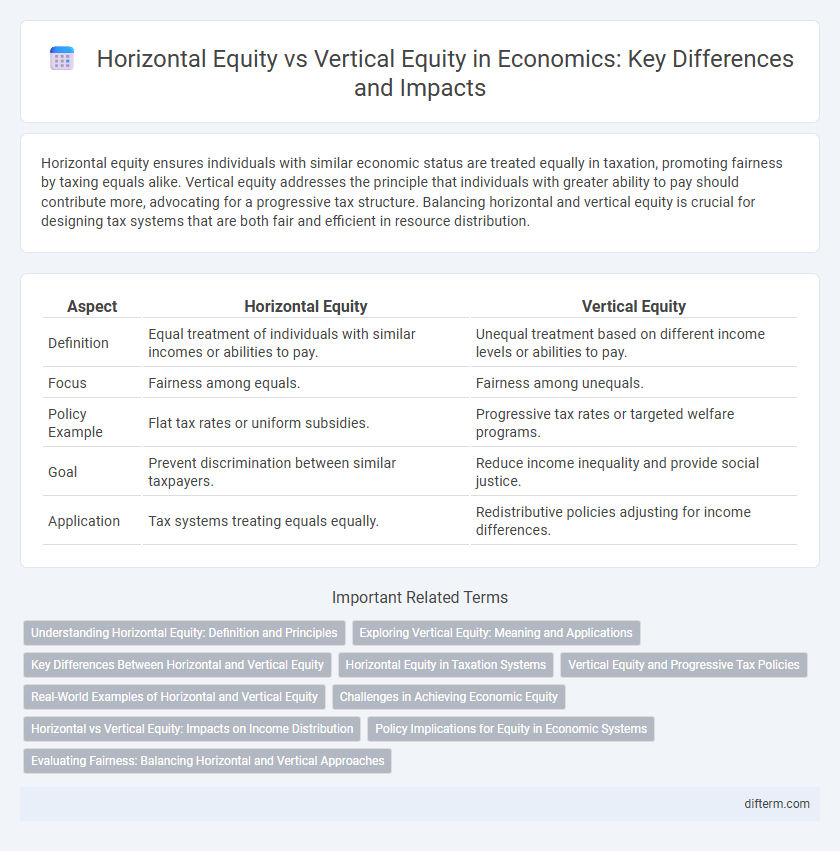

Horizontal equity ensures individuals with similar economic status are treated equally in taxation, promoting fairness by taxing equals alike. Vertical equity addresses the principle that individuals with greater ability to pay should contribute more, advocating for a progressive tax structure. Balancing horizontal and vertical equity is crucial for designing tax systems that are both fair and efficient in resource distribution.

Table of Comparison

| Aspect | Horizontal Equity | Vertical Equity |

|---|---|---|

| Definition | Equal treatment of individuals with similar incomes or abilities to pay. | Unequal treatment based on different income levels or abilities to pay. |

| Focus | Fairness among equals. | Fairness among unequals. |

| Policy Example | Flat tax rates or uniform subsidies. | Progressive tax rates or targeted welfare programs. |

| Goal | Prevent discrimination between similar taxpayers. | Reduce income inequality and provide social justice. |

| Application | Tax systems treating equals equally. | Redistributive policies adjusting for income differences. |

Understanding Horizontal Equity: Definition and Principles

Horizontal equity in economics refers to the principle that individuals with similar income or ability to pay should be taxed at the same rate, ensuring fairness in tax burdens among equals. It emphasizes equal treatment under the tax system, preventing discrimination between taxpayers with comparable economic situations. This concept supports the idea that tax policies should not arbitrarily favor or disadvantage taxpayers who are essentially in the same financial position.

Exploring Vertical Equity: Meaning and Applications

Vertical equity in economics refers to the principle that individuals with a greater ability to pay should contribute a larger share of taxes, highlighting fairness in the distribution of tax burdens. This concept is crucial in progressive taxation systems where higher income earners pay higher tax rates, promoting social justice and reducing income inequality. Applications of vertical equity extend to welfare policies and public spending that aim to support lower-income groups while taxing wealthier individuals more heavily.

Key Differences Between Horizontal and Vertical Equity

Horizontal equity ensures individuals with similar economic circumstances are treated equally in taxation, emphasizing fairness by applying the same tax rate to equals. Vertical equity addresses differences in income or ability to pay, advocating higher tax rates on wealthier individuals to achieve redistribution and reduce inequality. These concepts differ fundamentally in that horizontal equity prioritizes uniform treatment among equals, while vertical equity focuses on proportional contribution based on economic disparities.

Horizontal Equity in Taxation Systems

Horizontal equity in taxation systems ensures that individuals with similar income levels or economic situations are taxed equally, promoting fairness and consistency in tax burdens. This principle aims to eliminate arbitrary disparities by applying uniform tax rates to taxpayers with analogous financial circumstances. Emphasizing horizontal equity helps build public trust and perceived legitimacy in the tax system, facilitating compliance and social cohesion.

Vertical Equity and Progressive Tax Policies

Vertical equity emphasizes the principle that taxpayers with higher incomes should pay a larger proportion of their earnings in taxes, ensuring fairness by addressing income disparities. Progressive tax policies implement vertical equity by imposing higher tax rates on higher income brackets, effectively redistributing wealth to support social welfare programs and reduce inequality. Empirical studies show that countries with strong vertical equity and progressive taxation experience lower Gini coefficients, indicating reduced income inequality and enhanced social cohesion.

Real-World Examples of Horizontal and Vertical Equity

Horizontal equity is exemplified in progressive tax systems where individuals with similar incomes pay comparable taxes, such as the U.S. federal income tax brackets ensuring uniform rates for earners within the same income group. Vertical equity is reflected in social welfare programs like the Earned Income Tax Credit (EITC), which provides greater financial support to low-income families compared to high-income earners. Comparative analysis of Scandinavian countries shows extensive vertical equity through steeply graduated taxes funding comprehensive public services, while horizontal equity is maintained by equal treatment of taxpayers within each income level.

Challenges in Achieving Economic Equity

Horizontal equity faces challenges in ensuring individuals with similar incomes are taxed equally despite varying deductions and credits, leading to perceived unfairness. Vertical equity struggles with designing progressive tax systems that effectively redistribute wealth without discouraging economic growth or labor participation. Both equity types contend with complexities in accurately measuring ability to pay and preventing tax avoidance, complicating policy implementation.

Horizontal vs Vertical Equity: Impacts on Income Distribution

Horizontal equity ensures individuals with similar income levels are taxed equally, promoting fairness by treating equals equally, which helps maintain consistent income distribution within comparable groups. Vertical equity targets income redistribution by imposing higher taxes on wealthier individuals and lower taxes on the poor, aiming to reduce income inequality and enhance social welfare. Balancing horizontal and vertical equity is crucial for effective tax policy that addresses disparities while maintaining fairness across different income brackets.

Policy Implications for Equity in Economic Systems

Horizontal equity requires that individuals with similar income or wealth levels be treated equally by tax and welfare policies, ensuring fairness among peers. Vertical equity emphasizes redistributive measures where taxpayers with greater ability to pay contribute more, addressing income inequality. Policymakers balance these principles to design tax systems that promote social justice without discouraging productivity or economic growth.

Evaluating Fairness: Balancing Horizontal and Vertical Approaches

Horizontal equity demands that individuals with similar income levels bear comparable tax burdens, ensuring fairness among equals. Vertical equity addresses the need for taxpayers with higher incomes to contribute a larger share, promoting fairness across different income brackets. Balancing these principles involves designing tax systems that neither excessively penalize wealth nor allow income disparities to persist unchecked, thereby fostering an equitable economic environment.

Horizontal equity vs Vertical equity Infographic

difterm.com

difterm.com