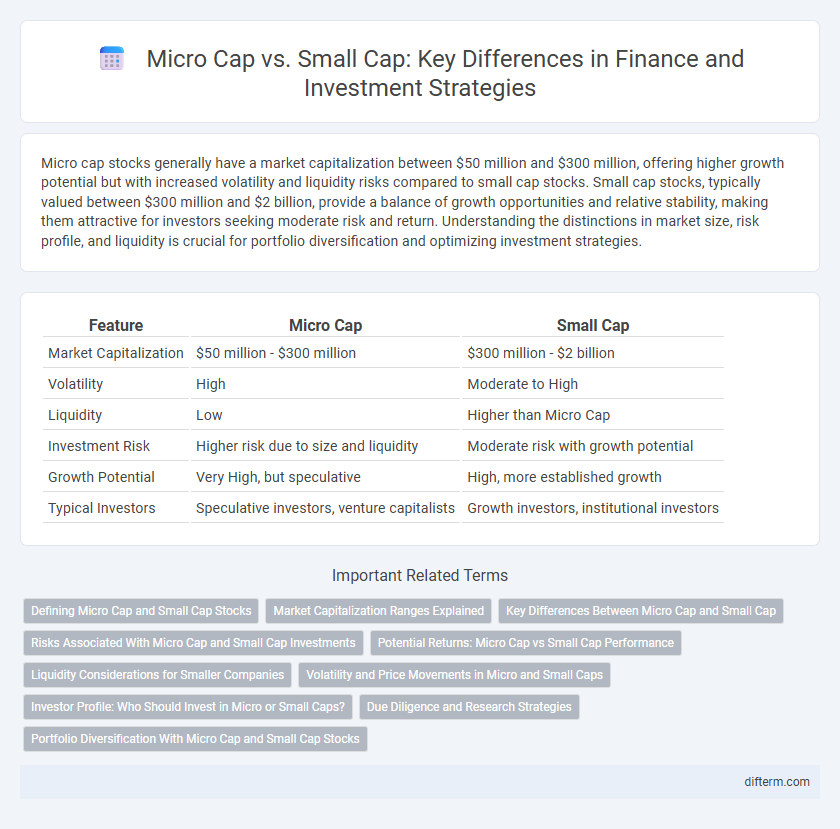

Micro cap stocks generally have a market capitalization between $50 million and $300 million, offering higher growth potential but with increased volatility and liquidity risks compared to small cap stocks. Small cap stocks, typically valued between $300 million and $2 billion, provide a balance of growth opportunities and relative stability, making them attractive for investors seeking moderate risk and return. Understanding the distinctions in market size, risk profile, and liquidity is crucial for portfolio diversification and optimizing investment strategies.

Table of Comparison

| Feature | Micro Cap | Small Cap |

|---|---|---|

| Market Capitalization | $50 million - $300 million | $300 million - $2 billion |

| Volatility | High | Moderate to High |

| Liquidity | Low | Higher than Micro Cap |

| Investment Risk | Higher risk due to size and liquidity | Moderate risk with growth potential |

| Growth Potential | Very High, but speculative | High, more established growth |

| Typical Investors | Speculative investors, venture capitalists | Growth investors, institutional investors |

Defining Micro Cap and Small Cap Stocks

Micro cap stocks refer to companies with a market capitalization typically between $50 million and $300 million, often representing early-stage or niche businesses with high growth potential but increased risk. Small cap stocks have market capitalizations ranging from approximately $300 million to $2 billion, offering more stability than micro caps while still presenting substantial growth opportunities. Both categories provide diversification benefits and appeal to investors seeking exposure to evolving sectors within the stock market.

Market Capitalization Ranges Explained

Micro-cap stocks typically have market capitalizations ranging from $50 million to $300 million, representing smaller, often more volatile companies with higher growth potential. Small-cap stocks generally fall between $300 million and $2 billion in market capitalization, offering a balance of growth prospects and relative stability compared to micro-caps. Understanding these market capitalization ranges helps investors tailor diversification strategies and risk tolerance effectively within equity portfolios.

Key Differences Between Micro Cap and Small Cap

Micro cap stocks typically have market capitalizations ranging from $50 million to $300 million, whereas small cap stocks range from $300 million to $2 billion, impacting their liquidity and volatility profiles. Micro cap companies often face higher risk and less analyst coverage but offer greater growth potential compared to small cap firms. Investment strategies differ as micro caps require more intensive research due to limited financial data and market presence, while small caps provide relatively stable growth opportunities with moderate risk.

Risks Associated With Micro Cap and Small Cap Investments

Micro-cap stocks, typically valued under $300 million, carry higher volatility and liquidity risks compared to small-cap stocks, which range from $300 million to $2 billion in market capitalization. Investors in micro-cap equities often face greater price manipulation and limited analyst coverage, increasing the risk of price swings and harder exit options. Small-cap stocks, while still riskier than large-cap, generally offer better liquidity and more robust financial disclosures, reducing but not eliminating investment risks.

Potential Returns: Micro Cap vs Small Cap Performance

Micro-cap stocks, typically valued under $300 million, often exhibit higher volatility but can deliver substantial potential returns due to their growth opportunities and market inefficiencies. Small-cap stocks, generally valued between $300 million and $2 billion, tend to offer more stability while still providing strong growth potential, often outperforming large-cap stocks over extended periods. Historical data shows micro-cap equities may outperform small caps during bullish markets, but small caps usually provide a better risk-adjusted return profile for long-term investors.

Liquidity Considerations for Smaller Companies

Micro cap stocks typically exhibit lower liquidity compared to small cap stocks, resulting in wider bid-ask spreads and increased price volatility. Investors face challenges in executing large trades without significantly impacting market prices due to limited trading volumes. Assessing liquidity metrics such as average daily trading volume and turnover ratio is crucial for managing risks associated with smaller company investments.

Volatility and Price Movements in Micro and Small Caps

Micro cap stocks exhibit significantly higher volatility and more pronounced price movements compared to small cap stocks, largely due to their lower market capitalization and limited liquidity. These factors lead to greater susceptibility to market sentiment and news, resulting in rapid and often unpredictable price fluctuations. Investors in micro caps must carefully assess risk tolerance given the amplified price sensitivity relative to the more stable small cap segment.

Investor Profile: Who Should Invest in Micro or Small Caps?

Investors with a high risk tolerance and a long-term investment horizon are well-suited for micro-cap stocks, as these companies typically offer substantial growth potential but with increased volatility and lower liquidity. Small-cap stocks appeal to investors seeking a balance between growth and stability, providing opportunities for capital appreciation with comparatively moderate risk. Both micro-cap and small-cap investments require thorough research and a willingness to withstand market fluctuations to capitalize on potential outsized returns.

Due Diligence and Research Strategies

Micro cap stocks, typically valued under $300 million, require intensive due diligence due to limited analyst coverage and higher volatility compared to small cap stocks valued between $300 million and $2 billion. Investors should prioritize deep fundamental analysis, including financial statement scrutiny, management evaluation, and market niche potential to mitigate risks. Employing alternative data sources and direct industry contacts enhances the research strategy, uncovering insights often missed in traditional small cap evaluations.

Portfolio Diversification With Micro Cap and Small Cap Stocks

Micro cap stocks, typically valued under $300 million, offer high growth potential but come with increased volatility and liquidity risks, making them a strategic choice for aggressive portfolio diversification. Small cap stocks, ranging from $300 million to $2 billion in market capitalization, provide a balance between growth and stability, enhancing portfolio resilience against market fluctuations. Incorporating both micro cap and small cap equities allows investors to optimize diversification by blending high-risk, high-reward opportunities with more established growth companies, thus improving risk-adjusted returns.

Micro Cap vs Small Cap Infographic

difterm.com

difterm.com