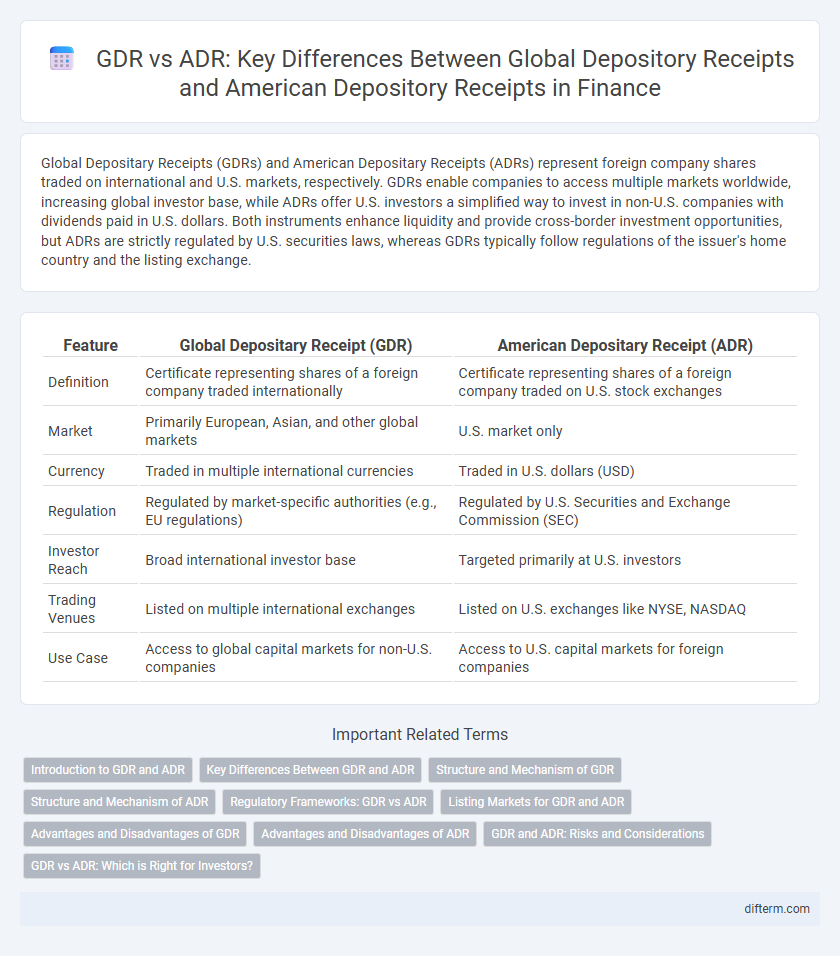

Global Depositary Receipts (GDRs) and American Depositary Receipts (ADRs) represent foreign company shares traded on international and U.S. markets, respectively. GDRs enable companies to access multiple markets worldwide, increasing global investor base, while ADRs offer U.S. investors a simplified way to invest in non-U.S. companies with dividends paid in U.S. dollars. Both instruments enhance liquidity and provide cross-border investment opportunities, but ADRs are strictly regulated by U.S. securities laws, whereas GDRs typically follow regulations of the issuer's home country and the listing exchange.

Table of Comparison

| Feature | Global Depositary Receipt (GDR) | American Depositary Receipt (ADR) |

|---|---|---|

| Definition | Certificate representing shares of a foreign company traded internationally | Certificate representing shares of a foreign company traded on U.S. stock exchanges |

| Market | Primarily European, Asian, and other global markets | U.S. market only |

| Currency | Traded in multiple international currencies | Traded in U.S. dollars (USD) |

| Regulation | Regulated by market-specific authorities (e.g., EU regulations) | Regulated by U.S. Securities and Exchange Commission (SEC) |

| Investor Reach | Broad international investor base | Targeted primarily at U.S. investors |

| Trading Venues | Listed on multiple international exchanges | Listed on U.S. exchanges like NYSE, NASDAQ |

| Use Case | Access to global capital markets for non-U.S. companies | Access to U.S. capital markets for foreign companies |

Introduction to GDR and ADR

Global Depository Receipts (GDRs) and American Depository Receipts (ADRs) are financial instruments that allow companies to raise capital in international markets while enabling investors to trade shares of foreign companies. GDRs are typically issued outside the U.S. and listed on European or other international stock exchanges, representing ownership in shares of a foreign company. ADRs are specifically designed for the U.S. market, allowing American investors to buy shares of foreign companies through U.S. exchanges, thereby facilitating cross-border investment and liquidity.

Key Differences Between GDR and ADR

Global Depositary Receipts (GDRs) and American Depositary Receipts (ADRs) both represent shares of foreign companies traded in different markets, but GDRs primarily facilitate trading in European and other international markets, while ADRs are specifically designed for the U.S. market. GDRs often have more flexible regulatory requirements and can represent multiple class shares, whereas ADRs are subject to U.S. Securities and Exchange Commission (SEC) regulations and typically represent common stock. Currency denomination also varies, with GDRs usually issued in U.S. dollars or Euros, and ADRs exclusively issued in U.S. dollars, impacting investor accessibility and trading liquidity.

Structure and Mechanism of GDR

Global Depository Receipts (GDRs) represent a financial instrument that enables investors to hold shares in foreign companies through a local depositary bank, which issues these receipts against the underlying shares held in custody. The structure of GDRs involves a depository bank issuing negotiable certificates that trade on international stock exchanges, facilitating cross-border investment and liquidity without the need for investors to directly purchase shares in foreign markets. The mechanism includes converting shares into GDRs, which simplifies transactions, improves accessibility for global investors, and enhances the issuer's access to international capital without adherence to the regulations of the domestic stock exchange alone.

Structure and Mechanism of ADR

American Depositary Receipts (ADRs) represent shares of a foreign company held by a U.S. depositary bank, allowing U.S. investors to trade these securities on American stock exchanges without dealing with foreign currency or regulations. The ADR structure involves issuing receipts that correspond to a specific number of underlying foreign shares, which the depositary bank holds in custody, facilitating dividends and voting rights through the depositary. This mechanism streamlines investment in foreign equities by converting complex cross-border transactions into tradable U.S.-denominated securities, enhancing liquidity and market access.

Regulatory Frameworks: GDR vs ADR

Global Depository Receipts (GDRs) and American Depository Receipts (ADRs) differ primarily in their regulatory frameworks, with GDRs falling under the jurisdiction of the International Financial Services Centre Authority (IFSCA) and multiple foreign regulations, while ADRs are governed by the U.S. Securities and Exchange Commission (SEC) under the Securities Act of 1933 and the Securities Exchange Act of 1934. GDR issuers must comply with international securities laws and can be listed on European or other global exchanges, whereas ADR issuers must adhere to stringent SEC reporting requirements, including the Sarbanes-Oxley Act for financial transparency and corporate governance. Regulatory compliance influences disclosure obligations, investor protections, and market accessibility, making the choice between GDR and ADR critical for multinational companies seeking cross-border capital raising.

Listing Markets for GDR and ADR

Global Depositary Receipts (GDRs) are primarily listed on European and international stock exchanges such as the London Stock Exchange and Luxembourg Stock Exchange, catering to investors seeking exposure to emerging markets. American Depositary Receipts (ADRs) are listed mainly on U.S. exchanges like the New York Stock Exchange (NYSE) and NASDAQ, providing foreign companies access to American investors. The distinct listing venues reflect their target investor bases and regulatory environments, with GDRs facilitating cross-border investments in diverse markets and ADRs focusing on the U.S. market's liquidity and transparency.

Advantages and Disadvantages of GDR

Global Depositary Receipts (GDRs) offer companies the advantage of accessing multiple international markets and attracting global investors, enhancing liquidity and broadening capital base. However, GDRs involve higher regulatory complexity and compliance costs compared to American Depositary Receipts (ADRs), potentially deterring smaller firms. Limited investor familiarity outside the issuing region can restrict demand, impacting trading volumes and price stability.

Advantages and Disadvantages of ADR

American Depositary Receipts (ADRs) offer advantages such as easier access to U.S. investors, enhanced liquidity, and simplified regulatory compliance under the SEC, boosting foreign companies' visibility and capital raising potential in the American markets. However, ADRs involve disadvantages including higher administrative costs for issuers, exposure to currency exchange risk for investors, and possible dilution of control due to the representation of shares. The complexity of navigating U.S. accounting standards and ongoing disclosure requirements can also burden foreign issuers using ADRs.

GDR and ADR: Risks and Considerations

Global Depository Receipts (GDRs) and American Depository Receipts (ADRs) expose investors to currency risk, as changes in exchange rates can affect the value and returns. Regulatory environments differ significantly between markets, with ADRs typically subject to U.S. Securities and Exchange Commission (SEC) regulations, while GDRs are governed by the laws of the issuing country and the international market. Liquidity also varies, with ADRs often trading on major U.S. exchanges, providing higher liquidity compared to GDRs, which may trade on less liquid international platforms, impacting execution and pricing.

GDR vs ADR: Which is Right for Investors?

Global Depositary Receipts (GDRs) and American Depositary Receipts (ADRs) offer investors access to foreign equities but differ in market reach and regulatory frameworks, with GDRs primarily targeted at European and international investors and ADRs focused on the U.S. market. GDRs provide exposure to multiple markets through listings on stock exchanges like London and Luxembourg, while ADRs facilitate investment in foreign companies specifically on U.S. exchanges such as the NYSE or NASDAQ. Investors should consider factors like currency risk, liquidity, and regulatory compliance when choosing between GDRs and ADRs to optimize portfolio diversification and global market participation.

GDR vs ADR Infographic

difterm.com

difterm.com