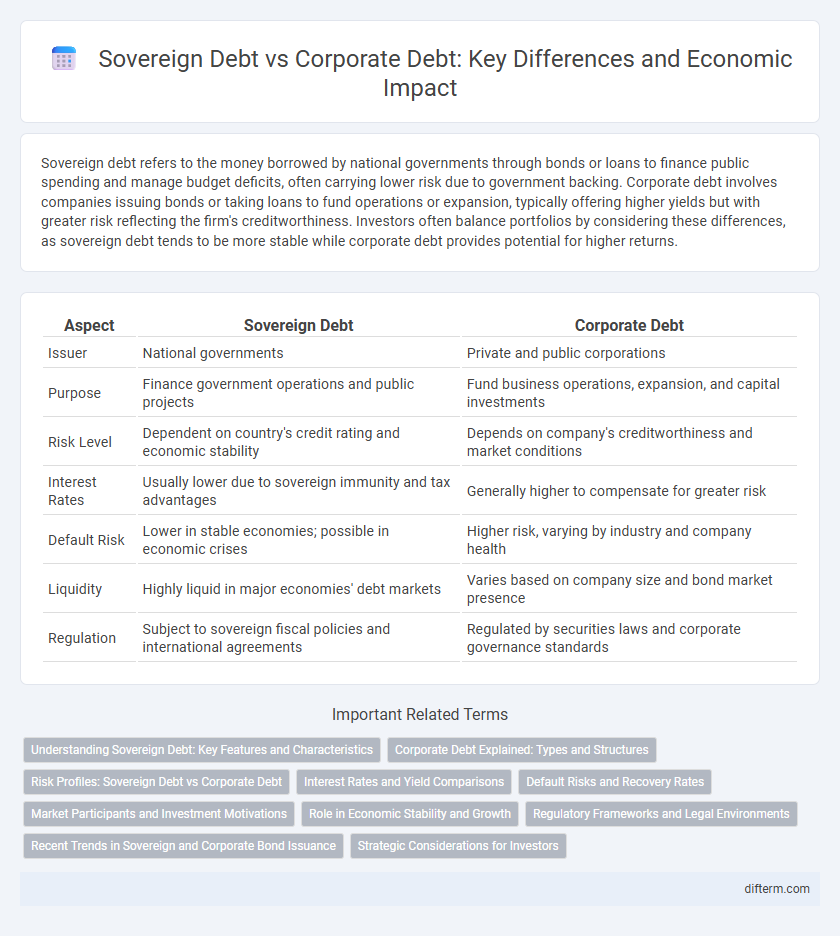

Sovereign debt refers to the money borrowed by national governments through bonds or loans to finance public spending and manage budget deficits, often carrying lower risk due to government backing. Corporate debt involves companies issuing bonds or taking loans to fund operations or expansion, typically offering higher yields but with greater risk reflecting the firm's creditworthiness. Investors often balance portfolios by considering these differences, as sovereign debt tends to be more stable while corporate debt provides potential for higher returns.

Table of Comparison

| Aspect | Sovereign Debt | Corporate Debt |

|---|---|---|

| Issuer | National governments | Private and public corporations |

| Purpose | Finance government operations and public projects | Fund business operations, expansion, and capital investments |

| Risk Level | Dependent on country's credit rating and economic stability | Depends on company's creditworthiness and market conditions |

| Interest Rates | Usually lower due to sovereign immunity and tax advantages | Generally higher to compensate for greater risk |

| Default Risk | Lower in stable economies; possible in economic crises | Higher risk, varying by industry and company health |

| Liquidity | Highly liquid in major economies' debt markets | Varies based on company size and bond market presence |

| Regulation | Subject to sovereign fiscal policies and international agreements | Regulated by securities laws and corporate governance standards |

Understanding Sovereign Debt: Key Features and Characteristics

Sovereign debt represents the money borrowed by a national government through bonds or other securities, often denominated in the country's own currency or foreign currencies, which affects repayment risk. Key characteristics include its role in funding public expenditures and influencing fiscal policy, along with varying interest rates and maturities dependent on credit ratings and economic stability. Unlike corporate debt, sovereign debt carries sovereign risk tied to political decisions, economic conditions, and potential currency fluctuations, impacting investor confidence and borrowing costs.

Corporate Debt Explained: Types and Structures

Corporate debt refers to the various forms of loans and bonds that companies use to finance operations and growth, typically classified into secured debt, unsecured debt, and convertible debt based on collateral and convertibility features. Common structures include term loans, revolving credits, and debentures, each offering different risk levels and repayment schedules to suit corporate financing needs. Understanding these debt types and structures is crucial for assessing a company's leverage, creditworthiness, and overall financial health in comparison to sovereign debt.

Risk Profiles: Sovereign Debt vs Corporate Debt

Sovereign debt typically carries lower risk due to government backing and tax revenue capabilities, while corporate debt risk varies significantly based on company performance and market conditions. Sovereign debt often benefits from sovereign immunity and central bank support, reducing default likelihood compared to corporate bonds, which depend heavily on the issuer's cash flow and credit ratings. Investors assess sovereign debt risk using country credit ratings like those from Moody's or S&P, whereas corporate debt risk is evaluated through financial metrics such as EBITDA, leverage ratios, and credit spreads.

Interest Rates and Yield Comparisons

Sovereign debt typically offers lower interest rates compared to corporate debt due to government backing and lower default risk, making sovereign yields a benchmark for risk-free returns. Corporate debt carries higher yields to compensate investors for increased credit risk and market volatility associated with private issuers. Yield spreads between sovereign and corporate bonds fluctuate with economic conditions, credit ratings, and monetary policies, reflecting investor risk appetite and macroeconomic stability.

Default Risks and Recovery Rates

Sovereign debt typically exhibits lower default risks compared to corporate debt due to government taxation power and monetary control, yet its recovery rates in default can be highly variable based on political stability and fiscal health. Corporate debt defaults tend to have higher recovery rates from asset liquidation but face greater default probabilities linked to business cycles and firm-specific risks. Investors often assess sovereign credit ratings and corporate credit spreads to gauge default likelihood and potential recovery outcomes.

Market Participants and Investment Motivations

Market participants in sovereign debt primarily include governments, central banks, institutional investors, and sovereign wealth funds seeking stable returns and portfolio diversification through high-credit-quality instruments. Corporate debt attracts pension funds, mutual funds, hedge funds, and private equity firms aiming for higher yields and capital growth by investing in varying credit risk profiles issued by public and private companies. Investment motivations differ as sovereign debt prioritizes security and liquidity, while corporate debt emphasizes risk-adjusted returns and potential for income generation in the broader fixed-income market.

Role in Economic Stability and Growth

Sovereign debt plays a crucial role in economic stability by funding public projects and social programs that stimulate growth and maintain infrastructure. Corporate debt drives business expansion and innovation, directly enhancing productivity and employment opportunities within the economy. Balanced management of both debt types supports sustainable economic growth by ensuring liquidity while mitigating default risks.

Regulatory Frameworks and Legal Environments

Sovereign debt is governed by international treaties and sovereign immunity principles, resulting in distinct regulatory frameworks that prioritize state sovereignty and political risk factors. Corporate debt operates under national securities laws, regulatory agencies like the SEC in the U.S., and bankruptcy codes, providing structured mechanisms for enforcement and creditor rights protection. These divergent legal environments drive differences in credit risk assessment, dispute resolution, and investor protections between sovereign and corporate debt markets.

Recent Trends in Sovereign and Corporate Bond Issuance

Recent trends reveal a surge in sovereign bond issuance driven by governments seeking to finance expansive fiscal stimuli amid global economic uncertainties. Corporate debt issuance has also grown, supported by low interest rates and strong investor demand for higher yields. This dual increase impacts credit markets, influencing yield spreads and risk assessments across bond classes.

Strategic Considerations for Investors

Sovereign debt offers investors lower risk due to government backing and often provides stable returns, making it attractive for conservative portfolios focused on capital preservation. Corporate debt can yield higher returns but entails greater credit risk and market volatility, suitable for investors seeking higher income and willing to assess company-specific financial health. Strategic allocation between sovereign and corporate debt should balance risk tolerance, investment horizon, and macroeconomic factors influencing interest rates and default probabilities.

Sovereign debt vs Corporate debt Infographic

difterm.com

difterm.com