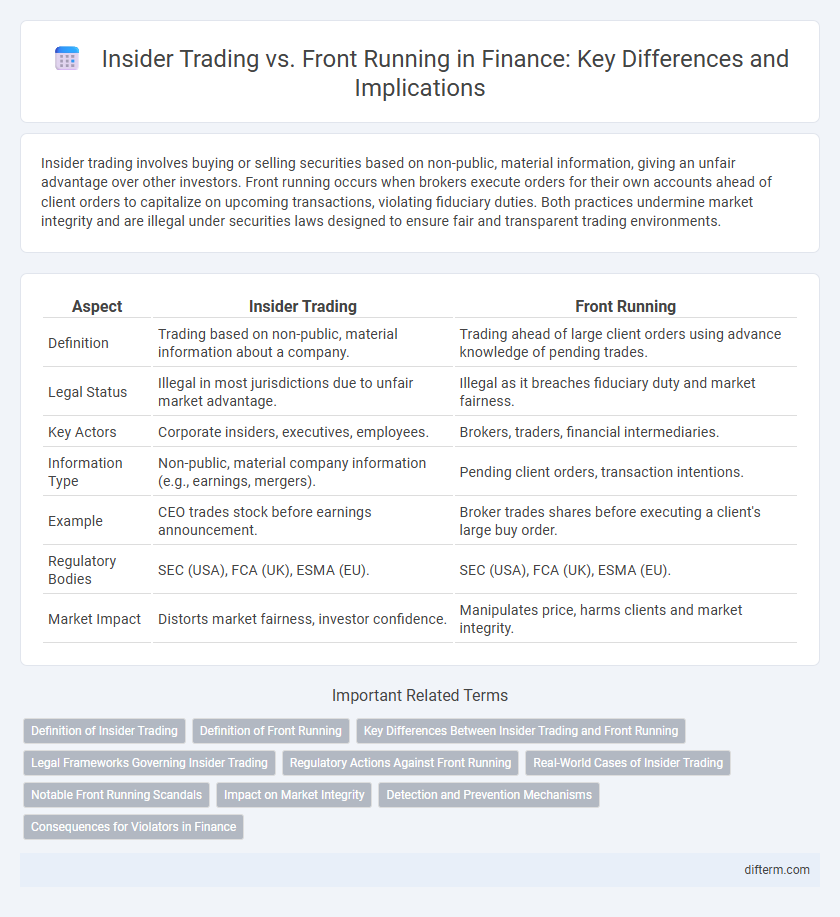

Insider trading involves buying or selling securities based on non-public, material information, giving an unfair advantage over other investors. Front running occurs when brokers execute orders for their own accounts ahead of client orders to capitalize on upcoming transactions, violating fiduciary duties. Both practices undermine market integrity and are illegal under securities laws designed to ensure fair and transparent trading environments.

Table of Comparison

| Aspect | Insider Trading | Front Running |

|---|---|---|

| Definition | Trading based on non-public, material information about a company. | Trading ahead of large client orders using advance knowledge of pending trades. |

| Legal Status | Illegal in most jurisdictions due to unfair market advantage. | Illegal as it breaches fiduciary duty and market fairness. |

| Key Actors | Corporate insiders, executives, employees. | Brokers, traders, financial intermediaries. |

| Information Type | Non-public, material company information (e.g., earnings, mergers). | Pending client orders, transaction intentions. |

| Example | CEO trades stock before earnings announcement. | Broker trades shares before executing a client's large buy order. |

| Regulatory Bodies | SEC (USA), FCA (UK), ESMA (EU). | SEC (USA), FCA (UK), ESMA (EU). |

| Market Impact | Distorts market fairness, investor confidence. | Manipulates price, harms clients and market integrity. |

Definition of Insider Trading

Insider trading refers to the buying or selling of a company's securities by individuals who possess non-public, material information about the company. This illegal practice undermines market integrity by giving unfair advantages to insiders such as executives, employees, or connected parties. Regulatory bodies like the SEC (Securities and Exchange Commission) actively monitor and prosecute insider trading to protect investors and ensure a level playing field.

Definition of Front Running

Front running is an unethical financial practice where a broker or trader executes orders on a security for their own account before fulfilling customer orders, capitalizing on the anticipated price movement caused by the pending transactions. This activity exploits non-public information about upcoming trades to gain unfair profits, violating securities regulations and market fairness principles. Front running contrasts with insider trading by specifically involving the misuse of knowledge about client orders rather than confidential corporate information.

Key Differences Between Insider Trading and Front Running

Insider trading involves trading securities based on non-public, material information about a company, violating fiduciary duties and securities laws. Front running occurs when a broker executes orders on a security for its own account ahead of a customer's large pending order, exploiting advanced knowledge to gain unfair profit. Key differences include the source of information--confidential corporate data for insider trading versus client order knowledge for front running--and the parties involved, with insider trading typically linked to corporate insiders and front running associated with brokers or traders.

Legal Frameworks Governing Insider Trading

Insider trading is regulated under laws such as the Securities Exchange Act of 1934, which prohibits trading based on non-public, material information to ensure market fairness. Front running, often addressed by SEC rules and various international regulations, involves brokers executing orders on advance knowledge of clients' pending transactions, violating fiduciary duty. Enforcement agencies like the SEC and FINRA actively investigate and prosecute violations, imposing penalties including fines, disgorgement, and imprisonment to maintain market integrity.

Regulatory Actions Against Front Running

Regulatory authorities have intensified enforcement efforts against front running due to its violation of market fairness and investor trust. The Securities and Exchange Commission (SEC) imposes substantial fines and penalties on firms engaging in front running, while the Commodity Futures Trading Commission (CFTC) pursues criminal charges for severe cases. Enhanced surveillance technologies and stricter compliance protocols are implemented across financial institutions to detect and prevent front running practices more effectively.

Real-World Cases of Insider Trading

Real-world cases of insider trading, such as the 2001 ImClone scandal involving Martha Stewart, highlight illegal trading based on non-public, material information. These incidents emphasize the critical role of regulatory bodies like the SEC in investigating suspicious trades and enforcing legal penalties to maintain market integrity. In contrast, front running involves brokers executing orders ahead of large client trades, which, while unethical, typically falls under different regulatory scrutiny.

Notable Front Running Scandals

The 2003 case involving Raj Rajaratnam of the Galleon Group stands as one of the most notable front running scandals, where illegal trades were executed based on non-public information, resulting in a $92 million insider trading conviction. Another significant case occurred with the 2016 JPMorgan Chase incident, where traders manipulated the market by front running large client orders, leading to hefty fines and regulatory scrutiny. These scandals emphasize the ongoing regulatory challenges in detecting and preventing front running practices within financial markets.

Impact on Market Integrity

Insider trading and front running both undermine market integrity by creating unfair advantages that distort price discovery and erode investor confidence. Insider trading enables individuals with access to non-public information to execute trades that disadvantage ordinary investors, while front running exploits pending large orders to profit ahead of market movements. These practices compromise transparency and fairness, leading to reduced market efficiency and potential regulatory sanctions.

Detection and Prevention Mechanisms

Insider trading detection relies heavily on monitoring unusual trading patterns through algorithmic surveillance systems that analyze trade timing and volume against access to non-public information. Front running prevention employs real-time transaction monitoring and strict compliance protocols, including trade sequence audits and employee conduct reviews, to identify and stop trades executed ahead of large client orders. Advanced machine learning models enhance both detection methods by identifying complex patterns and anomalies indicative of illicit trading behavior.

Consequences for Violators in Finance

Violators of insider trading face severe penalties, including hefty fines, disgorgement of profits, and potential imprisonment under securities laws enforced by the SEC. Front running offenses result in similar sanctions, with regulatory bodies imposing steep financial penalties and banning individuals from trading activities. Both practices damage market integrity, leading to reputational harm and restrictive legal consequences for financial professionals involved.

Insider Trading vs Front Running Infographic

difterm.com

difterm.com