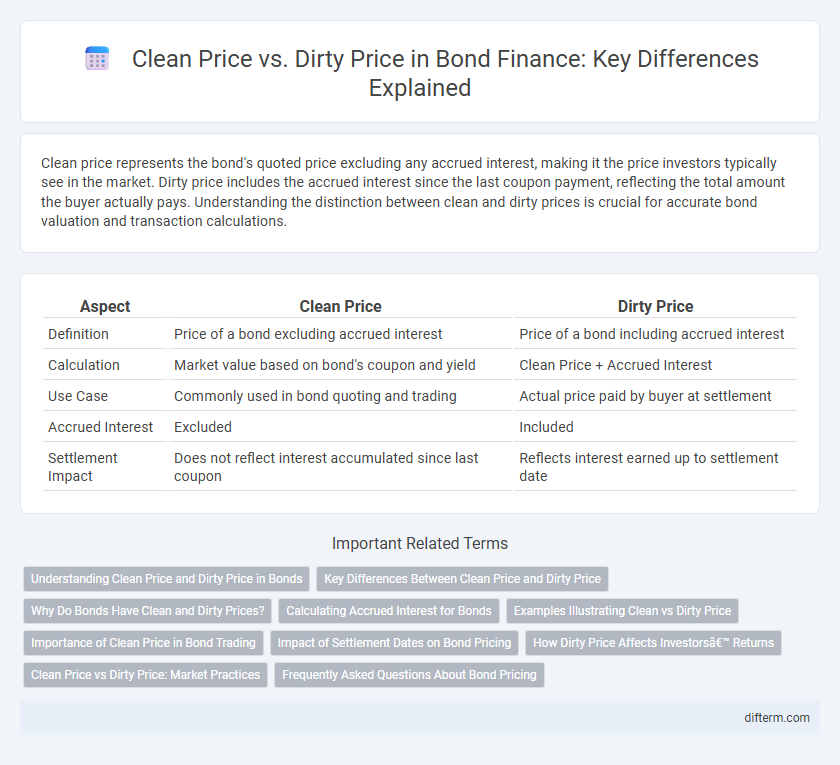

Clean price represents the bond's quoted price excluding any accrued interest, making it the price investors typically see in the market. Dirty price includes the accrued interest since the last coupon payment, reflecting the total amount the buyer actually pays. Understanding the distinction between clean and dirty prices is crucial for accurate bond valuation and transaction calculations.

Table of Comparison

| Aspect | Clean Price | Dirty Price |

|---|---|---|

| Definition | Price of a bond excluding accrued interest | Price of a bond including accrued interest |

| Calculation | Market value based on bond's coupon and yield | Clean Price + Accrued Interest |

| Use Case | Commonly used in bond quoting and trading | Actual price paid by buyer at settlement |

| Accrued Interest | Excluded | Included |

| Settlement Impact | Does not reflect interest accumulated since last coupon | Reflects interest earned up to settlement date |

Understanding Clean Price and Dirty Price in Bonds

Clean price represents the quoted price of a bond excluding any accrued interest since the last coupon payment, reflecting the bond's intrinsic value. Dirty price includes both the clean price and accrued interest, providing the total amount a buyer pays when purchasing the bond between coupon dates. Understanding the distinction between clean price and dirty price is essential for accurate bond valuation and transaction clarity in fixed income markets.

Key Differences Between Clean Price and Dirty Price

Clean price represents the bond's price excluding accrued interest, reflecting its value on the last coupon payment date, while dirty price includes accrued interest, showing the total amount a buyer pays. The key difference lies in accrued interest calculation, where dirty price incorporates interest earned since the last coupon, impacting transaction costs and yield assessment. Understanding these prices is crucial for precise bond valuation, trading, and accounting in fixed income markets.

Why Do Bonds Have Clean and Dirty Prices?

Bonds have clean and dirty prices to distinguish the quoted price from the total amount paid by the buyer, including accrued interest. The clean price reflects the bond's price excluding accrued interest, facilitating easier comparison across bonds. The dirty price accounts for accrued interest since the last coupon payment, ensuring the seller receives compensation for the holding period.

Calculating Accrued Interest for Bonds

Accrued interest for bonds is calculated by multiplying the bond's coupon rate by the fraction of the coupon period that has elapsed since the last payment. This accrued interest is added to the clean price to determine the dirty price, reflecting the total amount the buyer pays. Accurate calculation of accrued interest ensures fair compensation to the seller for the interest earned during the holding period.

Examples Illustrating Clean vs Dirty Price

Clean price of a bond excludes accrued interest and reflects only the bond's quoted price, for example, a bond quoted at $980 with $20 accrued interest has a clean price of $960. Dirty price combines the clean price and accrued interest, making the investor's actual purchase price; in this case, the dirty price equals $980. When trading bonds between coupon payments, the dirty price accurately represents the total cost paid, while the clean price is primarily used for reporting and comparison purposes.

Importance of Clean Price in Bond Trading

Clean price represents the bond's value excluding accrued interest, providing a clear indicator of the bond's market value and facilitating transparent comparisons among different bonds. Traders rely on the clean price to accurately assess price movements without the distortion of fluctuating accrued interest, enhancing decision-making efficiency. Understanding the clean price is essential for precise portfolio valuation, risk management, and executing fair bond transactions in active markets.

Impact of Settlement Dates on Bond Pricing

Settlement dates directly influence bond pricing by determining whether accrued interest is included in the transaction price, distinguishing between clean price and dirty price calculations. The clean price reflects the bond's value excluding accrued interest, while the dirty price incorporates accrued interest up to the settlement date, affecting buyer and seller cash flows. Variations in settlement dates thus alter the accrued interest portion, impacting the total amount paid during bond transactions.

How Dirty Price Affects Investors’ Returns

Dirty price, which includes accrued interest, directly impacts investors' returns by reflecting the total cost of acquiring a bond between coupon payments. Since the dirty price accounts for interest earned but not yet paid, investors pay a premium that adjusts the yield calculation, influencing realized income and capital gains. Understanding the dirty price is essential for accurately assessing the net return and making informed decisions in bond investment strategies.

Clean Price vs Dirty Price: Market Practices

Clean price reflects a bond's value excluding accrued interest, aligning with market practice for quoting fixed income securities to enhance comparability across transactions. Dirty price includes accrued interest, representing the actual amount paid by buyers, crucial for settlement calculations and accurate yield assessment. Market participants prefer clean price for pricing transparency while relying on dirty price for cash flow and accounting accuracy.

Frequently Asked Questions About Bond Pricing

Clean price refers to a bond's price excluding accrued interest, while dirty price includes accrued interest to reflect the total amount payable by the buyer. Investors often ask how these prices affect yield calculations and transaction settlements, with dirty price providing a more accurate measure of the actual transaction cost. Understanding the distinction between clean and dirty prices is crucial for accurately assessing bond investments and calculating returns.

Clean Price vs Dirty Price (bonds) Infographic

difterm.com

difterm.com