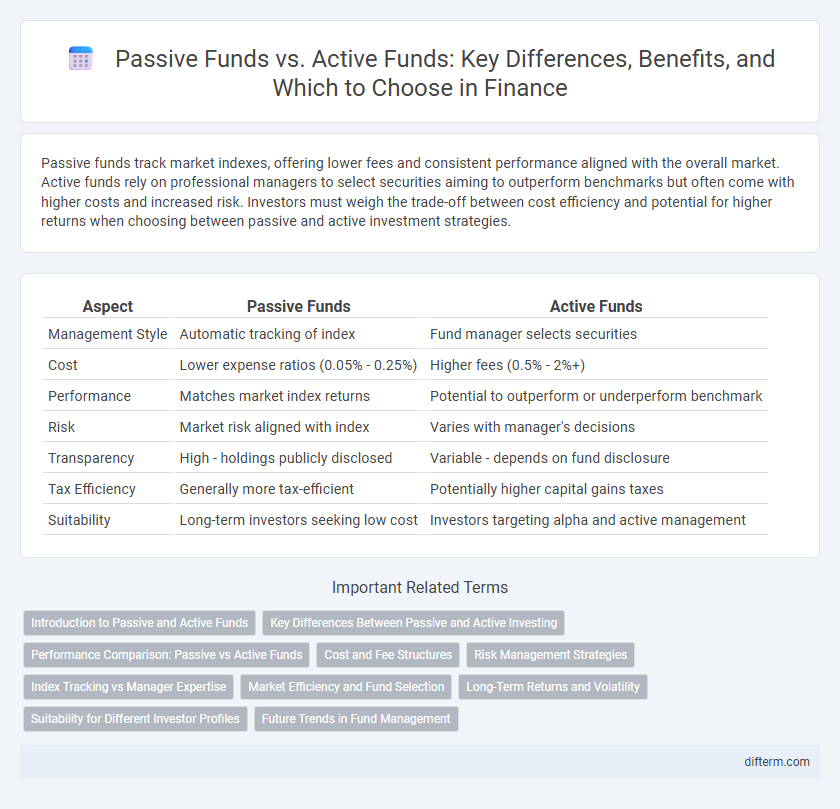

Passive funds track market indexes, offering lower fees and consistent performance aligned with the overall market. Active funds rely on professional managers to select securities aiming to outperform benchmarks but often come with higher costs and increased risk. Investors must weigh the trade-off between cost efficiency and potential for higher returns when choosing between passive and active investment strategies.

Table of Comparison

| Aspect | Passive Funds | Active Funds |

|---|---|---|

| Management Style | Automatic tracking of index | Fund manager selects securities |

| Cost | Lower expense ratios (0.05% - 0.25%) | Higher fees (0.5% - 2%+) |

| Performance | Matches market index returns | Potential to outperform or underperform benchmark |

| Risk | Market risk aligned with index | Varies with manager's decisions |

| Transparency | High - holdings publicly disclosed | Variable - depends on fund disclosure |

| Tax Efficiency | Generally more tax-efficient | Potentially higher capital gains taxes |

| Suitability | Long-term investors seeking low cost | Investors targeting alpha and active management |

Introduction to Passive and Active Funds

Passive funds track a specific market index, aiming to replicate its performance by holding the same securities in the same proportions, which results in lower management fees and reduced trading costs. Active funds rely on portfolio managers who use research, market forecasts, and their own judgment to select investments, seeking to outperform the market index. The choice between passive and active funds depends on factors such as risk tolerance, investment objectives, and the willingness to pay higher fees for potential outperformance.

Key Differences Between Passive and Active Investing

Passive funds track market indices using a buy-and-hold strategy with low management fees and minimal portfolio turnover, emphasizing broad market exposure and cost efficiency. Active funds involve portfolio managers selecting securities to outperform benchmarks, incurring higher fees and increased trading activity due to ongoing market analysis and stock picking. Key differences include cost structure, management style, risk tolerance, and potential for higher returns versus market average performance.

Performance Comparison: Passive vs Active Funds

Passive funds often deliver returns closely aligned with their benchmark indexes, minimizing management fees and reducing costs for investors. Active funds aim to outperform benchmarks through selective stock picking and market timing, but their performance can be inconsistent and is frequently offset by higher expenses. Historical data reveals that, over the long term, a majority of active funds underperform passive funds after fees are accounted for.

Cost and Fee Structures

Passive funds generally have lower cost and fee structures due to their algorithm-driven strategies and minimal portfolio management expenses. Active funds incur higher fees because of the extensive research, analysis, and frequent trading required by fund managers to outperform market benchmarks. Investors often weigh these cost differences against potential returns when choosing between passive and active fund options.

Risk Management Strategies

Passive funds typically employ broad market indexing strategies that minimize active decision-making, reducing management risk and promoting consistent risk exposure aligned with market performance. Active funds implement dynamic risk management techniques such as sector rotation, stock selection, and tactical asset allocation to potentially outperform benchmarks but carry higher manager-related risk. Effective risk management in active funds involves continuous market analysis and adaptive portfolio adjustments, whereas passive funds rely on diversification and low turnover to mitigate risk.

Index Tracking vs Manager Expertise

Passive funds primarily focus on index tracking, aiming to replicate the performance of benchmark indexes like the S&P 500 with low fees and minimal portfolio turnover. Active funds rely on manager expertise to select securities, attempting to outperform the market through research, analysis, and strategic trades, often resulting in higher costs. The choice between passive index funds and active management hinges on the trade-off between cost efficiency and the potential for alpha generation.

Market Efficiency and Fund Selection

Market efficiency significantly influences the performance differences between passive and active funds, with passive funds typically excelling in highly efficient markets due to lower costs and broad market exposure. Active funds seek to outperform by leveraging market inefficiencies through skilled fund selection and active management strategies, which may yield higher returns in less efficient or emerging markets. Investors should evaluate market conditions and fund management expertise when choosing between passive and active funds for optimal portfolio performance.

Long-Term Returns and Volatility

Passive funds typically deliver steady long-term returns by tracking market indices, minimizing fees and reducing the impact of market volatility. Active funds aim to outperform benchmarks through expert stock selection, but their higher fees and frequent trading often increase volatility and may erode long-term gains. Over extended periods, passive funds generally provide more consistent returns with lower risk compared to the unpredictable performance of active management.

Suitability for Different Investor Profiles

Passive funds suit investors seeking low-cost, long-term growth with minimal portfolio management, ideal for those with a conservative risk tolerance and preference for market-average returns. Active funds appeal to investors willing to accept higher fees for the potential of outperforming the market, fitting profiles with a higher risk appetite and interest in tactical asset allocation. Understanding individual financial goals, risk tolerance, and investment horizon is crucial in choosing between passive and active fund strategies.

Future Trends in Fund Management

Future trends in fund management indicate a growing shift towards passive funds due to their lower fees and improved tracking of market indices. Advances in AI and big data analytics are enabling active fund managers to enhance stock selection and risk management strategies, potentially narrowing the performance gap. Sustainable investing and ESG criteria are increasingly integrated into both passive and active funds, shaping portfolio construction and investor demand.

Passive Funds vs Active Funds Infographic

difterm.com

difterm.com