The Quantity Theory of Money emphasizes the direct relationship between money supply and price levels, asserting that increasing money leads to proportional inflation. Keynesian Theory, in contrast, highlights the role of money demand influenced by interest rates and income, suggesting that changes in money supply affect output and employment rather than just prices. Understanding these theories helps analyze monetary policy impacts on economic stability and growth.

Table of Comparison

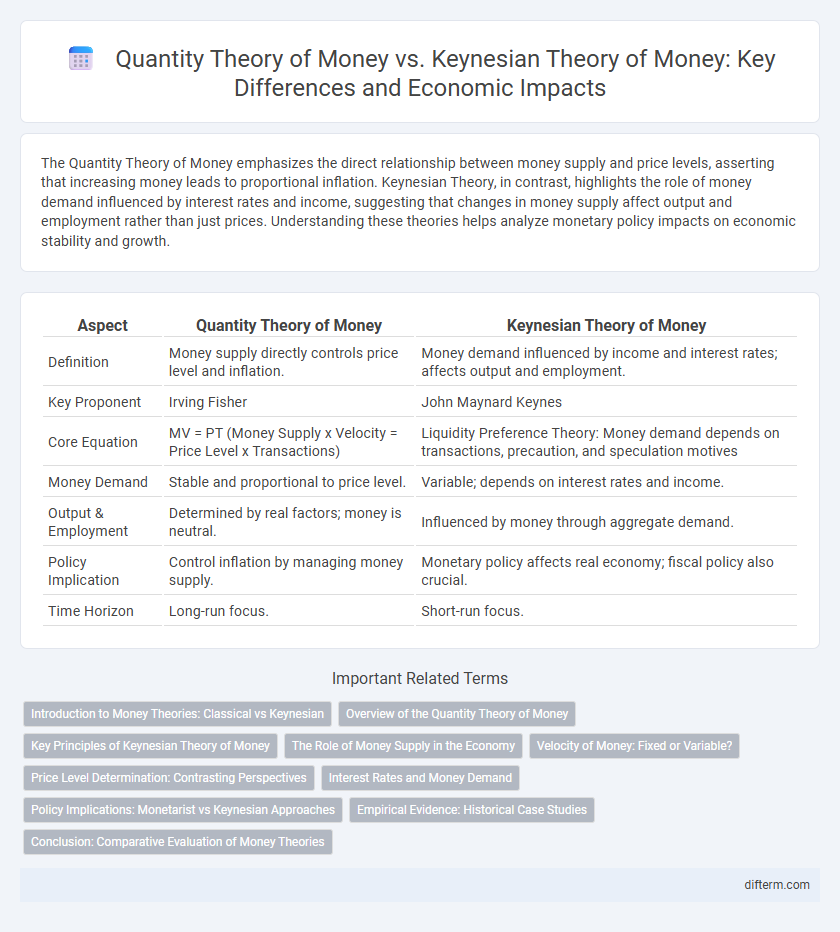

| Aspect | Quantity Theory of Money | Keynesian Theory of Money |

|---|---|---|

| Definition | Money supply directly controls price level and inflation. | Money demand influenced by income and interest rates; affects output and employment. |

| Key Proponent | Irving Fisher | John Maynard Keynes |

| Core Equation | MV = PT (Money Supply x Velocity = Price Level x Transactions) | Liquidity Preference Theory: Money demand depends on transactions, precaution, and speculation motives |

| Money Demand | Stable and proportional to price level. | Variable; depends on interest rates and income. |

| Output & Employment | Determined by real factors; money is neutral. | Influenced by money through aggregate demand. |

| Policy Implication | Control inflation by managing money supply. | Monetary policy affects real economy; fiscal policy also crucial. |

| Time Horizon | Long-run focus. | Short-run focus. |

Introduction to Money Theories: Classical vs Keynesian

The Quantity Theory of Money emphasizes that changes in the money supply directly affect price levels, assuming a stable velocity of money and output in the classical model. In contrast, Keynesian theory highlights the role of money demand influenced by income and interest rates, suggesting that money supply alone does not determine economic activity. Classical theory focuses on long-term price stability, while Keynesian theory addresses short-term economic fluctuations and liquidity preference.

Overview of the Quantity Theory of Money

The Quantity Theory of Money asserts that the general price level is directly proportional to the money supply, holding the velocity of money and output constant. This classical economic theory emphasizes that changes in money supply primarily drive inflation and purchasing power. It contrasts with the Keynesian perspective, which highlights the role of money demand and interest rates in influencing economic activity.

Key Principles of Keynesian Theory of Money

Keynesian theory of money emphasizes money's role beyond a mere medium of exchange, highlighting its function as a store of value and a determinant of interest rates through liquidity preference. Unlike the Quantity Theory of Money, which links money supply directly to price levels, Keynesian theory focuses on money demand influenced by income and interest rates, asserting that changes in money supply affect output and employment in the short run. The theory advocates active fiscal and monetary policies to manage aggregate demand and stabilize economic fluctuations.

The Role of Money Supply in the Economy

The Quantity Theory of Money emphasizes a direct and proportional relationship between money supply and price levels, asserting that changes in money supply primarily impact inflation. Keynesian theory, however, views money supply as influencing interest rates and aggregate demand, stressing that the economy may experience liquidity traps where increases in money supply do not boost economic output. These contrasting perspectives highlight the role of money supply in either controlling inflation or managing economic activity through demand stimulation.

Velocity of Money: Fixed or Variable?

The Quantity Theory of Money assumes a fixed velocity of money, implying that changes in the money supply directly affect the price level. Keynesian theory, however, views the velocity of money as variable, influenced by factors like interest rates, income, and liquidity preferences. This variability in velocity allows monetary policy to impact output and employment in the short run.

Price Level Determination: Contrasting Perspectives

The Quantity Theory of Money asserts that price levels are primarily determined by the money supply, where an increase in money supply directly causes proportional inflation. In contrast, Keynesian Theory emphasizes aggregate demand and output gaps, suggesting that price levels are influenced by factors such as employment, wage rigidities, and economic slack. These contrasting perspectives highlight the Quantity Theory's focus on monetary neutrality in the long run versus Keynesian recognition of price stickiness and demand-driven fluctuations in the short run.

Interest Rates and Money Demand

The Quantity Theory of Money emphasizes a direct relationship between money supply and price levels, assuming a stable velocity of money and treating interest rates as exogenous to money demand. In contrast, Keynesian theory highlights that money demand is interest-sensitive, with higher interest rates reducing the demand for money as individuals prefer interest-bearing assets. Keynesian perspectives argue that changes in interest rates significantly influence liquidity preference and aggregate spending, diverging from the Quantity Theory's fixed velocity assumption.

Policy Implications: Monetarist vs Keynesian Approaches

The Quantity Theory of Money emphasizes controlling money supply to manage inflation, suggesting that monetary policy should focus on steady growth of money to ensure price stability. In contrast, the Keynesian Theory advocates for active fiscal and monetary interventions to influence aggregate demand, promoting government spending and interest rate adjustments to address unemployment and economic fluctuations. Monetarist policies prioritize limiting government involvement and targeting money supply, while Keynesian approaches support counter-cyclical policies for economic stabilization.

Empirical Evidence: Historical Case Studies

Empirical evidence from the Great Depression supports Keynesian theory, highlighting that changes in money supply did not directly correlate with inflation or output, contradicting the Quantity Theory of Money. Historical case studies from hyperinflation episodes in Weimar Germany and Zimbabwe demonstrate Quantity Theory predictions, where rapid money supply growth led to runaway inflation. Modern analyses often find mixed results, suggesting that both theories explain different aspects of monetary effects depending on economic context and policy responses.

Conclusion: Comparative Evaluation of Money Theories

The Quantity Theory of Money emphasizes a direct, proportional relationship between money supply and price levels, asserting that controlling money supply stabilizes inflation. Keynesian Theory argues that money impacts interest rates and aggregate demand, highlighting the role of liquidity preference and fiscal policy in influencing economic output and employment. A comparative evaluation reveals that while Quantity Theory suits long-term inflation control, Keynesian Theory better explains short-term economic fluctuations and guides active monetary and fiscal interventions.

Quantity theory of money vs Keynesian theory of money Infographic

difterm.com

difterm.com