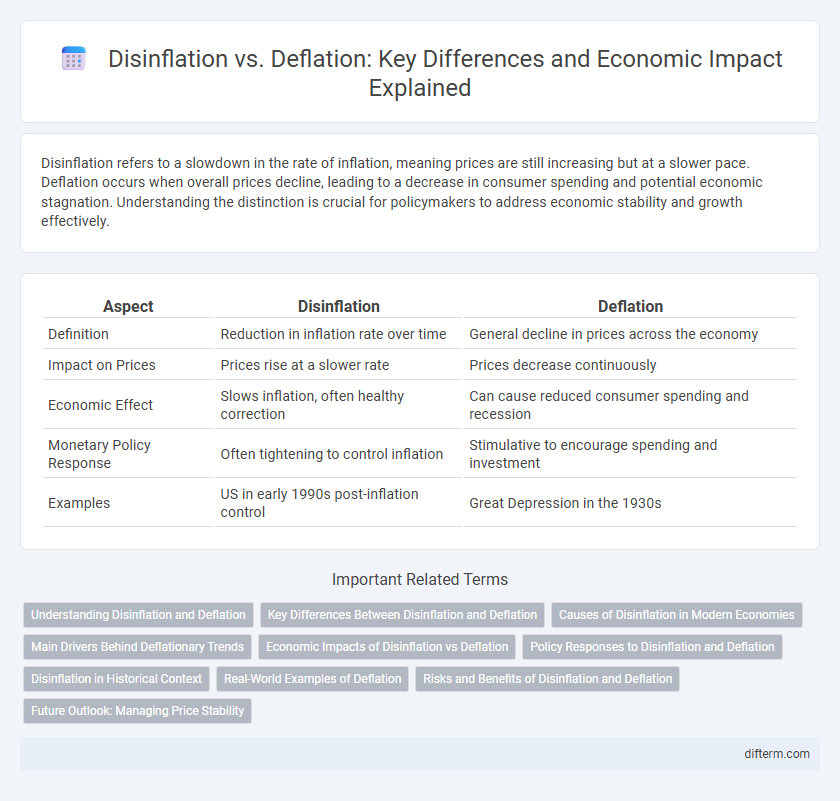

Disinflation refers to a slowdown in the rate of inflation, meaning prices are still increasing but at a slower pace. Deflation occurs when overall prices decline, leading to a decrease in consumer spending and potential economic stagnation. Understanding the distinction is crucial for policymakers to address economic stability and growth effectively.

Table of Comparison

| Aspect | Disinflation | Deflation |

|---|---|---|

| Definition | Reduction in inflation rate over time | General decline in prices across the economy |

| Impact on Prices | Prices rise at a slower rate | Prices decrease continuously |

| Economic Effect | Slows inflation, often healthy correction | Can cause reduced consumer spending and recession |

| Monetary Policy Response | Often tightening to control inflation | Stimulative to encourage spending and investment |

| Examples | US in early 1990s post-inflation control | Great Depression in the 1930s |

Understanding Disinflation and Deflation

Disinflation refers to a slowdown in the rate of inflation, where prices continue to rise but at a decreasing pace, signaling a gradual cooling of economic pressures without entering negative territory. Deflation, on the other hand, involves a sustained decline in general price levels, often linked to reduced consumer demand, decreased production, and potential economic contraction. Understanding the distinction is critical for policymakers aiming to balance growth and control inflation without triggering a deflationary spiral.

Key Differences Between Disinflation and Deflation

Disinflation refers to a slowdown in the rate of inflation, where prices continue to rise but at a decreasing pace, whereas deflation signifies a sustained decline in overall price levels across an economy. Disinflation often indicates improving price stability and can result from monetary policy adjustments, while deflation typically signals weakened demand, economic contraction, and potential increases in unemployment. The key difference lies in the direction of price movement: disinflation involves prices still increasing but more slowly, while deflation involves actual price decreases over time.

Causes of Disinflation in Modern Economies

Disinflation in modern economies occurs primarily due to tightened monetary policies implemented by central banks to control rising inflation rates. Improvements in productivity and technological advancements reduce production costs, contributing to slower price increases. Additionally, weakened consumer demand during economic slowdowns leads to a moderation in the inflation rate without causing negative price growth associated with deflation.

Main Drivers Behind Deflationary Trends

Deflationary trends are primarily driven by a significant drop in aggregate demand, often triggered by tightening monetary policy or falling consumer confidence. Technological advancements and increased productivity can also suppress prices by reducing production costs and enabling goods to be supplied more efficiently. Furthermore, an oversupply of goods and excess capacity in industries contributes to prolonged price decreases, reinforcing deflationary pressure in the economy.

Economic Impacts of Disinflation vs Deflation

Disinflation, a slowdown in the rate of inflation, typically signals a cooling economy but maintains positive price growth, supporting consumer spending and moderate wage increases. Deflation, characterized by a sustained decline in the general price level, often leads to reduced consumer demand, increased real debt burdens, and economic contraction, heightening the risk of recession. Policymakers monitor these trends closely to balance monetary policy, aiming to avoid deflationary spirals while encouraging stable growth during periods of disinflation.

Policy Responses to Disinflation and Deflation

Policy responses to disinflation often involve monetary easing, such as lowering interest rates to stimulate spending and investment, while deflation may require more aggressive measures including quantitative easing and fiscal stimulus to counteract falling prices and declining demand. Central banks monitor inflation expectations closely, adjusting policy tools to prevent prolonged deflation, which can lead to decreased consumer spending and economic stagnation. Effective coordination between monetary and fiscal authorities is critical to reviving growth and maintaining price stability during periods of disinflation or deflation.

Disinflation in Historical Context

Disinflation refers to a slowdown in the rate of inflation, where prices continue to rise but at a reduced pace, distinguishing it from deflation, which is an absolute decline in prices. Historically, periods of disinflation often occur in response to monetary tightening policies aimed at stabilizing an economy after bouts of high inflation, such as during the early 1980s in the United States. This controlled reduction helps restore purchasing power without triggering the economic contraction and increased unemployment commonly associated with deflation.

Real-World Examples of Deflation

Deflation is characterized by a sustained decrease in general price levels, as evidenced by Japan's prolonged deflationary period since the 1990s, which hindered economic growth and increased debt burdens. The Great Depression in the 1930s provides another critical example, when deflation caused widespread unemployment and business failures across the United States. Unlike disinflation, where inflation rates slow but remain positive, deflation signals a dangerous economic contraction requiring targeted policy interventions.

Risks and Benefits of Disinflation and Deflation

Disinflation, characterized by a decline in the inflation rate, reduces the risk of runaway price increases and preserves purchasing power but can signal slowing economic growth and higher unemployment. Deflation, a general decrease in price levels, can increase real debt burdens and suppress consumer spending, potentially triggering prolonged recessions. Both phenomena pose significant risks to economic stability, yet moderate disinflation is often viewed as beneficial for maintaining price stability without the severe contractionary effects associated with deflation.

Future Outlook: Managing Price Stability

Disinflation signals a slowdown in inflation growth, allowing central banks to gradually adjust monetary policies to sustain moderate price stability without triggering economic contraction. Deflation, characterized by a persistent drop in prices, poses risks of reduced consumer spending and increased debt burdens, prompting policymakers to implement stimulus measures to revive demand. Future economic outlook emphasizes vigilant monitoring of price trends and adaptive policy frameworks to balance risk between disinflation's controlled stabilization and deflation's potential downturn.

Disinflation vs Deflation Infographic

difterm.com

difterm.com