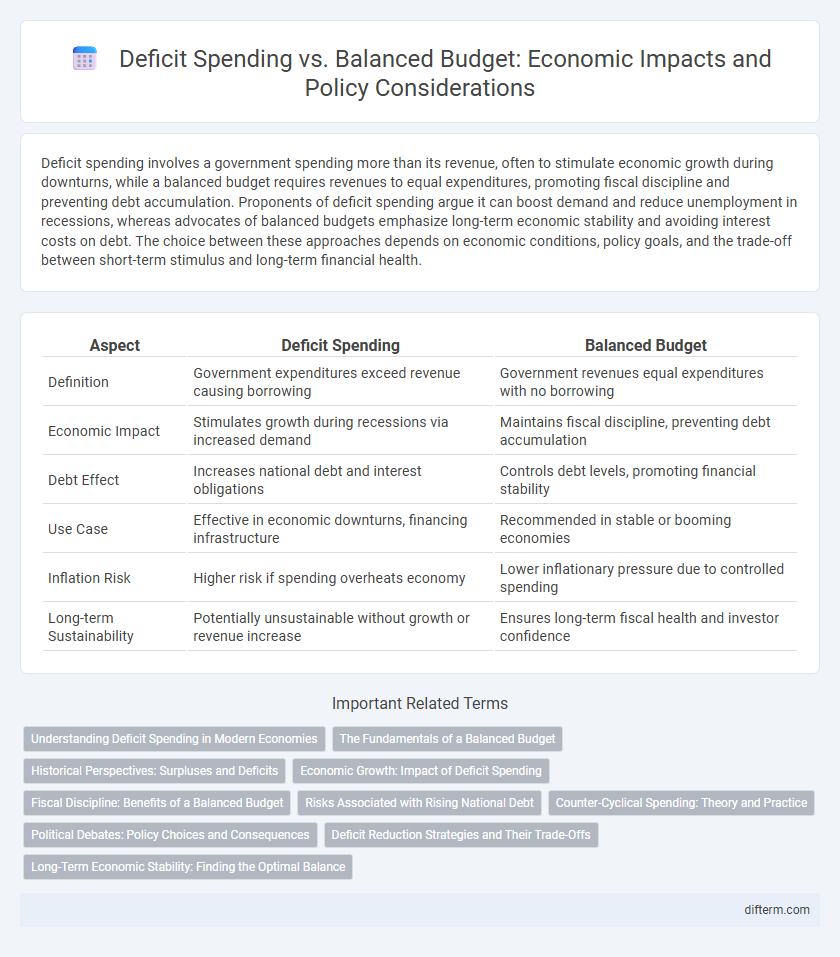

Deficit spending involves a government spending more than its revenue, often to stimulate economic growth during downturns, while a balanced budget requires revenues to equal expenditures, promoting fiscal discipline and preventing debt accumulation. Proponents of deficit spending argue it can boost demand and reduce unemployment in recessions, whereas advocates of balanced budgets emphasize long-term economic stability and avoiding interest costs on debt. The choice between these approaches depends on economic conditions, policy goals, and the trade-off between short-term stimulus and long-term financial health.

Table of Comparison

| Aspect | Deficit Spending | Balanced Budget |

|---|---|---|

| Definition | Government expenditures exceed revenue causing borrowing | Government revenues equal expenditures with no borrowing |

| Economic Impact | Stimulates growth during recessions via increased demand | Maintains fiscal discipline, preventing debt accumulation |

| Debt Effect | Increases national debt and interest obligations | Controls debt levels, promoting financial stability |

| Use Case | Effective in economic downturns, financing infrastructure | Recommended in stable or booming economies |

| Inflation Risk | Higher risk if spending overheats economy | Lower inflationary pressure due to controlled spending |

| Long-term Sustainability | Potentially unsustainable without growth or revenue increase | Ensures long-term fiscal health and investor confidence |

Understanding Deficit Spending in Modern Economies

Deficit spending occurs when a government's expenditures exceed its revenues, financing the gap through borrowing, which can stimulate economic growth during recessions by increasing aggregate demand. Modern economies use deficit spending strategically to fund public investments and social programs, balancing short-term borrowing with long-term economic benefits. Persistent deficits, however, may lead to rising national debt and higher borrowing costs, potentially constraining future fiscal flexibility.

The Fundamentals of a Balanced Budget

A balanced budget occurs when government expenditures are equal to its revenues, ensuring no new debt is incurred. This fiscal discipline helps maintain economic stability by preventing excessive borrowing that can lead to inflation or increased interest rates. Essential components include accurate revenue forecasting, controlled spending, and contingency planning for economic fluctuations.

Historical Perspectives: Surpluses and Deficits

Historical perspectives on deficit spending reveal that periods of war and economic crisis often necessitated significant deficits to stimulate growth and maintain stability, while times of peace and prosperity frequently resulted in balanced budgets or surpluses. The Great Depression and post-World War II era showcased how deficit spending financed recovery and infrastructure, contrasting with the balanced budgets of the 1990s which correlated with economic expansion and fiscal discipline. Examining these patterns highlights the cyclical nature of government finances influenced by external economic shocks and policy priorities.

Economic Growth: Impact of Deficit Spending

Deficit spending stimulates economic growth by increasing aggregate demand during periods of recession, enabling governments to finance infrastructure projects and social programs that create jobs and boost consumer spending. However, sustained deficit spending can lead to higher national debt and interest rates, potentially crowding out private investment and slowing long-term growth. Balanced budgets promote fiscal discipline and sustainable debt levels but may constrain government intervention during economic downturns, limiting short-term growth opportunities.

Fiscal Discipline: Benefits of a Balanced Budget

A balanced budget promotes fiscal discipline by ensuring government expenditures do not exceed revenues, reducing the need for excessive borrowing and limiting national debt growth. This financial restraint enhances investor confidence, stabilizes interest rates, and fosters sustainable economic growth. Maintaining a balanced budget also provides governments with greater flexibility to respond effectively to economic crises without compromising long-term fiscal health.

Risks Associated with Rising National Debt

Rising national debt from persistent deficit spending increases the risk of higher interest rates as government borrowing intensifies, crowding out private investment and slowing economic growth. A growing debt burden can lead to reduced fiscal flexibility, limiting the government's ability to respond to economic crises or invest in essential infrastructure. Excessive debt levels also raise concerns about long-term inflationary pressures and potential downgrades in sovereign credit ratings, further escalating borrowing costs.

Counter-Cyclical Spending: Theory and Practice

Counter-cyclical spending involves governments increasing expenditures and running deficits during economic downturns to stimulate growth, while reducing spending and aiming for balanced budgets during expansions to curb inflation. Keynesian economic theory supports this approach, emphasizing the role of fiscal policy in stabilizing aggregate demand across business cycles. Empirical evidence from post-recession recoveries shows that counter-cyclical deficit spending can accelerate economic recovery and reduce unemployment rates more effectively than balanced budget policies during recessions.

Political Debates: Policy Choices and Consequences

Deficit spending sparks intense political debates as policymakers weigh short-term economic stimulus against long-term debt risks, influencing fiscal policy decisions. Advocates argue it can boost growth during recessions by funding public projects, while opponents warn of inflation and unsustainable national debt levels. Balanced budgets appeal to fiscal conservatives prioritizing economic stability and reduced borrowing, but critics highlight potential cuts to essential services and slower recovery during economic downturns.

Deficit Reduction Strategies and Their Trade-Offs

Deficit reduction strategies often involve cutting government spending, increasing taxes, or a combination of both, each carrying significant economic trade-offs such as slowed economic growth or reduced public services. Implementing austerity measures can improve fiscal health but risks increasing unemployment and lowering consumer confidence. Alternatively, prioritizing balanced budgets may constrain investment in infrastructure and social programs, potentially hindering long-term economic development.

Long-Term Economic Stability: Finding the Optimal Balance

Deficit spending can stimulate short-term economic growth by increasing government expenditure during downturns, but persistent deficits may lead to unsustainable debt levels, threatening long-term economic stability. A balanced budget promotes fiscal discipline and reduces debt accumulation, yet overly stringent adherence can constrain necessary investments in infrastructure and social programs vital for future growth. Optimal long-term economic stability requires a strategic balance where temporary deficits support economic recovery without compromising fiscal health, ensuring sustained growth and resilience.

Deficit spending vs Balanced budget Infographic

difterm.com

difterm.com