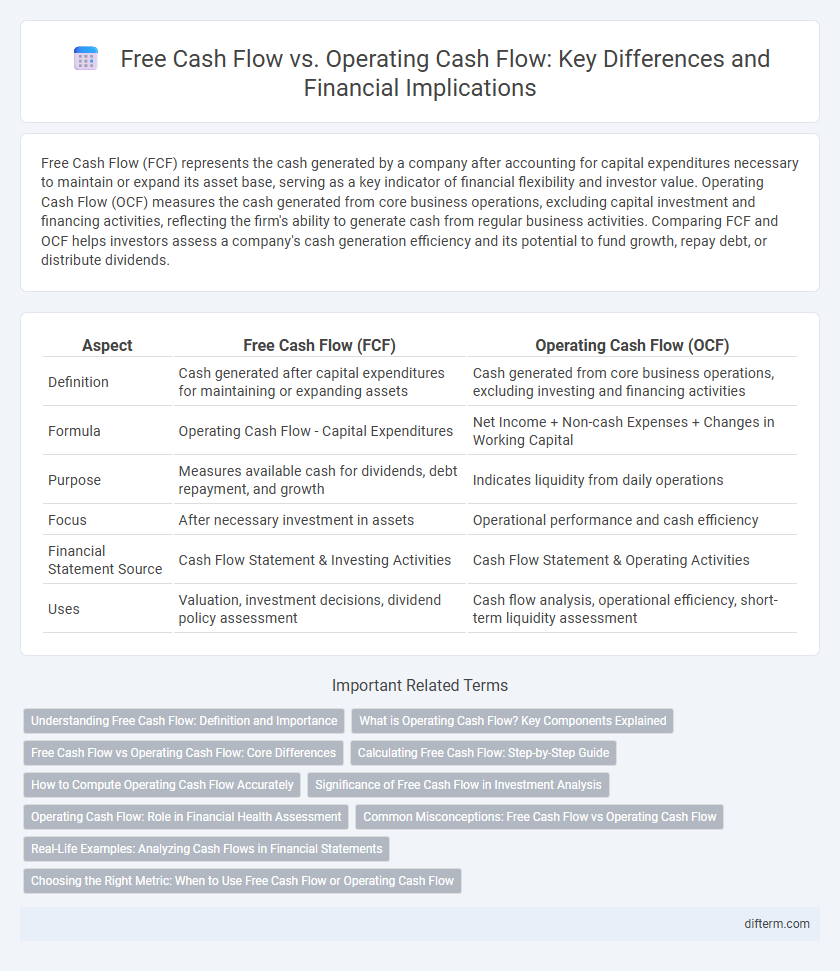

Free Cash Flow (FCF) represents the cash generated by a company after accounting for capital expenditures necessary to maintain or expand its asset base, serving as a key indicator of financial flexibility and investor value. Operating Cash Flow (OCF) measures the cash generated from core business operations, excluding capital investment and financing activities, reflecting the firm's ability to generate cash from regular business activities. Comparing FCF and OCF helps investors assess a company's cash generation efficiency and its potential to fund growth, repay debt, or distribute dividends.

Table of Comparison

| Aspect | Free Cash Flow (FCF) | Operating Cash Flow (OCF) |

|---|---|---|

| Definition | Cash generated after capital expenditures for maintaining or expanding assets | Cash generated from core business operations, excluding investing and financing activities |

| Formula | Operating Cash Flow - Capital Expenditures | Net Income + Non-cash Expenses + Changes in Working Capital |

| Purpose | Measures available cash for dividends, debt repayment, and growth | Indicates liquidity from daily operations |

| Focus | After necessary investment in assets | Operational performance and cash efficiency |

| Financial Statement Source | Cash Flow Statement & Investing Activities | Cash Flow Statement & Operating Activities |

| Uses | Valuation, investment decisions, dividend policy assessment | Cash flow analysis, operational efficiency, short-term liquidity assessment |

Understanding Free Cash Flow: Definition and Importance

Free Cash Flow (FCF) represents the cash a company generates after accounting for capital expenditures necessary to maintain or expand its asset base, serving as a critical indicator of financial health and liquidity. It differs from Operating Cash Flow (OCF), which measures cash generated from core business operations before investment activities and capital spending. Investors and analysts prioritize Free Cash Flow as it reveals the actual cash available for dividends, debt repayment, and growth opportunities beyond operational efficiency.

What is Operating Cash Flow? Key Components Explained

Operating Cash Flow (OCF) represents the cash generated from a company's core business operations, excluding financing and investing activities. Key components of OCF include net income, adjustments for non-cash expenses such as depreciation and amortization, changes in working capital items like accounts receivable, accounts payable, and inventory. Accurate analysis of OCF provides insight into the business's ability to generate sufficient cash to maintain and grow operations without external financing.

Free Cash Flow vs Operating Cash Flow: Core Differences

Free Cash Flow (FCF) measures the cash a company generates after capital expenditures, reflecting the cash available to investors and creditors, while Operating Cash Flow (OCF) indicates cash generated from core business operations without deducting capital expenditures. FCF provides insight into a company's ability to pursue expansion, dividends, or debt reduction, distinguishing it from OCF, which focuses strictly on operational efficiency. The core difference lies in FCF accounting for investment in fixed assets, making it a cleaner indicator of financial flexibility compared to OCF's operational cash perspective.

Calculating Free Cash Flow: Step-by-Step Guide

Calculating free cash flow (FCF) begins with operating cash flow (OCF), which reflects the cash generated from a company's core business operations. Subtract capital expenditures (CapEx) from OCF to account for investments in property, plant, and equipment, revealing the cash available for shareholders and debt holders. This step-by-step approach ensures accurate assessment of financial health by highlighting funds free for expansion, debt repayment, or dividends.

How to Compute Operating Cash Flow Accurately

To compute Operating Cash Flow (OCF) accurately, start with net income and adjust for non-cash expenses such as depreciation and amortization, changes in working capital, and other operating activities. Accurate OCF calculation requires careful analysis of the cash flow statement's operating activities section and proper exclusion of investing and financing cash flows. Ensuring precise adjustments helps assess a company's true cash-generating ability from core business operations.

Significance of Free Cash Flow in Investment Analysis

Free Cash Flow (FCF) serves as a critical indicator of a company's financial health by measuring the cash available after capital expenditures, directly impacting valuation models and investor decisions. Unlike Operating Cash Flow, which reflects cash generated from core business operations, FCF reveals the actual liquidity accessible for dividends, debt repayment, or growth opportunities. Analysts prioritize Free Cash Flow to assess sustainable profitability and long-term investment potential, making it essential in evaluating a firm's economic resilience and shareholder value creation.

Operating Cash Flow: Role in Financial Health Assessment

Operating Cash Flow (OCF) measures the cash generated by a company's core business operations, providing critical insight into its ability to maintain and grow operations without external financing. It is a key indicator of financial health, reflecting the liquidity and solvency necessary to meet short-term liabilities and invest in capital expenditures. Unlike Free Cash Flow, which accounts for capital spending and debt payments, OCF focuses purely on operational efficiency and cash generation from normal business activities.

Common Misconceptions: Free Cash Flow vs Operating Cash Flow

Free Cash Flow (FCF) is often confused with Operating Cash Flow (OCF), but FCF accounts for capital expenditures subtracted from OCF, reflecting the cash available after maintaining or expanding asset base. Investors mistakenly view OCF alone as a measure of liquidity, ignoring that high OCF without considering capital investments can misrepresent a company's financial health. Understanding that FCF provides a clearer picture of cash generation capability for dividends, debt repayment, or growth is essential for accurate financial analysis.

Real-Life Examples: Analyzing Cash Flows in Financial Statements

Free Cash Flow (FCF) represents the cash a company generates after accounting for capital expenditures, reflecting its ability to fund expansion or return value to shareholders. Operating Cash Flow (OCF), extracted directly from financial statements, measures the cash generated from core business operations, indicating operational efficiency. Analyzing Apple's 2023 financials reveals strong OCF driven by product sales, while its FCF highlights substantial investment in research and development, demonstrating cash flow management in real-world corporate finance.

Choosing the Right Metric: When to Use Free Cash Flow or Operating Cash Flow

Free Cash Flow (FCF) provides a clear picture of the cash available after capital expenditures, making it ideal for assessing a company's ability to generate cash for dividends, debt repayment, or expansion. Operating Cash Flow (OCF) highlights cash generated from core business operations, useful for evaluating operational efficiency and short-term liquidity. Use FCF for long-term investment decisions and OCF to analyze operational performance and working capital management.

Free Cash Flow vs Operating Cash Flow Infographic

difterm.com

difterm.com