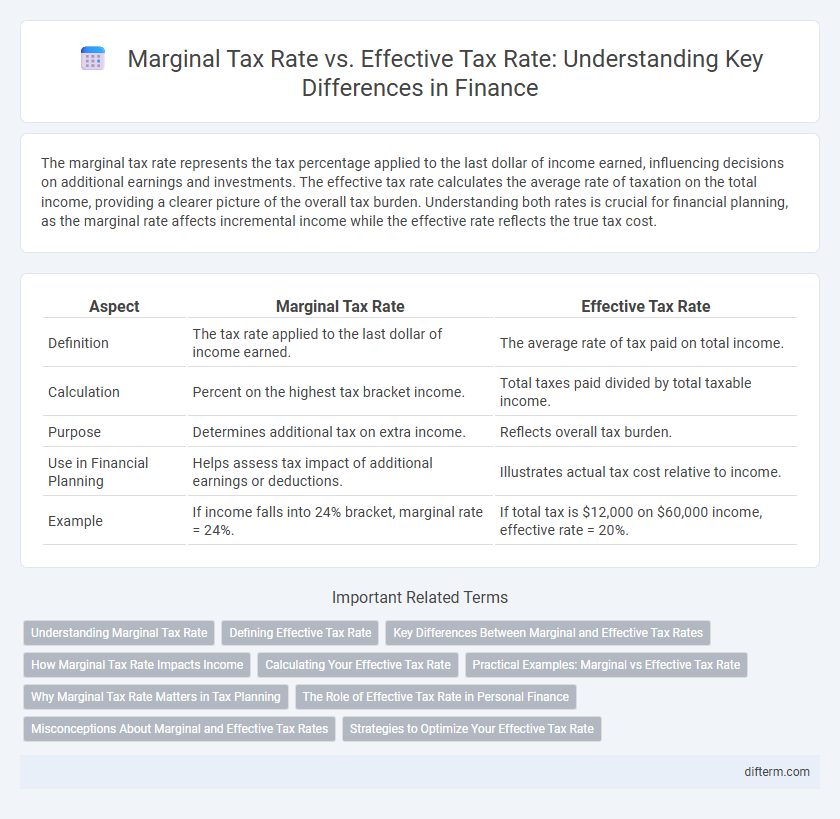

The marginal tax rate represents the tax percentage applied to the last dollar of income earned, influencing decisions on additional earnings and investments. The effective tax rate calculates the average rate of taxation on the total income, providing a clearer picture of the overall tax burden. Understanding both rates is crucial for financial planning, as the marginal rate affects incremental income while the effective rate reflects the true tax cost.

Table of Comparison

| Aspect | Marginal Tax Rate | Effective Tax Rate |

|---|---|---|

| Definition | The tax rate applied to the last dollar of income earned. | The average rate of tax paid on total income. |

| Calculation | Percent on the highest tax bracket income. | Total taxes paid divided by total taxable income. |

| Purpose | Determines additional tax on extra income. | Reflects overall tax burden. |

| Use in Financial Planning | Helps assess tax impact of additional earnings or deductions. | Illustrates actual tax cost relative to income. |

| Example | If income falls into 24% bracket, marginal rate = 24%. | If total tax is $12,000 on $60,000 income, effective rate = 20%. |

Understanding Marginal Tax Rate

The marginal tax rate refers to the percentage of tax applied to the last dollar of an individual's income, crucial for understanding how additional earnings are taxed. It differs from the effective tax rate, which represents the average rate of tax on total income, calculated by dividing total taxes paid by total income. Understanding the marginal tax rate aids in making informed financial decisions, such as optimizing investments and evaluating the tax impact of additional income.

Defining Effective Tax Rate

Effective tax rate represents the average rate at which an individual or corporation is taxed on their total income, reflecting the actual percentage of income paid in taxes after deductions and credits. It is calculated by dividing total tax liability by total taxable income, offering a more comprehensive measure of tax burden than the marginal tax rate. Understanding effective tax rate helps businesses and investors assess true tax impacts and plan financial strategies accordingly.

Key Differences Between Marginal and Effective Tax Rates

Marginal tax rate refers to the percentage of tax applied to the last dollar of income earned, representing the rate at which additional income is taxed within a tax bracket structure. Effective tax rate calculates the average rate of taxation on total income, determined by dividing total tax paid by total taxable income, reflecting the overall tax burden. The key difference lies in marginal tax rate measuring the rate on incremental income, while effective tax rate indicates the actual average tax rate paid across all income.

How Marginal Tax Rate Impacts Income

The marginal tax rate directly influences how much additional income is taxed, determining the portion of each extra dollar earned that goes to taxes. High marginal tax rates can discourage additional work or investment by reducing net gains from increased earnings. Understanding marginal tax rates helps individuals and businesses plan income strategies to optimize after-tax income efficiently.

Calculating Your Effective Tax Rate

Calculating your effective tax rate involves dividing your total tax liability by your total taxable income, providing a clear percentage of income paid in taxes. This metric offers a more accurate reflection of your overall tax burden compared to the marginal tax rate, which only indicates the rate applied to the last dollar of income earned. Understanding the effective tax rate helps in better financial planning and assessing the true impact of taxes on your income.

Practical Examples: Marginal vs Effective Tax Rate

A marginal tax rate represents the percentage paid on the next dollar of income, while the effective tax rate reflects the average rate paid on total income. For instance, if an individual earns $100,000 with a marginal tax rate of 24% but an effective tax rate of 18%, the difference accounts for deductions, credits, and lower rates on initial income brackets. Understanding both rates helps in accurate tax planning, highlighting the impact of progressive tax systems on overall tax liability.

Why Marginal Tax Rate Matters in Tax Planning

Marginal tax rate matters in tax planning because it determines the tax rate applied to the next dollar of income, directly influencing decisions on additional earnings, investments, and deductions. Understanding the marginal tax rate helps taxpayers optimize income timing and structure to minimize tax liability and maximize after-tax returns. Effective tax rate reflects the average tax paid but does not capture the incremental cost of earning more, making marginal tax rate essential for strategic financial planning.

The Role of Effective Tax Rate in Personal Finance

The effective tax rate plays a crucial role in personal finance by representing the actual percentage of income paid in taxes after deductions and credits, providing a more accurate picture of one's tax burden compared to the marginal tax rate. Understanding the effective tax rate helps individuals make informed decisions on savings, investments, and expenditures, optimizing tax efficiency. This metric directly impacts budgeting strategies and long-term financial planning by reflecting the true cost of taxes on overall income.

Misconceptions About Marginal and Effective Tax Rates

Many taxpayers confuse the marginal tax rate with the effective tax rate, mistakenly believing they pay their marginal rate on all income. The marginal tax rate refers to the percentage paid on the last dollar earned, while the effective tax rate is the average rate paid on total income, often lower due to progressive tax brackets. Misunderstanding these rates can lead to poor financial planning and unrealistic expectations of tax liabilities.

Strategies to Optimize Your Effective Tax Rate

Maximizing tax efficiency involves understanding that the marginal tax rate applies to the next dollar earned, while the effective tax rate reflects the overall average rate paid on total income. Strategies to optimize your effective tax rate include tax-advantaged retirement contributions, capital gains management, and income deferral tactics that lower taxable income. Employing tax credits and deductions strategically can also reduce the overall tax burden, enhancing after-tax income and investment growth potential.

Marginal tax rate vs Effective tax rate Infographic

difterm.com

difterm.com