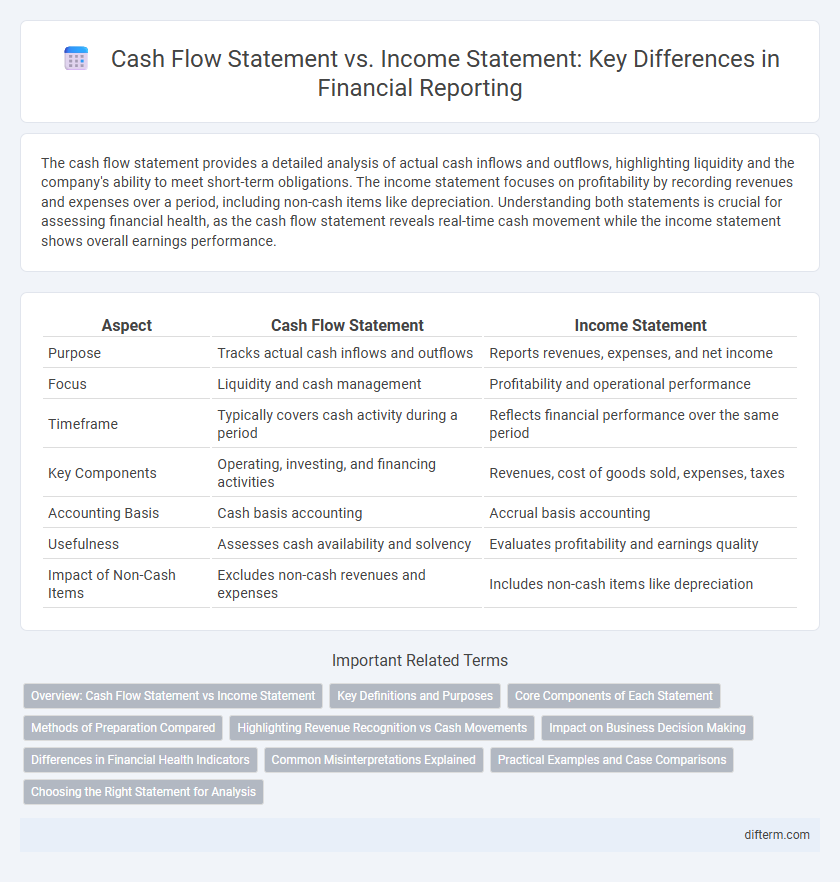

The cash flow statement provides a detailed analysis of actual cash inflows and outflows, highlighting liquidity and the company's ability to meet short-term obligations. The income statement focuses on profitability by recording revenues and expenses over a period, including non-cash items like depreciation. Understanding both statements is crucial for assessing financial health, as the cash flow statement reveals real-time cash movement while the income statement shows overall earnings performance.

Table of Comparison

| Aspect | Cash Flow Statement | Income Statement |

|---|---|---|

| Purpose | Tracks actual cash inflows and outflows | Reports revenues, expenses, and net income |

| Focus | Liquidity and cash management | Profitability and operational performance |

| Timeframe | Typically covers cash activity during a period | Reflects financial performance over the same period |

| Key Components | Operating, investing, and financing activities | Revenues, cost of goods sold, expenses, taxes |

| Accounting Basis | Cash basis accounting | Accrual basis accounting |

| Usefulness | Assesses cash availability and solvency | Evaluates profitability and earnings quality |

| Impact of Non-Cash Items | Excludes non-cash revenues and expenses | Includes non-cash items like depreciation |

Overview: Cash Flow Statement vs Income Statement

The Cash Flow Statement provides a detailed account of the actual inflows and outflows of cash within a business, highlighting operational, investing, and financing activities, which directly affect liquidity. In contrast, the Income Statement focuses on revenues, expenses, and net profit over a specific period, reflecting profitability but not necessarily cash movement. Understanding the difference is crucial for assessing a company's financial health, where cash flow offers insight into real-time solvency and the Income Statement reveals overall performance.

Key Definitions and Purposes

A Cash Flow Statement provides a detailed analysis of cash inflows and outflows from operating, investing, and financing activities, highlighting a company's liquidity and cash management. The Income Statement, also known as the Profit and Loss Statement, summarizes revenues, expenses, and profits over a specific period to measure financial performance and profitability. While the Cash Flow Statement focuses on actual cash transactions, the Income Statement emphasizes accrued revenues and expenses, offering complementary insights for financial analysis.

Core Components of Each Statement

The Cash Flow Statement highlights cash inflows and outflows categorized into operating, investing, and financing activities, providing insight into liquidity and cash management. The Income Statement focuses on revenues, expenses, and net profit over a specific period, reflecting the company's profitability and operational efficiency. Understanding these core components helps investors evaluate financial health from both cash generation and profit perspectives.

Methods of Preparation Compared

The Cash Flow Statement is prepared using the direct or indirect method, focusing on actual cash inflows and outflows from operating, investing, and financing activities. In contrast, the Income Statement is prepared using the accrual basis of accounting, recognizing revenues and expenses when earned or incurred, regardless of cash movements. These differing methods highlight cash flow's emphasis on liquidity and timing, while the income statement measures profitability over a period.

Highlighting Revenue Recognition vs Cash Movements

The Cash Flow Statement tracks actual cash inflows and outflows within operating, investing, and financing activities, providing insights into liquidity and cash management. The Income Statement recognizes revenue and expenses based on accrual accounting principles, reflecting profitability over a specific period regardless of cash timing. Understanding the distinction between revenue recognition on the Income Statement and cash movements on the Cash Flow Statement is crucial for accurate financial analysis and effective cash flow management.

Impact on Business Decision Making

The Cash Flow Statement provides critical insight into a company's liquidity by detailing inflows and outflows of cash, enabling business leaders to assess operational efficiency and short-term solvency. The Income Statement reflects profitability by summarizing revenues and expenses, influencing strategic decisions related to growth, investment, and cost management. Together, these financial statements inform comprehensive decision-making, balancing profit generation goals with cash management to sustain business operations.

Differences in Financial Health Indicators

The Cash Flow Statement provides a clear view of actual liquidity by detailing cash inflows and outflows, unlike the Income Statement which reflects profitability based on accrual accounting. Financial health indicators derived from the Cash Flow Statement emphasize cash generation capabilities, crucial for operational sustainability and debt servicing. In contrast, the Income Statement highlights earnings performance, including non-cash items, which may not accurately represent immediate financial stability.

Common Misinterpretations Explained

Cash flow statements reveal actual liquidity by tracking cash inflows and outflows, whereas income statements reflect profitability through revenue and expenses on an accrual basis. A common misinterpretation is equating net income with cash availability, ignoring non-cash expenses like depreciation that affect income but not cash flow. Understanding these differences is crucial for accurate financial analysis and decision-making, ensuring cash health is not overshadowed by accounting profits.

Practical Examples and Case Comparisons

The cash flow statement provides a detailed view of actual cash inflows and outflows, such as operating cash from sales collections and investing cash from asset purchases, unlike the income statement which shows revenues and expenses based on accrual accounting. For example, a company reporting net income of $500,000 may show negative cash flow if significant customer payments are delayed or large capital expenditures occur. Case comparisons reveal that startups often report losses on income statements but positive cash flows from investor funding, highlighting the importance of using both statements for accurate financial health assessments.

Choosing the Right Statement for Analysis

Selecting the appropriate financial statement depends on the analysis objective: use the cash flow statement to evaluate liquidity and actual cash movement, and the income statement to assess profitability over a specific period. The cash flow statement highlights operating, investing, and financing cash activities, crucial for understanding cash availability and management efficiency. The income statement provides detailed revenue, expense, and net income data, essential for analyzing business performance and profitability trends.

Cash Flow Statement vs Income Statement Infographic

difterm.com

difterm.com