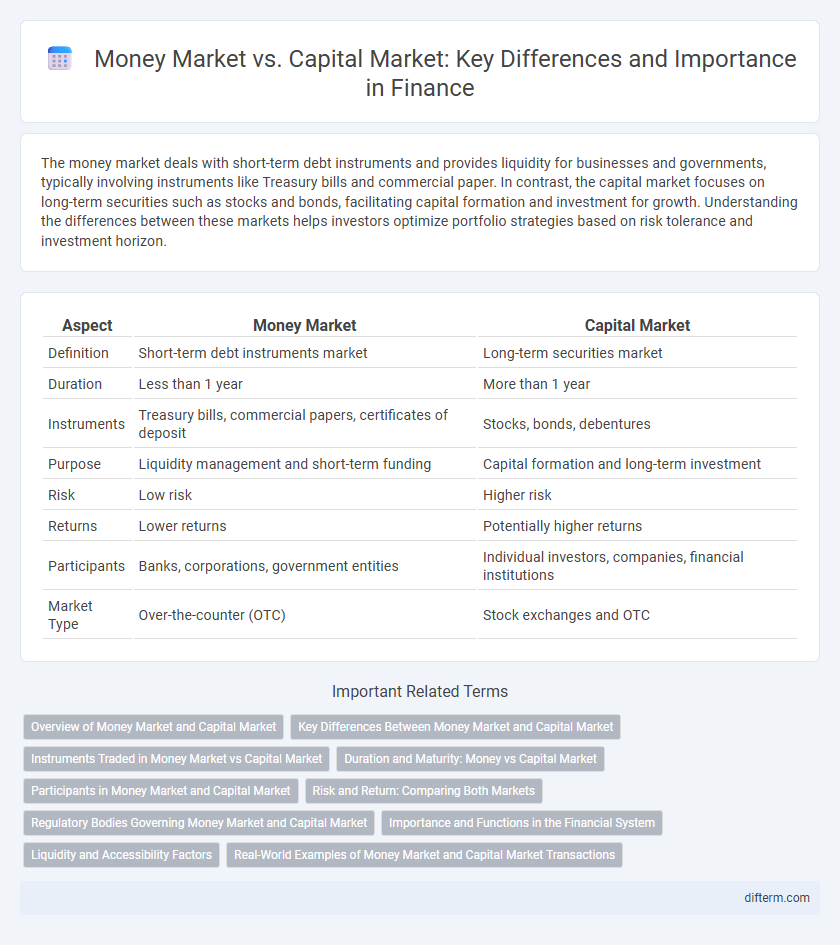

The money market deals with short-term debt instruments and provides liquidity for businesses and governments, typically involving instruments like Treasury bills and commercial paper. In contrast, the capital market focuses on long-term securities such as stocks and bonds, facilitating capital formation and investment for growth. Understanding the differences between these markets helps investors optimize portfolio strategies based on risk tolerance and investment horizon.

Table of Comparison

| Aspect | Money Market | Capital Market |

|---|---|---|

| Definition | Short-term debt instruments market | Long-term securities market |

| Duration | Less than 1 year | More than 1 year |

| Instruments | Treasury bills, commercial papers, certificates of deposit | Stocks, bonds, debentures |

| Purpose | Liquidity management and short-term funding | Capital formation and long-term investment |

| Risk | Low risk | Higher risk |

| Returns | Lower returns | Potentially higher returns |

| Participants | Banks, corporations, government entities | Individual investors, companies, financial institutions |

| Market Type | Over-the-counter (OTC) | Stock exchanges and OTC |

Overview of Money Market and Capital Market

Money markets facilitate short-term borrowing and lending, typically involving instruments like Treasury bills, commercial paper, and certificates of deposit with maturities of less than one year. Capital markets, on the other hand, provide long-term funding through equity and debt instruments such as stocks and bonds, supporting corporate expansion and government projects. Both markets play critical roles in financial stability by channeling funds efficiently between savers and borrowers.

Key Differences Between Money Market and Capital Market

Money markets primarily deal with short-term debt instruments such as Treasury bills, commercial paper, and certificates of deposit, typically maturing within one year, whereas capital markets involve long-term securities like stocks and bonds with maturities extending beyond one year. Money markets provide liquidity for governments, financial institutions, and corporations to manage short-term funding needs, while capital markets facilitate the raising of long-term capital for expansion and investment projects. The risk and return profile in money markets is generally lower compared to capital markets, which offer higher returns at increased risk due to the longer investment horizon.

Instruments Traded in Money Market vs Capital Market

The money market primarily involves short-term debt instruments such as Treasury bills, commercial paper, certificates of deposit, and repurchase agreements, which typically mature in less than one year. In contrast, the capital market deals with long-term securities including equities, bonds, debentures, and preferred stocks, facilitating the raising of capital for extended periods. These distinct instruments reflect the varying maturity profiles and risk-return characteristics inherent to money markets and capital markets.

Duration and Maturity: Money vs Capital Market

Money markets deal with short-term debt instruments typically maturing within one year, providing high liquidity and low risk for investors. Capital markets handle long-term securities such as stocks and bonds, with maturities extending beyond one year to support long-term investment and growth. The difference in duration and maturity reflects the distinct roles these markets play in financing immediate needs versus long-term capital formation.

Participants in Money Market and Capital Market

Money Market participants primarily include banks, money market mutual funds, corporations, and governments engaging in short-term borrowing and lending to manage liquidity. Capital Market participants consist of individual investors, institutional investors like pension funds and insurance companies, as well as corporations issuing stocks and bonds to raise long-term capital. Understanding the distinct roles of these participants helps in analyzing market dynamics and investment strategies within each market.

Risk and Return: Comparing Both Markets

Money markets generally involve short-term, low-risk instruments such as Treasury bills and commercial paper, offering lower returns but higher liquidity. Capital markets encompass long-term securities like stocks and bonds, which carry higher risk due to market volatility but provide greater return potential. Investors seeking capital preservation prioritize money markets, while those aiming for wealth growth tend to prefer capital markets for their risk-return tradeoff.

Regulatory Bodies Governing Money Market and Capital Market

The money market is primarily regulated by bodies such as the Federal Reserve, Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC) to ensure liquidity and short-term financing stability. The capital market operates under stringent oversight from the SEC, Financial Industry Regulatory Authority (FINRA), and various international regulatory agencies to maintain transparency and protect long-term investments in stocks and bonds. Both markets adhere to specific compliance frameworks that govern issuance, trading, and settlement processes to foster investor confidence and financial market integrity.

Importance and Functions in the Financial System

Money markets provide short-term funds and liquidity management essential for maintaining financial stability and meeting immediate financing needs. Capital markets facilitate long-term funding through equity and debt instruments, supporting economic growth by enabling investment in infrastructure, business expansion, and innovation. Together, these markets ensure efficient allocation of resources, risk diversification, and effective price discovery within the financial system.

Liquidity and Accessibility Factors

Money markets offer high liquidity and easy accessibility due to short-term debt instruments like treasury bills and commercial paper, making them ideal for investors seeking quick returns with minimal risk. Capital markets, characterized by long-term securities such as stocks and bonds, provide lower liquidity but greater potential for higher returns, catering to investors willing to commit funds for extended periods. The liquidity difference significantly influences investment strategies, with money markets serving immediate cash flow needs and capital markets supporting long-term capital growth.

Real-World Examples of Money Market and Capital Market Transactions

Money market transactions include short-term borrowing and lending such as Treasury bills issued by the U.S. government and commercial paper issued by corporations like Apple to manage liquidity. Capital market transactions involve long-term funding through equity and debt instruments, exemplified by companies like Tesla issuing common stock or bonds to finance expansion projects. These real-world examples demonstrate how businesses and governments utilize money markets for immediate cash needs and capital markets for substantial, long-term financing.

Money Market vs Capital Market Infographic

difterm.com

difterm.com