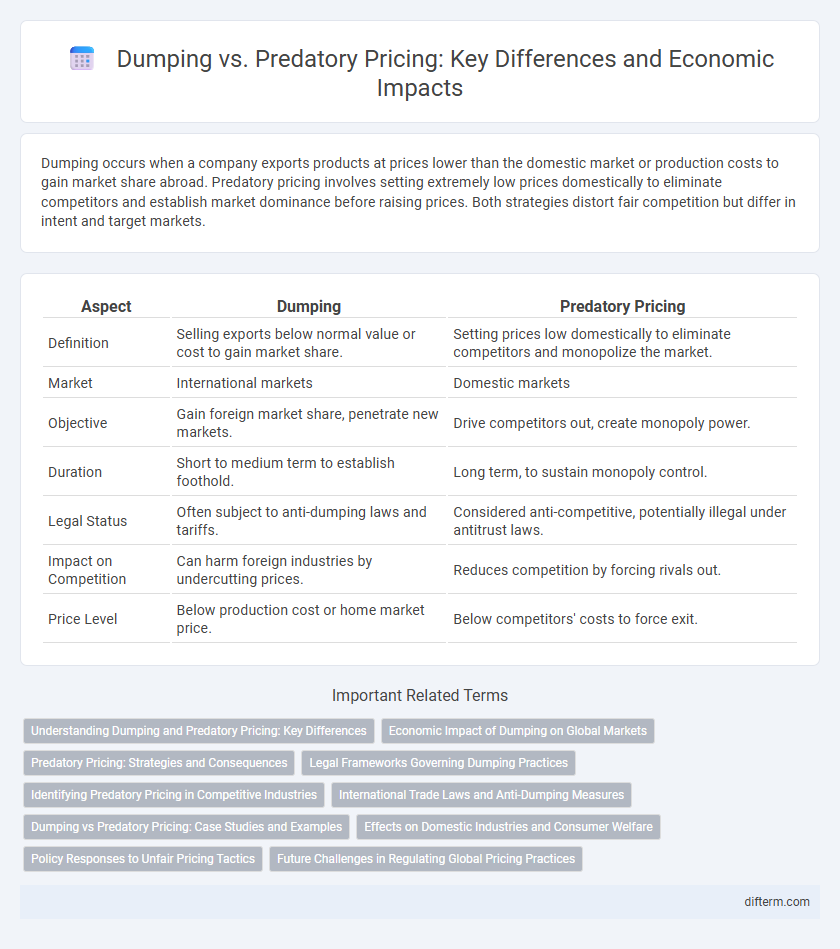

Dumping occurs when a company exports products at prices lower than the domestic market or production costs to gain market share abroad. Predatory pricing involves setting extremely low prices domestically to eliminate competitors and establish market dominance before raising prices. Both strategies distort fair competition but differ in intent and target markets.

Table of Comparison

| Aspect | Dumping | Predatory Pricing |

|---|---|---|

| Definition | Selling exports below normal value or cost to gain market share. | Setting prices low domestically to eliminate competitors and monopolize the market. |

| Market | International markets | Domestic markets |

| Objective | Gain foreign market share, penetrate new markets. | Drive competitors out, create monopoly power. |

| Duration | Short to medium term to establish foothold. | Long term, to sustain monopoly control. |

| Legal Status | Often subject to anti-dumping laws and tariffs. | Considered anti-competitive, potentially illegal under antitrust laws. |

| Impact on Competition | Can harm foreign industries by undercutting prices. | Reduces competition by forcing rivals out. |

| Price Level | Below production cost or home market price. | Below competitors' costs to force exit. |

Understanding Dumping and Predatory Pricing: Key Differences

Dumping occurs when a company exports a product at a price lower than its normal value, typically below the cost of production or domestic prices, to gain market share in a foreign market. Predatory pricing involves setting prices extremely low in a domestic market to eliminate competitors and establish a monopoly, with the intention of raising prices later. The key difference lies in the market scope and strategic intent: dumping targets international markets to disrupt foreign competition, while predatory pricing focuses on domestic competition to establish market dominance.

Economic Impact of Dumping on Global Markets

Dumping disrupts global markets by allowing exporters to sell goods below production costs, leading to unfair competition that can erode domestic industries and reduce market diversity. Persistent dumping often triggers retaliatory tariffs and trade disputes, increasing economic uncertainty and hindering international trade growth. The long-term economic impact includes distortions in resource allocation, market monopolization, and potential job losses in affected countries.

Predatory Pricing: Strategies and Consequences

Predatory pricing involves setting prices below cost to eliminate competitors and gain market dominance, often leading to monopolistic control once rivals exit the market. Firms use this strategy to undercut competitors temporarily, absorbing losses with the expectation of raising prices later to recoup profits. The consequences include reduced market competition, potential legal scrutiny under antitrust laws, and long-term harm to consumer welfare through higher prices and limited choices.

Legal Frameworks Governing Dumping Practices

Legal frameworks governing dumping practices involve international trade laws such as the World Trade Organization's Anti-Dumping Agreement, which sets rules to prevent exporting products at unfairly low prices that harm domestic industries. These regulations require investigations into whether prices are below normal value and if material injury to the importing country's industry exists. Enforcement mechanisms include imposing anti-dumping duties to level the competitive playing field and deter predatory pricing strategies designed to eliminate competitors.

Identifying Predatory Pricing in Competitive Industries

Identifying predatory pricing in competitive industries involves analyzing prices set below average variable costs with the intent to eliminate competitors and later raise prices to recoup losses. Key indicators include sustained below-cost pricing, a firm's significant market power, and the potential for recoupment after driving rivals out. Regulatory bodies examine patterns of aggressive pricing alongside market structure and entry barriers to distinguish predatory tactics from legitimate competitive pricing strategies.

International Trade Laws and Anti-Dumping Measures

Dumping involves exporting goods at unfairly low prices to gain international market share, triggering anti-dumping measures under World Trade Organization (WTO) rules to protect domestic industries. Predatory pricing entails setting prices below cost domestically to eliminate competitors before raising prices, often falling under competition law rather than international trade law. Anti-dumping duties and safeguards are critical tools used by governments to counteract dumping and ensure fair trade practices within global markets.

Dumping vs Predatory Pricing: Case Studies and Examples

Dumping involves exporting goods at prices lower than domestic markets or production costs, often evidenced by cases like China's steel exports to the US, which triggered anti-dumping duties. Predatory pricing occurs when firms deliberately set prices below cost to eliminate competitors, exemplified by Amazon's alleged pricing strategies in specific product categories to capture market share. Both practices disrupt fair competition, yet anti-dumping laws target international trade imbalances, while predatory pricing is addressed under domestic antitrust regulations.

Effects on Domestic Industries and Consumer Welfare

Dumping involves selling products abroad at prices below domestic levels, which can harm domestic industries by undermining local producers' market share and provoking retaliatory trade barriers. Predatory pricing, where a firm sets prices below cost intending to eliminate competitors and gain monopoly power, can lead to reduced competition and eventually higher prices for consumers. Both practices distort market dynamics, but while dumping primarily threatens domestic producers, predatory pricing poses long-term risks to consumer welfare through diminished choice and inflated prices.

Policy Responses to Unfair Pricing Tactics

Policy responses to unfair pricing tactics such as dumping and predatory pricing often include anti-dumping duties and competition law enforcement to protect domestic industries and maintain market competition. Regulatory authorities implement tariffs and fines to counteract below-cost pricing strategies that distort fair trade and harm economic stability. Enhanced monitoring and international cooperation facilitate early detection and swift action against these unfair practices, safeguarding market integrity and promoting sustainable economic growth.

Future Challenges in Regulating Global Pricing Practices

Regulating global pricing practices faces future challenges as authorities must distinguish between dumping, selling below cost to gain market share, and predatory pricing, intended to eliminate competitors. Globalization and digital markets increase complexity, requiring enhanced international cooperation and advanced data analytics to monitor cross-border price manipulations. Emerging trade policies and evolving economic dynamics demand adaptive regulatory frameworks to protect fair competition and prevent market distortions.

Dumping vs predatory pricing Infographic

difterm.com

difterm.com