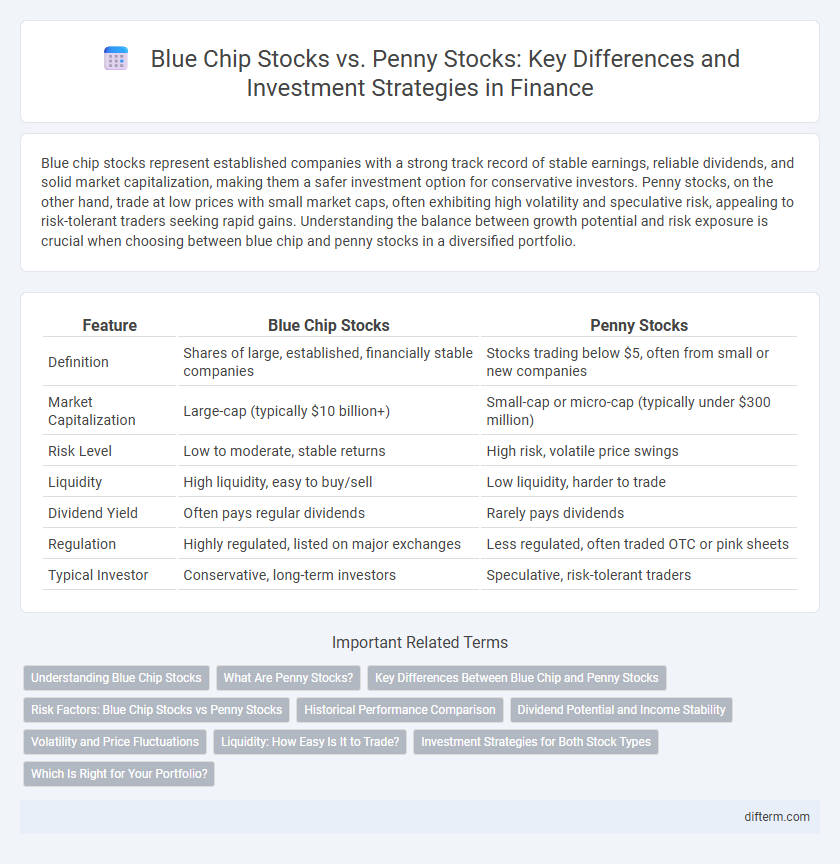

Blue chip stocks represent established companies with a strong track record of stable earnings, reliable dividends, and solid market capitalization, making them a safer investment option for conservative investors. Penny stocks, on the other hand, trade at low prices with small market caps, often exhibiting high volatility and speculative risk, appealing to risk-tolerant traders seeking rapid gains. Understanding the balance between growth potential and risk exposure is crucial when choosing between blue chip and penny stocks in a diversified portfolio.

Table of Comparison

| Feature | Blue Chip Stocks | Penny Stocks |

|---|---|---|

| Definition | Shares of large, established, financially stable companies | Stocks trading below $5, often from small or new companies |

| Market Capitalization | Large-cap (typically $10 billion+) | Small-cap or micro-cap (typically under $300 million) |

| Risk Level | Low to moderate, stable returns | High risk, volatile price swings |

| Liquidity | High liquidity, easy to buy/sell | Low liquidity, harder to trade |

| Dividend Yield | Often pays regular dividends | Rarely pays dividends |

| Regulation | Highly regulated, listed on major exchanges | Less regulated, often traded OTC or pink sheets |

| Typical Investor | Conservative, long-term investors | Speculative, risk-tolerant traders |

Understanding Blue Chip Stocks

Blue chip stocks represent shares of well-established companies with a history of reliable earnings, strong market capitalization, and consistent dividend payments. These stocks are typically less volatile and considered safer investments due to their stability and reputation in the market. Investors often prioritize blue chip stocks for long-term growth and wealth preservation in diversified portfolios.

What Are Penny Stocks?

Penny stocks are low-priced shares typically trading below $5 per share and often represent small or micro-cap companies. These stocks are known for their high volatility and limited liquidity, making them riskier investments compared to blue chip stocks. Investors are attracted to penny stocks due to their potential for significant short-term gains, but the lack of regulatory oversight increases the potential for fraud and large losses.

Key Differences Between Blue Chip and Penny Stocks

Blue chip stocks represent shares in established companies with a history of stable earnings, strong market capitalization, and reliable dividends, making them a safer investment option. Penny stocks, typically priced under $5 per share, come from smaller, less stable companies and carry higher volatility and risk but offer potential for significant short-term gains. Investors often choose blue chips for long-term growth and income, while penny stocks attract those seeking speculative profits despite the increased risk of loss.

Risk Factors: Blue Chip Stocks vs Penny Stocks

Blue chip stocks offer greater stability and lower volatility due to established market presence and strong financial performance, reducing investment risk. Penny stocks carry significantly higher risk, with price manipulation, low liquidity, and limited transparency contributing to their volatility and potential for substantial losses. Investors seeking capital preservation typically favor blue chip stocks, while those pursuing speculative gains might consider penny stocks despite their elevated risk.

Historical Performance Comparison

Blue chip stocks have consistently demonstrated strong historical performance characterized by steady dividend payments, reliable earnings growth, and resilience during economic downturns, making them a preferred choice for risk-averse investors. Penny stocks, in contrast, exhibit highly volatile price movements with sporadic gains that are often driven by speculative trading rather than fundamental financial health. Long-term data highlights blue chip stocks' superior stability and gradual capital appreciation compared to the unpredictable and high-risk nature of penny stocks.

Dividend Potential and Income Stability

Blue chip stocks offer higher dividend potential and more consistent income stability due to their established market presence and strong financial health. Penny stocks rarely pay dividends and exhibit significant volatility, which undermines reliable income generation. Investors seeking steady dividend income typically prefer blue chip stocks for their predictable payouts and lower risk profiles.

Volatility and Price Fluctuations

Blue chip stocks exhibit lower volatility and more stable price fluctuations due to their established market presence and strong financial fundamentals. Penny stocks experience high volatility, with rapid and unpredictable price swings driven by low liquidity and speculative trading. Investors seeking consistent returns often prefer blue chips, while those willing to take higher risks may consider penny stocks for potential gains.

Liquidity: How Easy Is It to Trade?

Blue chip stocks typically exhibit high liquidity due to their large market capitalization and frequent trading volumes, allowing investors to buy or sell shares quickly with minimal price impact. Penny stocks often suffer from low liquidity, resulting in wider bid-ask spreads and increased difficulty executing trades at desired prices. This liquidity disparity influences risk and transaction costs, making blue chip stocks generally more attractive for investors seeking easy market entry and exit.

Investment Strategies for Both Stock Types

Blue chip stocks offer investment strategies centered on long-term growth, stability, and dividend income, appealing to risk-averse investors seeking steady returns from established companies with strong financials. Penny stocks require high-risk, speculative strategies focused on short-term gains and market volatility, often involving intensive research and timing to capitalize on price fluctuations in small-cap or micro-cap companies. Diversifying a portfolio by combining blue chip stocks' resilience with penny stocks' growth potential can balance risk and reward based on the investor's objectives and risk tolerance.

Which Is Right for Your Portfolio?

Blue chip stocks offer stability with established companies known for consistent dividends and strong market capitalizations, making them ideal for risk-averse investors seeking long-term growth. Penny stocks present high volatility and potential for rapid gains but come with significant risks due to lower liquidity and less regulatory oversight. Assessing your risk tolerance, investment goals, and time horizon is essential to determine if blue chip stocks or penny stocks align better with your portfolio strategy.

Blue Chip Stocks vs Penny Stocks Infographic

difterm.com

difterm.com