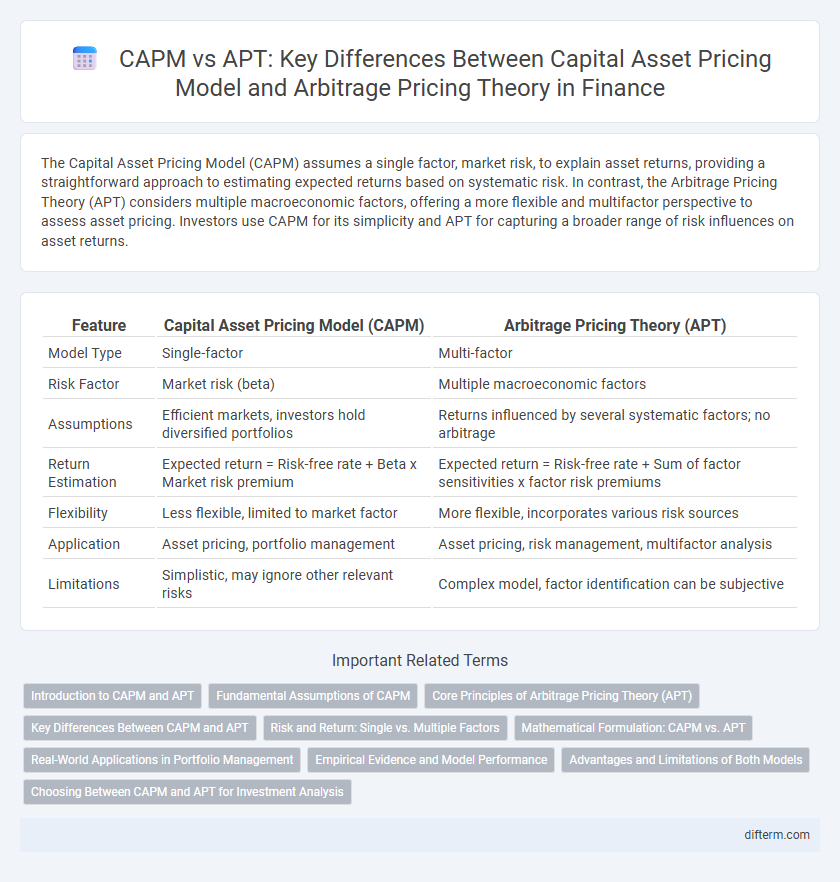

The Capital Asset Pricing Model (CAPM) assumes a single factor, market risk, to explain asset returns, providing a straightforward approach to estimating expected returns based on systematic risk. In contrast, the Arbitrage Pricing Theory (APT) considers multiple macroeconomic factors, offering a more flexible and multifactor perspective to assess asset pricing. Investors use CAPM for its simplicity and APT for capturing a broader range of risk influences on asset returns.

Table of Comparison

| Feature | Capital Asset Pricing Model (CAPM) | Arbitrage Pricing Theory (APT) |

|---|---|---|

| Model Type | Single-factor | Multi-factor |

| Risk Factor | Market risk (beta) | Multiple macroeconomic factors |

| Assumptions | Efficient markets, investors hold diversified portfolios | Returns influenced by several systematic factors; no arbitrage |

| Return Estimation | Expected return = Risk-free rate + Beta x Market risk premium | Expected return = Risk-free rate + Sum of factor sensitivities x factor risk premiums |

| Flexibility | Less flexible, limited to market factor | More flexible, incorporates various risk sources |

| Application | Asset pricing, portfolio management | Asset pricing, risk management, multifactor analysis |

| Limitations | Simplistic, may ignore other relevant risks | Complex model, factor identification can be subjective |

Introduction to CAPM and APT

The Capital Asset Pricing Model (CAPM) evaluates the expected return of an asset based on its systematic risk measured by beta relative to the overall market. The Arbitrage Pricing Theory (APT) extends this by incorporating multiple macroeconomic factors such as inflation, interest rates, and GDP growth to explain asset returns. Both models assist investors in asset pricing and portfolio management but differ in complexity and underlying assumptions about risk factors.

Fundamental Assumptions of CAPM

The Capital Asset Pricing Model (CAPM) assumes investors are rational, risk-averse, and aim to maximize utility based on mean-variance optimization, operating in a frictionless market with no taxes or transaction costs. It posits that all investors have homogeneous expectations regarding asset returns, variances, and covariances, leading to a single efficient frontier and market portfolio. These fundamental assumptions enable CAPM to derive a linear relationship between expected return and systematic risk, measured by beta.

Core Principles of Arbitrage Pricing Theory (APT)

The Arbitrage Pricing Theory (APT) relies on multiple macroeconomic factors to explain asset returns, contrasting with the single-factor model of the Capital Asset Pricing Model (CAPM). APT assumes that asset returns can be modeled as a linear function of various systematic risk factors, with arbitrage opportunities eliminated through investor actions. This multifactor approach provides a flexible framework for asset pricing, capturing risks from inflation, interest rates, and industrial production beyond market risk alone.

Key Differences Between CAPM and APT

CAPM (Capital Asset Pricing Model) uses a single market risk factor to determine expected returns, relying on beta as the measure of systematic risk, while APT (Arbitrage Pricing Theory) incorporates multiple macroeconomic factors to explain asset returns. CAPM assumes market equilibrium and investor rationality, whereas APT allows for no-arbitrage opportunities and does not require equilibrium conditions. The linear relationship in CAPM contrasts with APT's multifactor model, offering greater flexibility in capturing diverse risk sources affecting asset prices.

Risk and Return: Single vs. Multiple Factors

The Capital Asset Pricing Model (CAPM) assesses risk and return through a single market factor, emphasizing systematic risk measured by beta to predict expected returns. In contrast, the Arbitrage Pricing Theory (APT) incorporates multiple macroeconomic factors such as inflation, interest rates, and industrial production, providing a multifaceted approach to asset pricing. APT's multi-factor framework captures diverse sources of risk, offering a potentially more comprehensive explanation of asset returns compared to CAPM's singular focus.

Mathematical Formulation: CAPM vs. APT

The Capital Asset Pricing Model (CAPM) formulates expected asset returns using a single factor: the market beta, representing the sensitivity of returns to market movements, mathematically expressed as E(R_i) = R_f + b_i(E(R_m) - R_f). In contrast, the Arbitrage Pricing Theory (APT) extends this framework by incorporating multiple systematic risk factors, with the expected return modeled as E(R_i) = R_f + b_i1F_1 + b_i2F_2 + ... + b_inF_n, where each b_ij measures sensitivity to the j-th factor. The APT's multifactor approach provides a more flexible and potentially accurate depiction of asset returns by capturing various sources of systematic risk beyond market risk alone.

Real-World Applications in Portfolio Management

The Capital Asset Pricing Model (CAPM) is widely used in portfolio management for estimating expected returns based on systematic risk measured by beta, providing a straightforward tool for asset pricing and capital allocation. The Arbitrage Pricing Theory (APT) offers a multi-factor approach that captures various economic influences such as inflation, industrial production, and interest rates, allowing portfolio managers to incorporate broader risk factors beyond market risk. Practical applications of APT enable more nuanced risk assessment and diversification strategies, especially in complex or volatile market environments where CAPM's single-factor model may fall short.

Empirical Evidence and Model Performance

Empirical evidence reveals mixed results for the Capital Asset Pricing Model (CAPM) and the Arbitrage Pricing Theory (APT), with CAPM often criticized for its single-factor limitation and inconsistent ability to explain cross-sectional returns in diverse markets. APT, which incorporates multiple macroeconomic factors, generally demonstrates superior model performance in capturing asset returns variability and addressing multifactor risks. Academic studies highlight that while CAPM remains foundational for theoretical finance, APT's flexibility provides enhanced empirical robustness in portfolio risk assessment and asset pricing applications.

Advantages and Limitations of Both Models

The Capital Asset Pricing Model (CAPM) offers simplicity by using a single market factor to estimate expected returns, making it widely applicable and easy to implement, but it is limited by its assumptions of market efficiency and a single risk factor. The Arbitrage Pricing Theory (APT) provides a multi-factor approach that captures various sources of systemic risk, offering greater flexibility and potentially more accurate asset pricing in diverse market conditions; however, its complexity and the challenge of identifying relevant factors can hinder practical implementation. Both models have strengths in risk assessment, with CAPM favored for its straightforwardness and APT valued for its comprehensive risk sensitivity, yet each faces limitations that impact precise portfolio management and asset valuation.

Choosing Between CAPM and APT for Investment Analysis

CAPM offers a single-factor model emphasizing market risk to estimate expected returns, making it simpler for broad market analysis. APT incorporates multiple macroeconomic factors, providing flexibility and potentially more accurate insights for diverse portfolios. Investors should select CAPM for efficiency and ease with stable markets, while APT suits complex environments requiring multifactor risk assessment.

CAPM vs APT Infographic

difterm.com

difterm.com