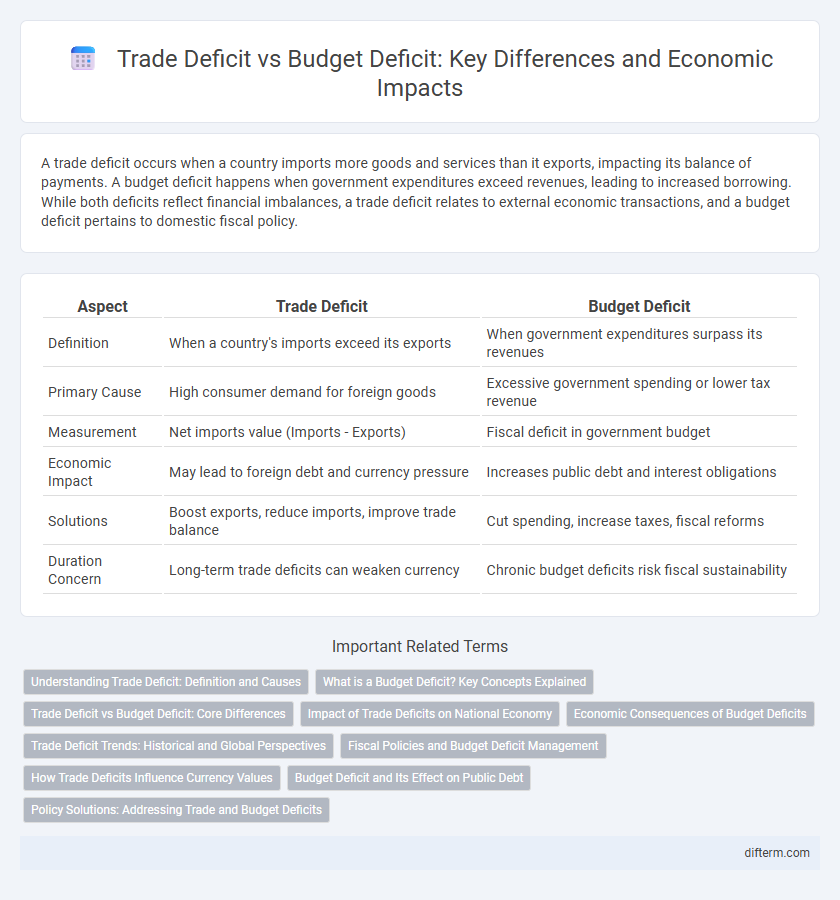

A trade deficit occurs when a country imports more goods and services than it exports, impacting its balance of payments. A budget deficit happens when government expenditures exceed revenues, leading to increased borrowing. While both deficits reflect financial imbalances, a trade deficit relates to external economic transactions, and a budget deficit pertains to domestic fiscal policy.

Table of Comparison

| Aspect | Trade Deficit | Budget Deficit |

|---|---|---|

| Definition | When a country's imports exceed its exports | When government expenditures surpass its revenues |

| Primary Cause | High consumer demand for foreign goods | Excessive government spending or lower tax revenue |

| Measurement | Net imports value (Imports - Exports) | Fiscal deficit in government budget |

| Economic Impact | May lead to foreign debt and currency pressure | Increases public debt and interest obligations |

| Solutions | Boost exports, reduce imports, improve trade balance | Cut spending, increase taxes, fiscal reforms |

| Duration Concern | Long-term trade deficits can weaken currency | Chronic budget deficits risk fiscal sustainability |

Understanding Trade Deficit: Definition and Causes

A trade deficit occurs when a country's imports exceed its exports, resulting in a negative balance of trade. Key causes include higher domestic consumption of foreign goods, currency valuation, and competitive disadvantages in global markets. Persistent trade deficits can impact economic growth by increasing foreign debt and affecting currency stability.

What is a Budget Deficit? Key Concepts Explained

A budget deficit occurs when a government's expenditures exceed its revenues within a fiscal year, requiring borrowing to cover the shortfall. This imbalance impacts national debt levels and can influence interest rates, inflation, and economic growth. Understanding budget deficits is crucial for evaluating fiscal policy, as persistent deficits may signal structural economic issues or priorities in public spending and tax policies.

Trade Deficit vs Budget Deficit: Core Differences

Trade deficit occurs when a country's imports exceed its exports, reflecting the balance of international goods and services, whereas budget deficit arises when government expenditures surpass its revenues, indicating fiscal imbalance. Trade deficits influence currency valuation and foreign exchange reserves, while budget deficits affect national debt and borrowing costs. Understanding these core differences is essential for interpreting economic policies and their impact on overall economic health.

Impact of Trade Deficits on National Economy

Trade deficits occur when a country's imports exceed its exports, leading to a net outflow of domestic currency to foreign markets that can weaken the national economy by increasing external debt and reducing domestic production. Persistent trade deficits may result in currency depreciation, higher interest rates, and decreased investor confidence, which can slow economic growth. While a trade deficit reflects global trade imbalances, it can also signal structural issues such as loss of competitiveness or overreliance on foreign consumption.

Economic Consequences of Budget Deficits

Budget deficits often lead to increased government borrowing, which can drive up interest rates and crowd out private investment, slowing economic growth. Persistent budget deficits may cause inflationary pressures and reduce national savings, undermining long-term fiscal sustainability. Unlike trade deficits, budget deficits directly affect a country's fiscal health and can constrain future government spending on essential services.

Trade Deficit Trends: Historical and Global Perspectives

Trade deficits occur when a country's imports exceed its exports, reflecting global economic integration and consumer preferences. Historically, significant trade deficits have been observed in the United States, China, and the European Union, influenced by manufacturing shifts, currency valuations, and trade policies. Global trends reveal that emerging economies often run trade surpluses due to export-driven growth, while advanced economies face persistent trade deficits tied to high domestic consumption.

Fiscal Policies and Budget Deficit Management

Fiscal policies target budget deficit management by adjusting government spending and taxation to balance public finances and sustain economic growth. A budget deficit occurs when government expenditures exceed revenues, requiring strategic interventions such as spending cuts or tax reforms to reduce debt levels. Unlike trade deficits, which reflect external imbalances, managing budget deficits involves internal fiscal discipline to ensure long-term economic stability.

How Trade Deficits Influence Currency Values

Trade deficits often lead to a depreciation of the national currency because increased imports require more foreign currency, raising the supply of the domestic currency in foreign exchange markets. A weaker currency can make exports cheaper and more competitive internationally, potentially reducing the trade deficit over time. Persistent trade deficits may undermine investor confidence, impacting currency stability and influencing long-term economic growth.

Budget Deficit and Its Effect on Public Debt

A budget deficit occurs when government expenditures exceed revenues, leading to increased borrowing and accumulation of public debt. Persistent budget deficits raise national debt levels, resulting in higher interest payments that can constrain future fiscal policy and limit government spending on public services. Managing budget deficits is crucial to maintaining debt sustainability and avoiding adverse economic consequences such as inflation and reduced investor confidence.

Policy Solutions: Addressing Trade and Budget Deficits

Policy solutions to address trade and budget deficits focus on boosting exports, reducing reliance on imports, and improving fiscal discipline through spending cuts and revenue enhancements. Implementing targeted industrial policies and trade agreements can stimulate domestic production and foreign investment, while prudent budget management ensures sustainable public finances. Coordinated monetary and fiscal policies play a critical role in stabilizing the economy and reducing persistent imbalances.

Trade deficit vs Budget deficit Infographic

difterm.com

difterm.com