term savings growth.

Minimum Balance Requirements: Money Market vs Savings

Money market accounts typically require a higher minimum balance, often ranging from $1,000 to $2,500, to avoid fees and earn interest, whereas savings accounts generally have lower minimum balance requirements, sometimes as low as $0 to $100. Maintaining these minimum balances in money market accounts can qualify for higher interest rates and check-writing privileges not usually available with savings accounts. Consumers should assess their ability to meet these thresholds when choosing between money market and savings accounts to optimize returns and avoid penalties.

Account Fees: What to Expect

Money market accounts typically have higher minimum balance requirements and may impose monthly maintenance fees if balances fall below the threshold, impacting overall returns. Savings accounts often feature lower or no minimum balance requirements and fewer fees, making them more accessible for everyday savers. Understanding these fee structures helps in choosing the most cost-effective option for managing short-term funds.

Safety and FDIC Insurance

Money Market Accounts and Savings Accounts both offer FDIC insurance protection up to $250,000 per depositor, ensuring the safety of funds held at insured banks. Money Market Accounts often provide limited check-writing privileges while maintaining the same federal insurance coverage as traditional Savings Accounts. Both account types are low-risk options ideal for preserving capital with the security of government-backed deposit insurance.

Best Uses for Each Account Type

Money market accounts are best suited for individuals seeking higher interest rates and limited check-writing privileges, making them ideal for emergency funds or short-term savings goals with easy access. Savings accounts provide a safe option for building long-term savings with lower minimum balance requirements and fewer withdrawal restrictions, perfect for regular deposits and gradual wealth accumulation. Choosing between the two depends on the need for liquidity, interest rate preferences, and account balance flexibility.

Choosing the Right Account for Your Financial Goals

Money market accounts typically offer higher interest rates and limited check-writing privileges, making them ideal for individuals seeking both liquidity and moderate returns. Savings accounts provide more accessibility and lower minimum balance requirements, suitable for short-term goals and emergency funds. Evaluating your financial goals, risk tolerance, and need for immediate access can guide the optimal choice between these two account types.

Money Market Account vs Savings Account Infographic

difterm.com

difterm.com