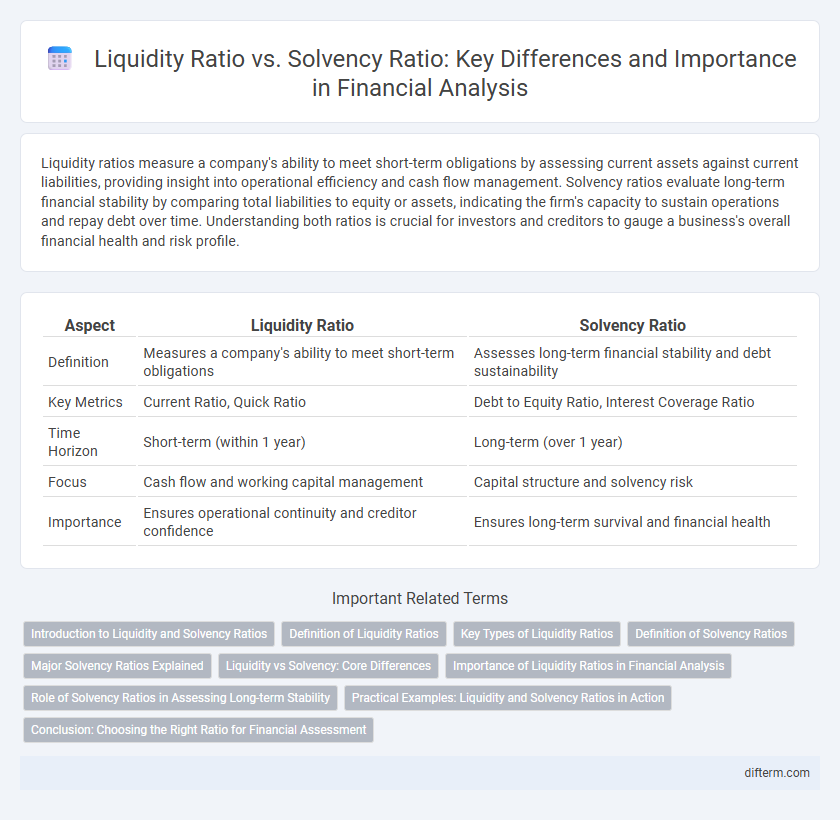

Liquidity ratios measure a company's ability to meet short-term obligations by assessing current assets against current liabilities, providing insight into operational efficiency and cash flow management. Solvency ratios evaluate long-term financial stability by comparing total liabilities to equity or assets, indicating the firm's capacity to sustain operations and repay debt over time. Understanding both ratios is crucial for investors and creditors to gauge a business's overall financial health and risk profile.

Table of Comparison

| Aspect | Liquidity Ratio | Solvency Ratio |

|---|---|---|

| Definition | Measures a company's ability to meet short-term obligations | Assesses long-term financial stability and debt sustainability |

| Key Metrics | Current Ratio, Quick Ratio | Debt to Equity Ratio, Interest Coverage Ratio |

| Time Horizon | Short-term (within 1 year) | Long-term (over 1 year) |

| Focus | Cash flow and working capital management | Capital structure and solvency risk |

| Importance | Ensures operational continuity and creditor confidence | Ensures long-term survival and financial health |

Introduction to Liquidity and Solvency Ratios

Liquidity ratios measure a company's ability to meet short-term obligations using its current assets, with key metrics including the current ratio and quick ratio. Solvency ratios assess long-term financial stability by analyzing the firm's capacity to meet long-term debt and financial commitments, highlighted by ratios such as debt to equity and interest coverage. Understanding both liquidity and solvency ratios provides critical insights into a company's overall financial health and risk management.

Definition of Liquidity Ratios

Liquidity ratios measure a company's ability to meet short-term obligations by evaluating assets easily convertible to cash, such as current assets against current liabilities. Key metrics include the current ratio, quick ratio, and cash ratio, which provide insights into operational efficiency and financial health. These ratios are essential for assessing immediate financial stability and the capacity to cover debts within a fiscal period.

Key Types of Liquidity Ratios

Key types of liquidity ratios include the current ratio, quick ratio, and cash ratio, each measuring a company's ability to meet short-term obligations with varying degrees of asset liquidity. The current ratio assesses all current assets against current liabilities, while the quick ratio excludes inventories for a stricter liquidity test. The cash ratio focuses solely on cash and cash equivalents, providing the most conservative view of a firm's immediate liquidity position.

Definition of Solvency Ratios

Solvency ratios measure a company's ability to meet its long-term financial obligations by comparing its total debt to total assets or equity. Common solvency ratios include the debt-to-equity ratio and the interest coverage ratio, which indicate financial stability and risk level. These ratios are crucial for assessing the firm's capacity to sustain operations and grow over time without facing insolvency.

Major Solvency Ratios Explained

Solvency ratios, including the Debt to Equity Ratio, Interest Coverage Ratio, and Equity Ratio, measure a company's long-term financial stability by evaluating its ability to meet long-term obligations. The Debt to Equity Ratio assesses the proportion of debt financing relative to shareholder equity, indicating financial leverage and risk levels. The Interest Coverage Ratio calculates how easily a company can pay interest expenses, while the Equity Ratio shows the percentage of total assets financed by shareholders' equity, providing insight into financial resilience.

Liquidity vs Solvency: Core Differences

Liquidity ratio measures a company's ability to meet short-term obligations using its most liquid assets, emphasizing cash flow and working capital efficiency. Solvency ratio evaluates long-term financial stability by assessing total debt relative to equity and assets, indicating sustained debt management capacity. The core difference lies in liquidity focusing on immediate financial health, while solvency addresses overall long-term viability.

Importance of Liquidity Ratios in Financial Analysis

Liquidity ratios are critical in financial analysis as they measure a company's ability to meet short-term obligations using its most liquid assets, directly impacting operational stability and creditor confidence. Unlike solvency ratios, which assess long-term financial sustainability, liquidity ratios provide immediate insights into cash flow management and short-term financial health. High liquidity ratios indicate efficient asset management, reduced risk of default, and stronger resilience during economic fluctuations.

Role of Solvency Ratios in Assessing Long-term Stability

Solvency ratios, such as the debt-to-equity ratio and interest coverage ratio, play a critical role in evaluating a company's long-term financial stability by measuring its ability to meet long-term debt obligations. These ratios provide insight into the firm's capital structure and risk level, reflecting its capacity to sustain operations during economic downturns. Unlike liquidity ratios that focus on short-term assets and liabilities, solvency ratios assess overall financial health and the sustainability of the business over an extended period.

Practical Examples: Liquidity and Solvency Ratios in Action

Liquidity ratio measures a company's ability to meet short-term obligations, exemplified by the current ratio of 2:1 indicating sufficient assets to cover liabilities within a year. Solvency ratio assesses long-term financial stability, such as the debt to equity ratio of 0.5 demonstrating balanced debt relative to shareholder equity. For instance, a firm with a quick ratio of 1.5 can quickly pay off immediate debts, while a solvency ratio of 0.8 reflects strong capacity to sustain operations and growth over time.

Conclusion: Choosing the Right Ratio for Financial Assessment

Liquidity ratios measure a company's ability to meet short-term obligations by assessing current assets against current liabilities, providing insight into immediate financial health. Solvency ratios evaluate long-term stability by comparing total debt to equity or assets, highlighting the firm's capacity to sustain operations over time. Selecting the appropriate ratio depends on the specific financial assessment objective: liquidity ratios are ideal for analyzing short-term cash flow sufficiency, while solvency ratios are crucial for understanding long-term financial resilience and risk exposure.

Liquidity Ratio vs Solvency Ratio Infographic

difterm.com

difterm.com