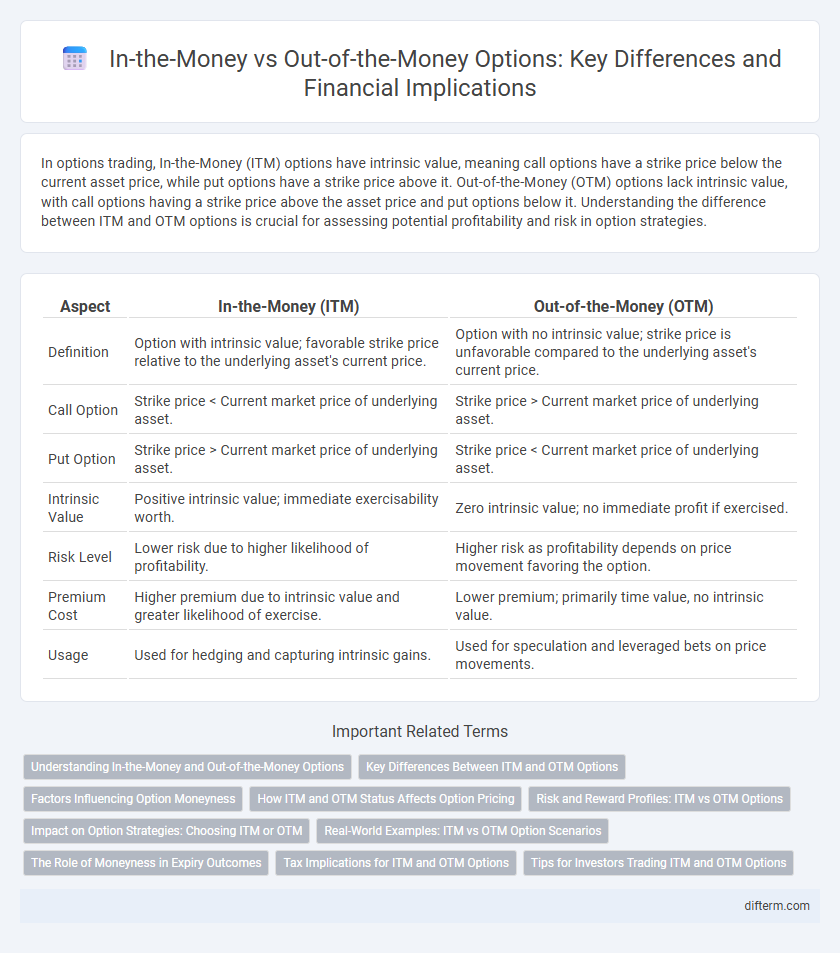

In options trading, In-the-Money (ITM) options have intrinsic value, meaning call options have a strike price below the current asset price, while put options have a strike price above it. Out-of-the-Money (OTM) options lack intrinsic value, with call options having a strike price above the asset price and put options below it. Understanding the difference between ITM and OTM options is crucial for assessing potential profitability and risk in option strategies.

Table of Comparison

| Aspect | In-the-Money (ITM) | Out-of-the-Money (OTM) |

|---|---|---|

| Definition | Option with intrinsic value; favorable strike price relative to the underlying asset's current price. | Option with no intrinsic value; strike price is unfavorable compared to the underlying asset's current price. |

| Call Option | Strike price < Current market price of underlying asset. | Strike price > Current market price of underlying asset. |

| Put Option | Strike price > Current market price of underlying asset. | Strike price < Current market price of underlying asset. |

| Intrinsic Value | Positive intrinsic value; immediate exercisability worth. | Zero intrinsic value; no immediate profit if exercised. |

| Risk Level | Lower risk due to higher likelihood of profitability. | Higher risk as profitability depends on price movement favoring the option. |

| Premium Cost | Higher premium due to intrinsic value and greater likelihood of exercise. | Lower premium; primarily time value, no intrinsic value. |

| Usage | Used for hedging and capturing intrinsic gains. | Used for speculation and leveraged bets on price movements. |

Understanding In-the-Money and Out-of-the-Money Options

In-the-money options have intrinsic value because the underlying asset's current price favors the option holder, such as a call option when the asset price exceeds the strike price, or a put option when the asset price is below the strike price. Out-of-the-money options have no intrinsic value, as the underlying asset's price does not benefit the holder--call options with strike prices above the asset price and put options with strike prices below the asset price fall into this category. Understanding these distinctions is crucial for options traders to evaluate potential profitability and risk management strategies.

Key Differences Between ITM and OTM Options

In-the-money (ITM) options have intrinsic value because the option's strike price is favorable compared to the current underlying asset price, making them more likely to be exercised profitably. Out-of-the-money (OTM) options lack intrinsic value since their strike price is less favorable than the current market price, resulting in a higher risk but lower premium cost. The key difference lies in their payoff potential and risk profile, with ITM options offering immediate exercise value and OTM options serving as speculative instruments for price movement.

Factors Influencing Option Moneyness

Option moneyness is primarily influenced by the underlying asset's current price relative to the option's strike price, time to expiration, and market volatility. Implied volatility increases the probability of an option moving in-the-money by affecting the premium and expected price swings. Interest rates and dividends also alter the intrinsic value calculation, impacting the likelihood of exercising the option profitably.

How ITM and OTM Status Affects Option Pricing

In-the-Money (ITM) options have intrinsic value, leading to higher premiums due to the immediate exercise profit potential, whereas Out-of-the-Money (OTM) options lack intrinsic value and are priced primarily based on time value and volatility. The delta of ITM options is closer to 1, reflecting a higher sensitivity to underlying asset price changes, while OTM options have a delta near zero, resulting in lower price sensitivity. Market factors such as implied volatility and time to expiration significantly influence the extrinsic value, with ITM options typically exhibiting higher overall option prices compared to OTM options.

Risk and Reward Profiles: ITM vs OTM Options

In-the-money (ITM) options carry higher premiums but offer lower risk due to intrinsic value, providing a better hedge against adverse price movements. Out-of-the-money (OTM) options have lower premiums and higher risk, as they lack intrinsic value and rely solely on favorable price shifts to become profitable. The reward profile for ITM options is moderate but more achievable, while OTM options promise higher potential returns but with significantly increased likelihood of expiring worthless.

Impact on Option Strategies: Choosing ITM or OTM

Selecting In-the-Money (ITM) options typically results in higher premiums and greater intrinsic value, which can offer more immediate profit potential but with increased upfront cost. Out-of-the-Money (OTM) options often have lower premiums and higher leverage, making them attractive for speculative strategies aiming for significant price moves with limited initial investment. The choice between ITM and OTM options significantly impacts risk management, potential returns, and the likelihood of options expiring worthless in various trading strategies.

Real-World Examples: ITM vs OTM Option Scenarios

In finance, an In-the-Money (ITM) call option on Apple Inc. (AAPL) with a strike price of $150, when AAPL's current stock price is $170, offers immediate intrinsic value, allowing the holder to buy shares below market price. Conversely, an Out-of-the-Money (OTM) call option with a $190 strike price holds no intrinsic value as the stock price is lower, representing a speculative bet on future price increases. Real-world scenarios demonstrate ITM options' use for hedging and guaranteed profits, while OTM options are commonly employed for leverage and speculative strategies with higher risk and potential reward.

The Role of Moneyness in Expiry Outcomes

Moneyness determines whether an option expires profitably; in-the-money (ITM) options have intrinsic value at expiry, meaning the underlying asset's price favors the option holder. Out-of-the-money (OTM) options hold no intrinsic value at expiry, leading to potential total loss of the premium paid. Understanding the role of moneyness helps traders anticipate payout scenarios and optimize option strategies based on market conditions.

Tax Implications for ITM and OTM Options

In-the-Money (ITM) options often trigger taxable events upon exercise, typically resulting in capital gains or losses based on the option's intrinsic value at exercise. Out-of-the-Money (OTM) options generally expire worthless, leading to a capital loss equal to the premium paid, which can be used to offset other gains for tax purposes. Understanding the tax implications of ITM and OTM options is crucial for effective tax planning and optimizing after-tax returns in options trading.

Tips for Investors Trading ITM and OTM Options

When trading In-the-Money (ITM) options, investors should prioritize monitoring intrinsic value and leverage higher delta to capture price movements efficiently. For Out-of-the-Money (OTM) options, focus on volatility analysis and time decay to mitigate premium loss while targeting significant price swings. Employing risk management strategies like stop-loss orders and position sizing is crucial for both ITM and OTM options to maximize returns and minimize losses.

In-the-Money vs Out-of-the-Money (Options) Infographic

difterm.com

difterm.com