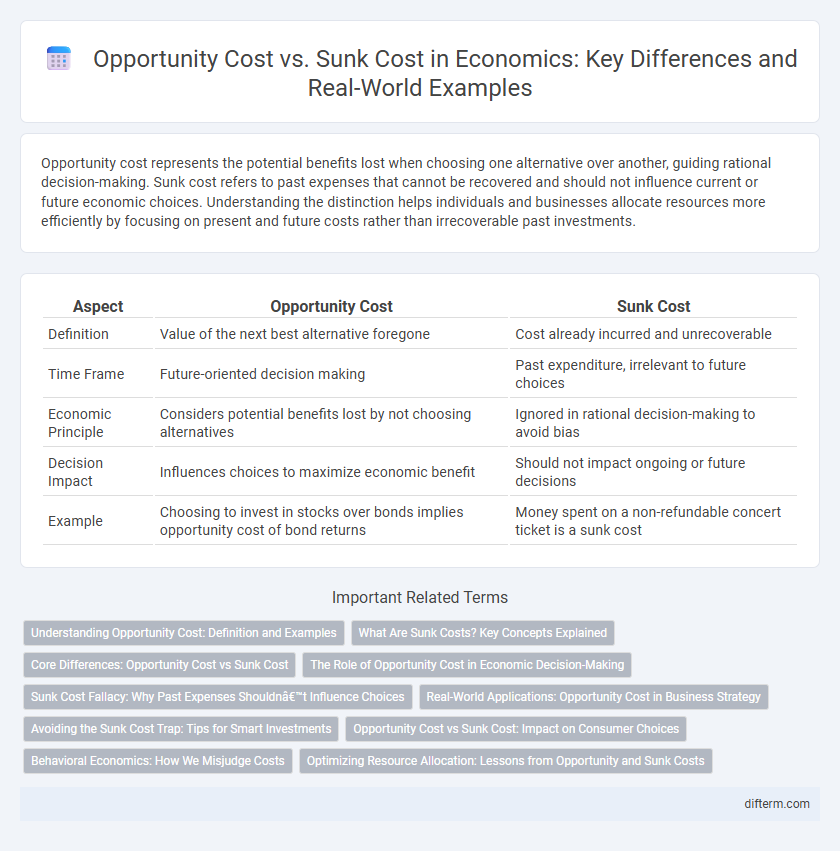

Opportunity cost represents the potential benefits lost when choosing one alternative over another, guiding rational decision-making. Sunk cost refers to past expenses that cannot be recovered and should not influence current or future economic choices. Understanding the distinction helps individuals and businesses allocate resources more efficiently by focusing on present and future costs rather than irrecoverable past investments.

Table of Comparison

| Aspect | Opportunity Cost | Sunk Cost |

|---|---|---|

| Definition | Value of the next best alternative foregone | Cost already incurred and unrecoverable |

| Time Frame | Future-oriented decision making | Past expenditure, irrelevant to future choices |

| Economic Principle | Considers potential benefits lost by not choosing alternatives | Ignored in rational decision-making to avoid bias |

| Decision Impact | Influences choices to maximize economic benefit | Should not impact ongoing or future decisions |

| Example | Choosing to invest in stocks over bonds implies opportunity cost of bond returns | Money spent on a non-refundable concert ticket is a sunk cost |

Understanding Opportunity Cost: Definition and Examples

Opportunity cost represents the value of the next best alternative foregone when making an economic decision, highlighting the trade-offs involved in resource allocation. For example, investing capital in new machinery means the opportunity cost is the potential returns from alternative investments like marketing expansion or employee training. Recognizing opportunity cost enables businesses and individuals to make informed choices that maximize economic efficiency and long-term profitability.

What Are Sunk Costs? Key Concepts Explained

Sunk costs are expenses that have already been incurred and cannot be recovered, making them irrelevant to future economic decisions. Unlike opportunity costs, which represent the potential benefits forgone when choosing one option over another, sunk costs should not influence ongoing choices. Understanding sunk costs helps businesses avoid the sunk cost fallacy and make rational decisions based on future benefits rather than past expenditures.

Core Differences: Opportunity Cost vs Sunk Cost

Opportunity cost represents the potential benefits lost when choosing one alternative over another, emphasizing future-oriented decision-making based on available options. Sunk cost refers to expenses already incurred and unrecoverable, which should not influence current or future economic decisions. Understanding the core differences between opportunity cost and sunk cost is crucial for effective resource allocation and maximizing economic efficiency.

The Role of Opportunity Cost in Economic Decision-Making

Opportunity cost plays a crucial role in economic decision-making by representing the potential benefits lost when choosing one alternative over another. Evaluating opportunity costs enables individuals and firms to allocate scarce resources efficiently, maximizing overall value and profitability. Unlike sunk costs, which are past expenditures that should not influence current decisions, opportunity costs provide forward-looking insights essential for rational economic choices.

Sunk Cost Fallacy: Why Past Expenses Shouldn’t Influence Choices

Sunk cost fallacy occurs when individuals continue investing in a project due to already incurred expenses rather than future benefits, leading to inefficient resource allocation. Recognizing that sunk costs are irrecoverable helps decision-makers avoid biased judgments and focus on opportunity cost, which evaluates potential gains from alternative options. Understanding this distinction is crucial for optimizing financial decisions and enhancing economic efficiency.

Real-World Applications: Opportunity Cost in Business Strategy

Opportunity cost plays a critical role in business strategy by guiding resource allocation decisions that maximize potential returns. Companies evaluate alternative investments and projects by assessing the foregone benefits of not choosing the next best option, ensuring optimal use of capital and labor. Ignoring sunk costs, which are past expenses that cannot be recovered, prevents firms from making biased decisions and promotes forward-looking strategies that enhance profitability and competitive advantage.

Avoiding the Sunk Cost Trap: Tips for Smart Investments

Avoiding the sunk cost trap requires recognizing that past investments, whether time or money, cannot be recovered and should not influence future decisions. Smart investors focus on opportunity cost by evaluating the potential returns of new investments rather than the irretrievable losses already incurred. Prioritizing decisions based on forward-looking value maximizes capital efficiency and reduces the risk of throwing good money after bad.

Opportunity Cost vs Sunk Cost: Impact on Consumer Choices

Opportunity cost influences consumer choices by representing the value of the next best alternative forgone when making a decision, encouraging rational evaluation of trade-offs in spending or saving. Sunk costs, being past expenditures that cannot be recovered, often lead to irrational consumer behavior, such as the sunk cost fallacy, where consumers continue investing in a losing proposition. Understanding the distinction between opportunity cost and sunk cost helps consumers make more economically sound decisions by focusing on future benefits rather than irrecoverable past expenses.

Behavioral Economics: How We Misjudge Costs

Behavioral economics reveals that individuals often misjudge opportunity costs by focusing on sunk costs, leading to irrational decision-making. While opportunity cost represents the true value of forgone alternatives, sunk costs are irrecoverable expenses that should not influence future choices but frequently do due to loss aversion. This cognitive bias causes people to persist with unproductive investments, distorting economic efficiency and personal financial outcomes.

Optimizing Resource Allocation: Lessons from Opportunity and Sunk Costs

Optimizing resource allocation requires distinguishing opportunity costs, the benefits forgone by choosing one option over another, from sunk costs, which are irrecoverable and should not influence future decisions. Effective economic strategies prioritize marginal analysis, redirecting resources toward opportunities with the highest potential returns while ignoring irrelevant sunk costs. This approach enhances decision-making efficiency and maximizes long-term value creation in competitive markets.

Opportunity cost vs Sunk cost Infographic

difterm.com

difterm.com