Crowdfunding allows startups to raise small amounts of capital from many individuals, providing broad market validation and diverse funding sources. Angel investing involves wealthy individuals offering not only capital but also mentorship and strategic guidance, often leading to stronger growth potential. While crowdfunding democratizes access to funds, angel investing typically delivers deeper financial and experiential support.

Table of Comparison

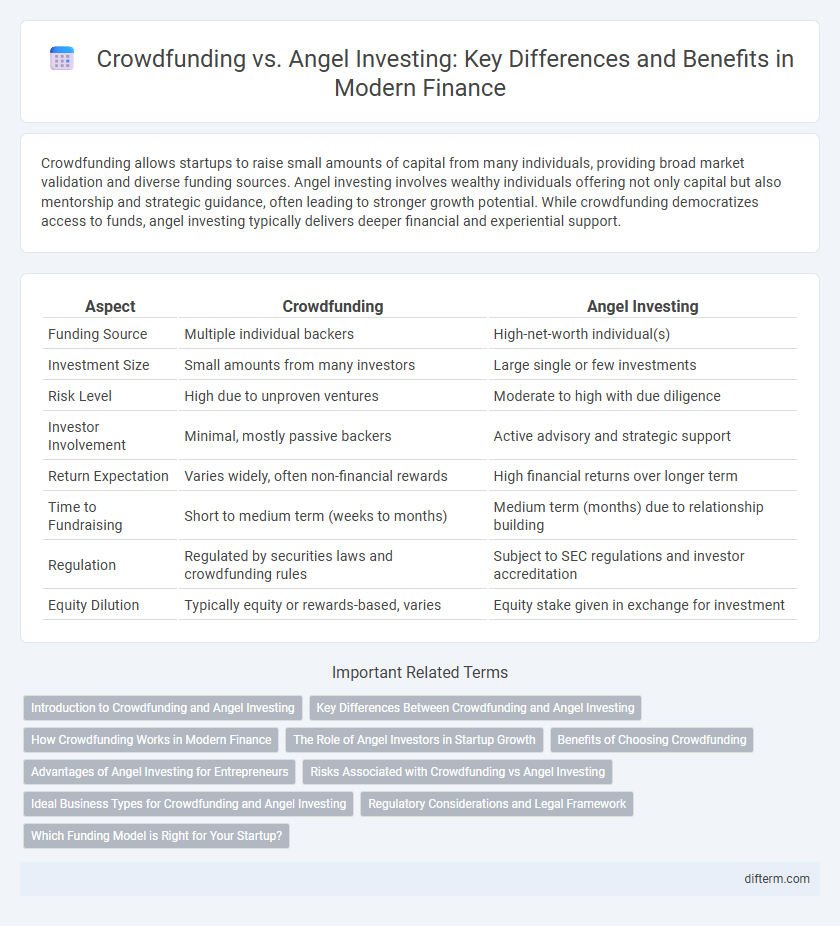

| Aspect | Crowdfunding | Angel Investing |

|---|---|---|

| Funding Source | Multiple individual backers | High-net-worth individual(s) |

| Investment Size | Small amounts from many investors | Large single or few investments |

| Risk Level | High due to unproven ventures | Moderate to high with due diligence |

| Investor Involvement | Minimal, mostly passive backers | Active advisory and strategic support |

| Return Expectation | Varies widely, often non-financial rewards | High financial returns over longer term |

| Time to Fundraising | Short to medium term (weeks to months) | Medium term (months) due to relationship building |

| Regulation | Regulated by securities laws and crowdfunding rules | Subject to SEC regulations and investor accreditation |

| Equity Dilution | Typically equity or rewards-based, varies | Equity stake given in exchange for investment |

Introduction to Crowdfunding and Angel Investing

Crowdfunding involves raising small amounts of capital from a large number of individuals via online platforms, offering entrepreneurs access to diverse funding sources without relying on traditional investors. Angel investing consists of affluent individuals providing early-stage capital in exchange for equity or convertible debt, often accompanied by mentorship and strategic guidance. Both methods serve as crucial alternatives to venture capital, with crowdfunding emphasizing broad participation and angel investing highlighting personalized, high-net-worth involvement.

Key Differences Between Crowdfunding and Angel Investing

Crowdfunding involves raising small amounts of capital from a large number of investors, typically through online platforms, providing access to diverse funding sources while diluting ownership. Angel investing entails high-net-worth individuals directly funding startups in exchange for equity, offering not only capital but also mentorship and strategic guidance. The key differences lie in investment scale, investor involvement, and funding structure, with crowdfunding favoring broad participation and angel investing emphasizing personalized support and larger capital commitments.

How Crowdfunding Works in Modern Finance

Crowdfunding in modern finance involves raising capital through small contributions from a large number of individuals, typically via online platforms such as Kickstarter, Indiegogo, or GoFundMe. This method allows startups and entrepreneurs to access a broad investor base, validate market demand, and receive early-stage funding without giving away significant equity or control. Crowdfunding campaigns often leverage social media and digital marketing to amplify reach, while regulatory frameworks like the JOBS Act facilitate equity crowdfunding by enabling non-accredited investors to participate legally.

The Role of Angel Investors in Startup Growth

Angel investors provide critical early-stage capital and strategic guidance that fuels startup growth, bridging the funding gap before venture capital involvement. Their hands-on expertise and industry connections accelerate product development, market entry, and scaling efforts. Compared to crowdfunding, angel investments offer personalized mentorship and higher funding amounts, making them pivotal for startups seeking sustainable growth and competitive advantage.

Benefits of Choosing Crowdfunding

Crowdfunding enables entrepreneurs to access a large pool of diverse investors, increasing the chances of securing funding without relinquishing significant equity. It offers enhanced market validation by engaging potential customers early, creating a built-in audience and feedback loop for product development. Crowdfunding campaigns also provide flexible funding options and reduce reliance on a few large investors, lowering financial risk and promoting community-driven growth.

Advantages of Angel Investing for Entrepreneurs

Angel investing offers entrepreneurs access to substantial capital alongside valuable mentorship from experienced investors, accelerating business growth and market entry. Unlike crowdfunding, angel investors provide strategic guidance and industry connections, enhancing the likelihood of long-term success. This personalized support often leads to faster decision-making and tailored resources critical for early-stage startups.

Risks Associated with Crowdfunding vs Angel Investing

Crowdfunding presents higher risks due to limited investor influence, lack of regulatory oversight, and potential for project failure without recourse. Angel investing involves significant capital risk but typically offers greater due diligence, fiduciary involvement, and potentially higher returns through equity stakes. Understanding these risk profiles is critical for investors when choosing between crowdfunding platforms and angel investment opportunities.

Ideal Business Types for Crowdfunding and Angel Investing

Crowdfunding suits startups and small businesses with consumer-facing products or innovative ideas that can capture broad public interest, such as tech gadgets or creative projects. Angel investing is ideal for early-stage companies with high growth potential and scalable business models, especially in sectors like technology, healthcare, and fintech, where investors provide not only capital but also strategic guidance. Understanding the distinct funding needs and growth trajectories helps entrepreneurs choose between the broad reach of crowdfunding and the targeted support of angel investors.

Regulatory Considerations and Legal Framework

Crowdfunding operates under the Regulation Crowdfunding rules enforced by the SEC, allowing non-accredited investors to participate with investment limits tied to income and net worth, while requiring issuers to disclose financial statements and business information. Angel investing typically involves accredited investors and is less regulated, relying on private placement exemptions under Regulation D, which limits solicitation and mandates fewer disclosure requirements. Understanding the distinct regulatory frameworks is crucial for entrepreneurs to ensure compliance and optimize funding strategies within the legal landscape.

Which Funding Model is Right for Your Startup?

Crowdfunding offers startups access to a broad base of investors, enabling rapid capital accumulation and market validation through public interest, while angel investing provides targeted mentorship and substantial funding from experienced individuals in exchange for equity. Startups with early-stage products seeking community engagement and smaller amounts might benefit from crowdfunding, whereas ventures requiring strategic guidance and larger investments should consider angel investors. Evaluating your startup's growth stage, capital needs, and desire for investor involvement helps determine the most suitable funding model.

Crowdfunding vs Angel Investing Infographic

difterm.com

difterm.com