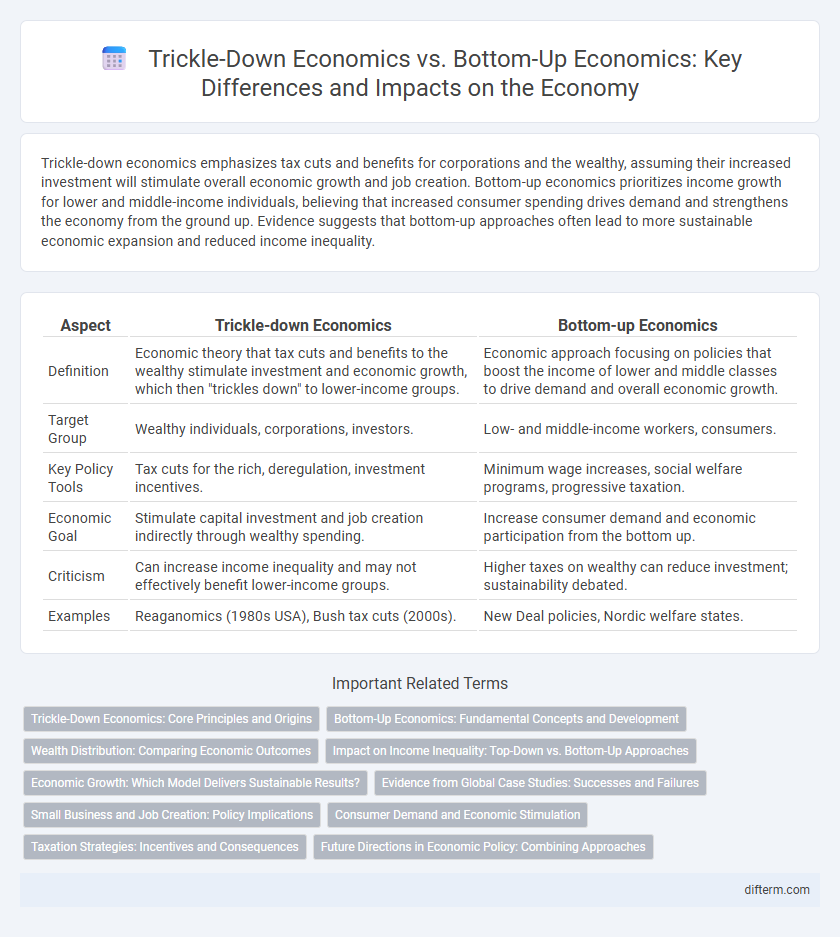

Trickle-down economics emphasizes tax cuts and benefits for corporations and the wealthy, assuming their increased investment will stimulate overall economic growth and job creation. Bottom-up economics prioritizes income growth for lower and middle-income individuals, believing that increased consumer spending drives demand and strengthens the economy from the ground up. Evidence suggests that bottom-up approaches often lead to more sustainable economic expansion and reduced income inequality.

Table of Comparison

| Aspect | Trickle-down Economics | Bottom-up Economics |

|---|---|---|

| Definition | Economic theory that tax cuts and benefits to the wealthy stimulate investment and economic growth, which then "trickles down" to lower-income groups. | Economic approach focusing on policies that boost the income of lower and middle classes to drive demand and overall economic growth. |

| Target Group | Wealthy individuals, corporations, investors. | Low- and middle-income workers, consumers. |

| Key Policy Tools | Tax cuts for the rich, deregulation, investment incentives. | Minimum wage increases, social welfare programs, progressive taxation. |

| Economic Goal | Stimulate capital investment and job creation indirectly through wealthy spending. | Increase consumer demand and economic participation from the bottom up. |

| Criticism | Can increase income inequality and may not effectively benefit lower-income groups. | Higher taxes on wealthy can reduce investment; sustainability debated. |

| Examples | Reaganomics (1980s USA), Bush tax cuts (2000s). | New Deal policies, Nordic welfare states. |

Trickle-Down Economics: Core Principles and Origins

Trickle-down economics is rooted in the belief that tax cuts and benefits for the wealthy and businesses stimulate investment, job creation, and overall economic growth, which eventually benefits all income levels. Originating in the early 20th century and popularized by Reaganomics in the 1980s, this theory assumes that wealth eventually "trickles down" to lower-income groups through increased economic activity. Core principles emphasize supply-side policies, reduced regulation, and incentivizing entrepreneurship as drivers of prosperity.

Bottom-Up Economics: Fundamental Concepts and Development

Bottom-up economics emphasizes stimulating economic growth by increasing the purchasing power and productivity of lower- and middle-income households, which fuels demand and drives broader economic expansion. Key concepts include wage growth, enhanced access to education and healthcare, and targeted fiscal policies such as progressive taxation and social safety nets to reduce income inequality. This approach contrasts with trickle-down economics by prioritizing direct investment in human capital and consumer demand rather than relying on benefits to high-income earners to eventually "trickle down" to lower economic tiers.

Wealth Distribution: Comparing Economic Outcomes

Wealth distribution under trickle-down economics often results in increased income inequality as benefits concentrate among the wealthy with limited flow to lower-income groups. In contrast, bottom-up economics emphasizes direct investment in middle and lower-income households, fostering broader economic participation and reducing poverty rates. Empirical studies highlight that bottom-up approaches tend to achieve more equitable wealth distribution and sustainable economic growth compared to trickle-down models.

Impact on Income Inequality: Top-Down vs. Bottom-Up Approaches

Trickle-down economics prioritizes tax cuts and benefits for the wealthy, assuming wealth will eventually "trickle down" to lower-income groups, often resulting in increased income inequality due to disproportionate gains at the top. In contrast, bottom-up economics emphasizes direct support to low- and middle-income households through policies like wage increases and social programs, effectively reducing income disparity by boosting purchasing power and economic participation. Empirical studies consistently show bottom-up approaches lead to more equitable income distribution and stronger middle-class growth compared to top-down strategies.

Economic Growth: Which Model Delivers Sustainable Results?

Trickle-down economics emphasizes tax cuts for the wealthy and corporations, aiming to stimulate investment and job creation, but often results in income inequality and limited long-term growth. Bottom-up economics prioritizes increasing wages and spending power for lower- and middle-income households, driving consumer demand that fuels sustainable economic expansion. Studies indicate that bottom-up economic policies lead to more durable growth by promoting widespread financial stability and increased productivity across all sectors.

Evidence from Global Case Studies: Successes and Failures

Global case studies reveal mixed outcomes for both trickle-down economics and bottom-up economics in stimulating growth and reducing inequality. Countries like the United States and the United Kingdom illustrate limited success with trickle-down policies, often exacerbating wealth disparities without significant wage growth for lower-income groups. In contrast, bottom-up approaches in nations such as South Korea and Brazil demonstrate stronger poverty alleviation and middle-class expansion by prioritizing investments in education, health, and social welfare.

Small Business and Job Creation: Policy Implications

Small businesses play a crucial role in job creation, with bottom-up economics emphasizing direct support through subsidies and tax breaks to stimulate growth and increase employment. Trickle-down economics relies on tax cuts for wealthy individuals and large corporations, assuming benefits will eventually reach small businesses and workers, though evidence suggests this effect is limited. Effective economic policy requires targeted investment in small business development and workforce training to maximize job opportunities and sustainable economic growth.

Consumer Demand and Economic Stimulation

Trickle-down economics posits that benefits for the wealthy eventually stimulate consumer demand through increased investment and job creation, though critics argue it often leads to income inequality without significantly boosting spending. Bottom-up economics emphasizes direct support to lower- and middle-income households, which increases disposable income and consumer demand more rapidly, driving stronger economic growth. Data from various OECD countries demonstrate that increased wages for the majority correlate closely with higher consumption and GDP expansion, reinforcing the efficacy of demand-side economic stimulation.

Taxation Strategies: Incentives and Consequences

Trickle-down economics advocates for tax cuts on corporations and the wealthy to stimulate investment and economic growth, assuming benefits will "trickle down" to lower-income groups, but often results in increased income inequality and budget deficits. Bottom-up economics emphasizes progressive taxation and direct support to lower- and middle-income earners to boost consumption and demand, which can lead to more equitable growth but may face challenges in funding without higher tax rates. The efficacy of these taxation strategies depends heavily on the broader economic context, fiscal policies, and enforcement mechanisms.

Future Directions in Economic Policy: Combining Approaches

Future economic policy may benefit from integrating elements of trickle-down economics, which emphasizes tax cuts for businesses and the wealthy to stimulate investment, with bottom-up approaches that prioritize direct support to low- and middle-income households to boost consumption and reduce inequality. Combining these strategies can create a balanced model promoting both investment-driven growth and widespread economic participation, enhancing resilience against recessions. Data from mixed-policy economies indicate improved GDP growth rates alongside more equitable income distribution, suggesting that hybrid frameworks could guide sustainable economic development.

Trickle-down Economics vs Bottom-up Economics Infographic

difterm.com

difterm.com