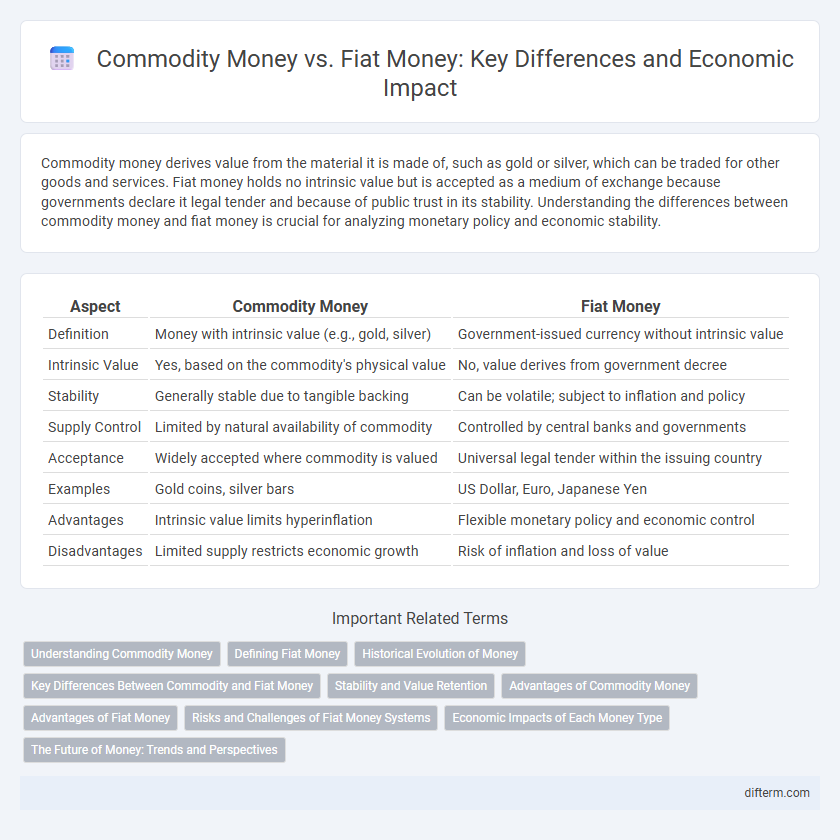

Commodity money derives value from the material it is made of, such as gold or silver, which can be traded for other goods and services. Fiat money holds no intrinsic value but is accepted as a medium of exchange because governments declare it legal tender and because of public trust in its stability. Understanding the differences between commodity money and fiat money is crucial for analyzing monetary policy and economic stability.

Table of Comparison

| Aspect | Commodity Money | Fiat Money |

|---|---|---|

| Definition | Money with intrinsic value (e.g., gold, silver) | Government-issued currency without intrinsic value |

| Intrinsic Value | Yes, based on the commodity's physical value | No, value derives from government decree |

| Stability | Generally stable due to tangible backing | Can be volatile; subject to inflation and policy |

| Supply Control | Limited by natural availability of commodity | Controlled by central banks and governments |

| Acceptance | Widely accepted where commodity is valued | Universal legal tender within the issuing country |

| Examples | Gold coins, silver bars | US Dollar, Euro, Japanese Yen |

| Advantages | Intrinsic value limits hyperinflation | Flexible monetary policy and economic control |

| Disadvantages | Limited supply restricts economic growth | Risk of inflation and loss of value |

Understanding Commodity Money

Commodity money derives its value from the intrinsic worth of the material from which it is made, such as gold, silver, or other precious metals. This form of money serves as a medium of exchange, store of value, and unit of account based on the tangible commodities' scarcity and acceptability. Markets historically relied on commodity money due to its stability and universal recognition before transitioning to fiat currency systems.

Defining Fiat Money

Fiat money is a type of currency that has no intrinsic value and is not backed by physical commodities such as gold or silver; its value is derived solely from government regulation and legal tender status. Central banks issue fiat money to facilitate trade and stabilize economies, relying on public trust and governmental authority to maintain its worth. Unlike commodity money, fiat currency's supply can be controlled and adjusted to influence economic activity, inflation, and monetary policy.

Historical Evolution of Money

Commodity money, rooted in tangible assets like gold and silver, served as early forms of currency due to their intrinsic value and widespread acceptance. The transition to fiat money, characterized by government-issued currency without intrinsic value, emerged as economies expanded and required more flexible monetary systems. This evolution facilitated centralized control, enabling monetary policy implementation to stabilize economies and support modern financial infrastructures.

Key Differences Between Commodity and Fiat Money

Commodity money derives its value from the intrinsic worth of the material, such as gold or silver, while fiat money has no intrinsic value and is backed solely by government decree. Commodity money is limited by the physical availability of the resource, influencing its supply and stability, whereas fiat money supply can be managed and expanded by central banks to support economic policies. Inflation impacts fiat money more directly due to its dependent trust system, whereas commodity money tends to resist inflation because of its tangible asset backing.

Stability and Value Retention

Commodity money maintains intrinsic value due to its physical attributes, often backed by precious metals like gold or silver, ensuring greater stability in economic fluctuations. Fiat money lacks intrinsic value but relies on government regulation and public trust to preserve its purchasing power, making it more susceptible to inflation and devaluation. Historical data reveals commodity money exhibits stronger value retention during periods of economic instability compared to fiat currencies, which can lose value rapidly under fiscal mismanagement.

Advantages of Commodity Money

Commodity money offers inherent value due to its physical properties, such as gold or silver, providing intrinsic worth that fiat money lacks. It resists inflation more effectively because its supply is limited by natural resources rather than government issuance, ensuring long-term stability. Historical trust in commodities enhances their acceptance and durability as a medium of exchange and store of value.

Advantages of Fiat Money

Fiat money offers greater flexibility in monetary policy by allowing central banks to control the money supply and stabilize the economy effectively. Unlike commodity money, it is not limited by physical reserves, enabling governments to respond quickly to economic crises and inflation. Its widespread acceptance and ease of transport enhance daily transactions and support modern financial systems globally.

Risks and Challenges of Fiat Money Systems

Fiat money systems face significant risks such as inflation, currency devaluation, and loss of public trust due to their value being backed solely by government decree rather than intrinsic worth. Central banks must carefully manage monetary policy to prevent hyperinflation and economic instability, which can occur when excessive money supply erodes purchasing power. Furthermore, fiat currencies are vulnerable to political influence and economic shocks, increasing the challenge of maintaining a stable and reliable financial system.

Economic Impacts of Each Money Type

Commodity money, backed by physical assets like gold or silver, often stabilizes inflation and preserves purchasing power due to intrinsic value, but it can limit monetary policy flexibility and economic growth. Fiat money, lacking intrinsic value and reliant on government decree, enables central banks to implement monetary policies that stabilize economies during downturns but risks inflation and currency devaluation if mismanaged. The economic impact of fiat money is stronger in promoting liquidity and credit expansion, while commodity money typically curbs excessive inflation but can constrain economic development.

The Future of Money: Trends and Perspectives

Commodity money, backed by physical assets like gold or silver, faces limitations in scalability and flexibility compared to fiat money, which is government-issued without intrinsic value but supported by trust and regulation. Emerging trends such as digital currencies, central bank digital currencies (CBDCs), and blockchain technology are reshaping monetary systems by enhancing transparency, security, and efficiency while challenging traditional fiat dominance. The future of money is likely to be a hybrid ecosystem integrating commodity-backed digital assets and innovative fiat-based payment solutions, driving financial inclusion and evolving economic policies.

Commodity Money vs Fiat Money Infographic

difterm.com

difterm.com