The expense ratio represents the total annual cost of owning a mutual fund, including management fees and operational expenses, expressed as a percentage of assets. The management fee is a portion of the expense ratio specifically paid to the fund's investment manager for their services. Understanding the difference between these fees helps investors assess the true cost of their investment and its impact on overall returns.

Table of Comparison

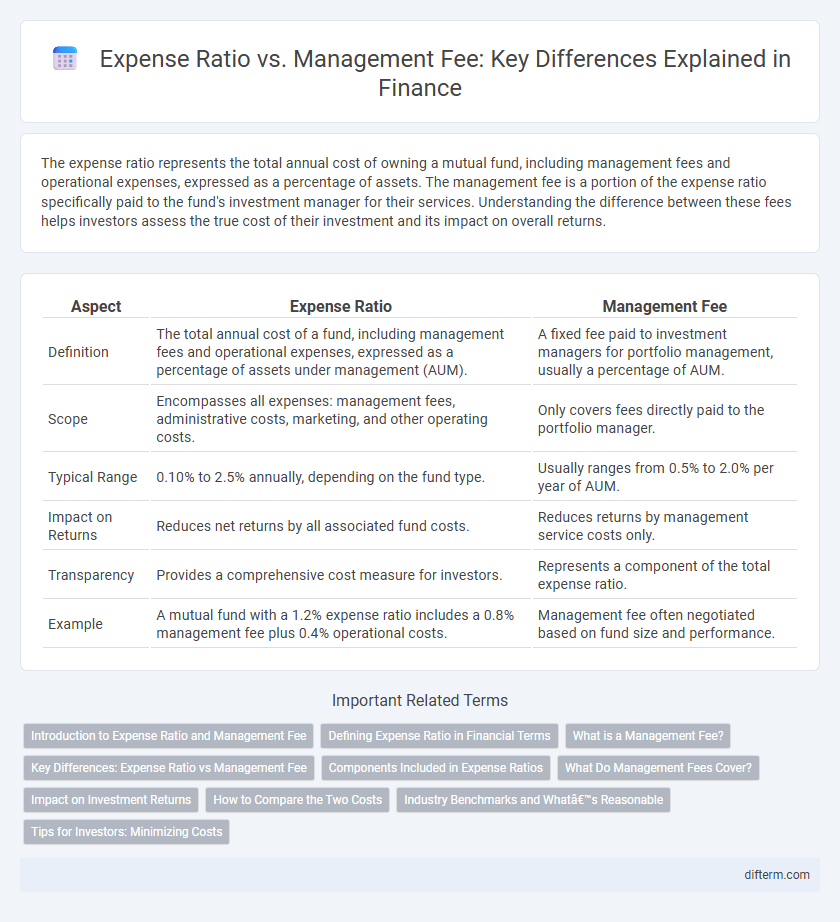

| Aspect | Expense Ratio | Management Fee |

|---|---|---|

| Definition | The total annual cost of a fund, including management fees and operational expenses, expressed as a percentage of assets under management (AUM). | A fixed fee paid to investment managers for portfolio management, usually a percentage of AUM. |

| Scope | Encompasses all expenses: management fees, administrative costs, marketing, and other operating costs. | Only covers fees directly paid to the portfolio manager. |

| Typical Range | 0.10% to 2.5% annually, depending on the fund type. | Usually ranges from 0.5% to 2.0% per year of AUM. |

| Impact on Returns | Reduces net returns by all associated fund costs. | Reduces returns by management service costs only. |

| Transparency | Provides a comprehensive cost measure for investors. | Represents a component of the total expense ratio. |

| Example | A mutual fund with a 1.2% expense ratio includes a 0.8% management fee plus 0.4% operational costs. | Management fee often negotiated based on fund size and performance. |

Introduction to Expense Ratio and Management Fee

Expense ratio represents the annual percentage of fund assets deducted to cover operating expenses, including administrative fees, compliance costs, and marketing. Management fee specifically refers to the portion of the expense ratio paid to the fund's investment manager for portfolio management services. Understanding the distinction between these fees helps investors evaluate the total cost associated with mutual funds or ETFs and their impact on net returns.

Defining Expense Ratio in Financial Terms

Expense ratio in financial terms represents the annual percentage of a fund's assets used to cover operating expenses, including management fees, administrative costs, and other fund-related expenses. It directly impacts investors' net returns by reducing the total gains realized from the investment. Understanding the distinction between the expense ratio and management fee is crucial, as the management fee is just one component of the overall expense ratio.

What is a Management Fee?

A management fee is a fixed annual charge investors pay to fund managers for overseeing and administering investment portfolios, typically expressed as a percentage of assets under management (AUM). This fee covers services such as research, asset selection, and portfolio rebalancing, directly impacting the net returns of mutual funds or ETFs. Unlike the broader expense ratio, the management fee specifically compensates the fund manager's expertise and operational costs.

Key Differences: Expense Ratio vs Management Fee

The expense ratio represents the total percentage of a mutual fund's assets used for operating expenses, including management fees, administrative costs, and other operational expenses. The management fee is a specific component within the expense ratio, covering the cost paid to the investment manager for portfolio management services. Key differences highlight that while the expense ratio encompasses all fund-related expenses, the management fee solely covers the compensation of the fund manager.

Components Included in Expense Ratios

Expense ratios encompass a broader range of costs, including management fees, administrative expenses, compliance costs, and operational fees, whereas management fees typically represent only the payment to the fund's investment manager. Expense ratios also cover marketing and distribution expenses, often referred to as 12b-1 fees, which are not included in management fees. Understanding the components of expense ratios helps investors evaluate the total cost of owning a fund more accurately compared to management fees alone.

What Do Management Fees Cover?

Management fees cover the operational costs of managing an investment fund, including portfolio management, research, compliance, and administrative expenses. These fees compensate fund managers for their expertise in selecting and monitoring securities to achieve investment objectives. Unlike the total expense ratio, management fees do not include additional costs such as marketing, distribution, or custodial services.

Impact on Investment Returns

Expense ratio directly reduces net investment returns by encompassing all fund operating costs, including management fees, administrative expenses, and other operational charges. Management fees, as a component of the expense ratio, specifically compensate the fund managers and can vary significantly, influencing the overall expense ratio and hence the net returns. Lower expense ratios typically lead to higher net returns, making the comparison critical for investors seeking cost-efficient fund options to maximize their investment performance.

How to Compare the Two Costs

Expense ratio represents the total percentage of fund assets used for operating expenses, while management fees specifically cover portfolio management services. When comparing these two costs, investors should analyze the expense ratio to understand the overall cost impact on returns, as it includes management fees along with administrative and other operational expenses. Evaluating fund performance relative to the expense ratio provides a clearer insight into cost efficiency and its effect on net returns.

Industry Benchmarks and What’s Reasonable

Expense ratios typically range from 0.1% to 2.0%, depending on the fund type and size, while management fees usually comprise 50% to 80% of the total expense ratio. Industry benchmarks indicate that a reasonable expense ratio for index funds hovers around 0.1% to 0.3%, whereas actively managed funds often exhibit ratios between 0.5% and 1.5%. Investors should evaluate expense ratios and management fees relative to fund performance and peers to determine cost-effectiveness within specific market segments.

Tips for Investors: Minimizing Costs

Investors can minimize costs by carefully comparing the expense ratio and management fee of investment funds, as the expense ratio includes both management and operational costs while the management fee specifically covers portfolio management services. Opting for funds with lower expense ratios typically leads to higher net returns over time, especially in passive investment strategies like index funds or ETFs. Regularly reviewing fund performance and cost structures empowers investors to make informed decisions that balance fees with potential growth.

Expense Ratio vs Management Fee Infographic

difterm.com

difterm.com