Peer-to-peer lending connects individual borrowers with investors directly, offering competitive interest rates and faster approval processes compared to traditional loans. Crowdfunding raises small amounts of money from a large number of people, often in exchange for rewards or equity, making it ideal for startups and creative projects. Both methods provide alternative financing options but differ in structure, risk, and regulatory requirements.

Table of Comparison

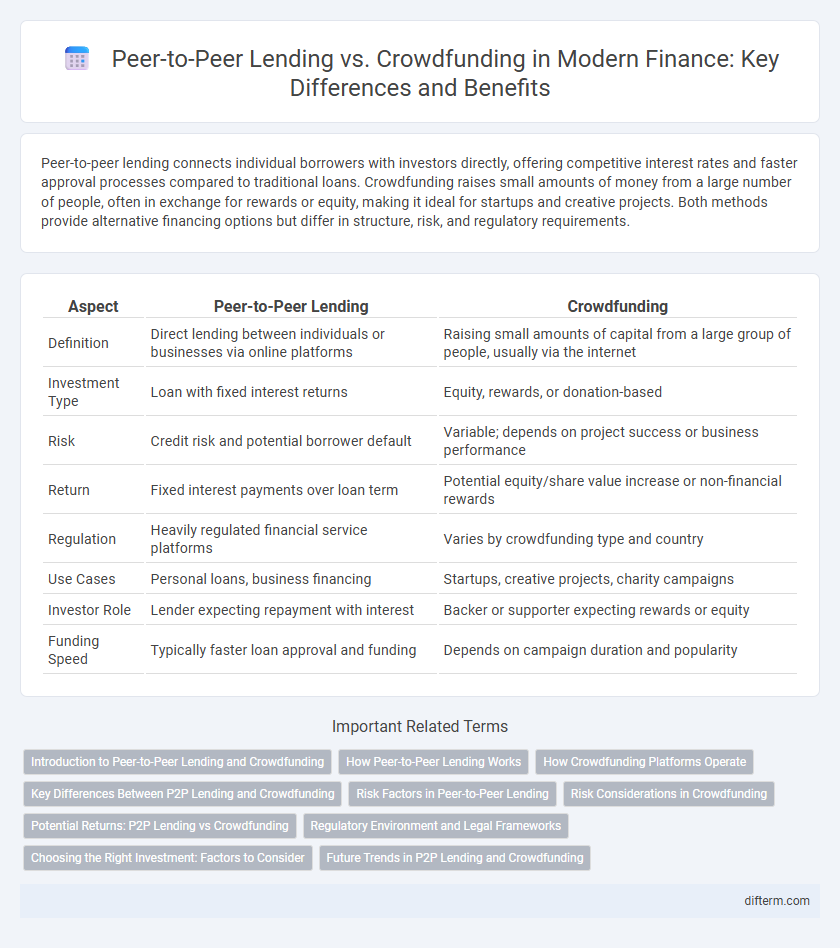

| Aspect | Peer-to-Peer Lending | Crowdfunding |

|---|---|---|

| Definition | Direct lending between individuals or businesses via online platforms | Raising small amounts of capital from a large group of people, usually via the internet |

| Investment Type | Loan with fixed interest returns | Equity, rewards, or donation-based |

| Risk | Credit risk and potential borrower default | Variable; depends on project success or business performance |

| Return | Fixed interest payments over loan term | Potential equity/share value increase or non-financial rewards |

| Regulation | Heavily regulated financial service platforms | Varies by crowdfunding type and country |

| Use Cases | Personal loans, business financing | Startups, creative projects, charity campaigns |

| Investor Role | Lender expecting repayment with interest | Backer or supporter expecting rewards or equity |

| Funding Speed | Typically faster loan approval and funding | Depends on campaign duration and popularity |

Introduction to Peer-to-Peer Lending and Crowdfunding

Peer-to-peer lending connects individual borrowers directly with investors through online platforms, bypassing traditional financial institutions to offer more accessible loan options. Crowdfunding aggregates small contributions from a broad audience to fund projects or businesses, often in exchange for rewards or equity stakes. Both models leverage digital technology to democratize financing, enabling faster access to capital with varying risk and return profiles.

How Peer-to-Peer Lending Works

Peer-to-peer lending connects individual borrowers directly with investors through online platforms, bypassing traditional financial institutions. Borrowers apply for loans, which are evaluated based on creditworthiness, and investors fund these loans in exchange for interest payments. This process enables lower borrowing costs and higher returns compared to conventional banking systems.

How Crowdfunding Platforms Operate

Crowdfunding platforms operate by connecting project creators or entrepreneurs directly with a large pool of individual investors who contribute small amounts of capital in exchange for rewards, equity, or debt instruments. These platforms utilize online portals to facilitate transparent communication, track funding progress, and manage transactions, often incorporating social media integration to amplify reach. Unlike peer-to-peer lending, crowdfunding supports diverse funding models, enabling startups, nonprofits, and creatives to access capital without traditional credit evaluations or interest rate negotiations.

Key Differences Between P2P Lending and Crowdfunding

Peer-to-peer lending involves individuals lending money directly to borrowers with a fixed interest rate and repayment schedule, while crowdfunding typically pools small contributions from many backers without traditional repayment, often supporting creative projects or startups. P2P lending platforms prioritize credit assessment and risk evaluation, enabling investors to earn interest, whereas crowdfunding emphasizes fundraising goals and community engagement without guaranteed financial returns. The regulatory frameworks also differ, with P2P lending subject to stricter financial oversight compared to the more flexible, reward-based or equity-driven crowdfunding models.

Risk Factors in Peer-to-Peer Lending

Peer-to-peer lending carries inherent risk factors such as borrower default, limited regulatory oversight, and potential platform insolvency, which can lead to significant investor losses. Unlike crowdfunding, where funds are often donated or contribute to early-stage projects with diversified backers, peer-to-peer lending exposes investors to concentrated credit risk from individual loan recipients. Understanding borrower creditworthiness and platform transparency is essential to mitigating these risks and protecting investor capital.

Risk Considerations in Crowdfunding

Crowdfunding involves pooling small amounts of capital from a large number of investors, which diversifies risk but exposes contributors to potential platform failures and project non-completion. Unlike peer-to-peer lending, where investors often have legal claims to repayment, crowdfunding typically offers limited recourse if the funded venture fails or fraud occurs. Understanding these risk factors is essential for investors evaluating the trade-offs between liquidity, return potential, and security within crowdfunding platforms.

Potential Returns: P2P Lending vs Crowdfunding

Peer-to-peer (P2P) lending typically offers investors higher potential returns with annual interest rates ranging from 5% to 12%, driven by direct loans to borrowers. Crowdfunding returns vary widely, often influenced by equity stakes or project success, with average returns between 0% and 20%, but carry higher risk and less predictability. Risk-adjusted return metrics generally favor P2P lending for consistent income, while crowdfunding may yield significant profits through equity appreciation or profit sharing in successful ventures.

Regulatory Environment and Legal Frameworks

Peer-to-peer lending platforms operate under stringent regulatory frameworks that often require licensing, transparency in borrower creditworthiness, and investor protection measures, varying significantly across jurisdictions such as the US, UK, and EU. Crowdfunding regulations emphasize investor limits, disclosure obligations, and campaign transparency, with frameworks like the SEC's Regulation Crowdfunding in the US facilitating compliance and risk mitigation. The evolving legal landscape demands continuous adaptation by both models to ensure adherence to anti-money laundering laws, data protection standards, and financial compliance protocols.

Choosing the Right Investment: Factors to Consider

Evaluating risk tolerance and expected returns is crucial when choosing between peer-to-peer lending and crowdfunding platforms. Peer-to-peer lending typically offers fixed interest rates with moderate risk, while crowdfunding investments vary widely in structure and potential upside. Assessing liquidity needs, platform credibility, and regulatory compliance ensures alignment with individual financial goals and investment horizons.

Future Trends in P2P Lending and Crowdfunding

Peer-to-peer lending and crowdfunding are rapidly evolving with the integration of blockchain technology and AI-driven credit scoring, enhancing transparency and risk assessment in financing. Regulatory frameworks are expected to adapt, promoting greater investor protection while enabling cross-border transactions to expand market reach. The increasing adoption of decentralized finance (DeFi) protocols may further disrupt traditional models by offering more efficient, low-cost, and accessible funding alternatives.

Peer-to-peer lending vs Crowdfunding Infographic

difterm.com

difterm.com