Cross-margin allows traders to utilize their entire available balance to prevent liquidation, effectively spreading risk across multiple positions. Isolated margin restricts margin to a specific position, limiting potential losses to the allocated amount but increasing the risk of liquidation for that position. Choosing between cross-margin and isolated margin depends on risk tolerance and trading strategy complexity.

Table of Comparison

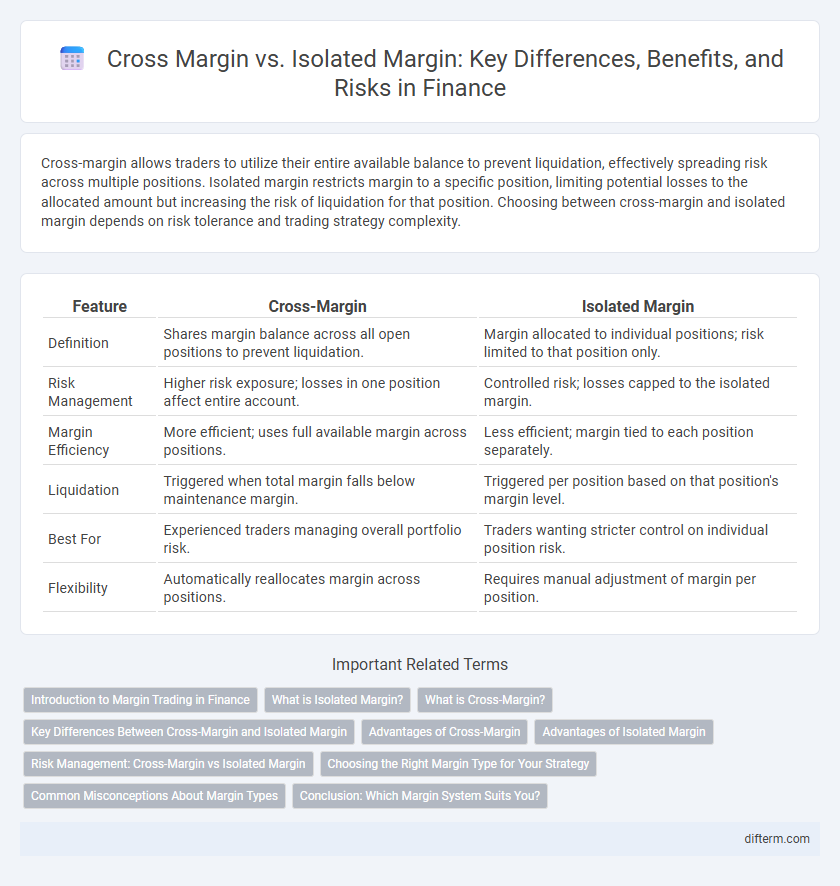

| Feature | Cross-Margin | Isolated Margin |

|---|---|---|

| Definition | Shares margin balance across all open positions to prevent liquidation. | Margin allocated to individual positions; risk limited to that position only. |

| Risk Management | Higher risk exposure; losses in one position affect entire account. | Controlled risk; losses capped to the isolated margin. |

| Margin Efficiency | More efficient; uses full available margin across positions. | Less efficient; margin tied to each position separately. |

| Liquidation | Triggered when total margin falls below maintenance margin. | Triggered per position based on that position's margin level. |

| Best For | Experienced traders managing overall portfolio risk. | Traders wanting stricter control on individual position risk. |

| Flexibility | Automatically reallocates margin across positions. | Requires manual adjustment of margin per position. |

Introduction to Margin Trading in Finance

Margin trading in finance allows investors to borrow funds to increase their trading positions, enhancing potential returns but also increasing risks. Cross-margin uses the entire account balance to cover margins across multiple positions, offering greater flexibility and risk management. In contrast, isolated margin limits the risk to a specific position by allocating fixed margin, preventing losses from spreading to other trades.

What is Isolated Margin?

Isolated Margin is a risk management method used in margin trading where the margin allocated to a specific position is limited to a fixed amount, preventing losses from exceeding that allocated margin. This allows traders to control their exposure on individual positions without affecting their entire account balance. Isolated Margin contrasts with Cross Margin, which uses the full available balance to maintain positions and cover potential losses.

What is Cross-Margin?

Cross-margin is a risk management method used in trading where all available funds in a trader's account are pooled to maintain margin requirements, allowing losses in one position to be offset by gains or available balance in other positions. This approach maximizes capital efficiency by utilizing the total equity to prevent liquidation, but it also exposes the entire balance to risk if market conditions worsen. Cross-margin is commonly applied in futures and derivatives markets to provide greater flexibility and reduce margin calls during volatile price movements.

Key Differences Between Cross-Margin and Isolated Margin

Cross-margin pools the entire account balance to cover losses across all positions, enabling greater flexibility but increasing risk exposure if one position faces significant losses. Isolated margin confines collateral to an individual trade, limiting potential losses strictly to the allocated margin without affecting the rest of the account. The choice between cross-margin and isolated margin affects risk management strategies, position leverage, and liquidation thresholds in trading portfolios.

Advantages of Cross-Margin

Cross-margin allows traders to use their entire account balance to avoid liquidation, providing greater flexibility and risk management compared to isolated margin. It optimizes capital efficiency by pooling margin across multiple positions, which helps maintain open trades during volatile market conditions. This strategy reduces the likelihood of forced liquidation, safeguarding overall portfolio value.

Advantages of Isolated Margin

Isolated margin allows traders to limit risk by allocating a fixed amount of capital to a single position, preventing losses from spilling over into other holdings. This targeted risk management enhances control over individual trades, making it easier to manage leverage and minimize liquidation impact. Isolated margin is especially advantageous for volatile markets where protecting overall portfolio balance is crucial.

Risk Management: Cross-Margin vs Isolated Margin

Cross-margin consolidates all positions into a single margin pool, allowing profits from one position to offset losses in another, enhancing overall risk management efficiency. Isolated margin limits risk by allocating a fixed amount of margin to each position independently, preventing losses from exceeding that specific margin allocation. Traders seeking controlled risk exposure often prefer isolated margin, while cross-margin suits those aiming to maximize capital efficiency by leveraging combined margin balances.

Choosing the Right Margin Type for Your Strategy

Selecting the appropriate margin type between cross-margin and isolated margin depends on your trading strategy and risk tolerance. Cross-margin allocates your entire account balance to maintain positions, reducing liquidation risk but exposing more capital, while isolated margin limits risk to the initial margin assigned to a specific position. Traders aiming for broader exposure and flexibility might prefer cross-margin, whereas those prioritizing risk control may opt for isolated margin to contain potential losses within predefined limits.

Common Misconceptions About Margin Types

Many traders mistakenly believe that cross-margin eliminates liquidation risk, but it primarily spreads the margin balance across all open positions, increasing exposure to market volatility. Isolated margin confines risk to a specific position, preventing losses from affecting the entire account, yet this is often misunderstood as offering complete protection. Misconceptions also arise around capital efficiency, where cross-margin is assumed to always maximize leverage, while isolated margin provides clearer control but may require more frequent margin adjustments.

Conclusion: Which Margin System Suits You?

Choosing between cross-margin and isolated margin depends on your risk tolerance and trading strategy; cross-margin pools your entire account balance to prevent liquidation, ideal for experienced traders managing multiple positions. Isolated margin limits risk to a specific position's margin, offering better control over losses, preferred by those seeking targeted exposure. Assess your risk appetite and portfolio complexity to determine the most suitable margin system for optimized capital efficiency and risk management.

Cross-Margin vs Isolated Margin Infographic

difterm.com

difterm.com