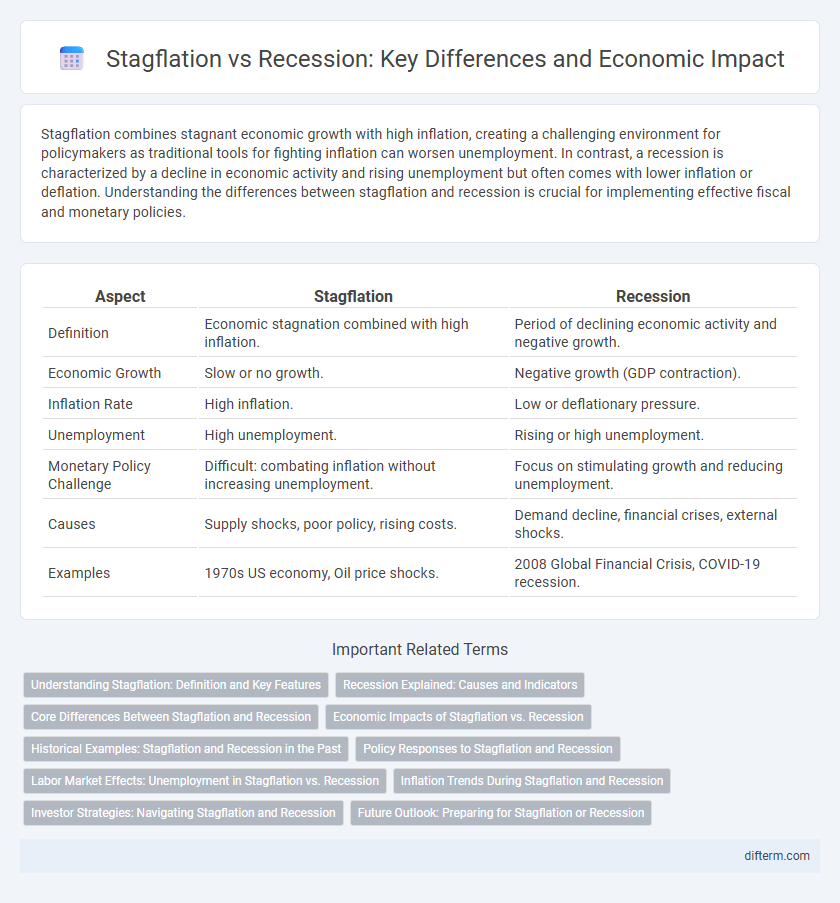

Stagflation combines stagnant economic growth with high inflation, creating a challenging environment for policymakers as traditional tools for fighting inflation can worsen unemployment. In contrast, a recession is characterized by a decline in economic activity and rising unemployment but often comes with lower inflation or deflation. Understanding the differences between stagflation and recession is crucial for implementing effective fiscal and monetary policies.

Table of Comparison

| Aspect | Stagflation | Recession |

|---|---|---|

| Definition | Economic stagnation combined with high inflation. | Period of declining economic activity and negative growth. |

| Economic Growth | Slow or no growth. | Negative growth (GDP contraction). |

| Inflation Rate | High inflation. | Low or deflationary pressure. |

| Unemployment | High unemployment. | Rising or high unemployment. |

| Monetary Policy Challenge | Difficult: combating inflation without increasing unemployment. | Focus on stimulating growth and reducing unemployment. |

| Causes | Supply shocks, poor policy, rising costs. | Demand decline, financial crises, external shocks. |

| Examples | 1970s US economy, Oil price shocks. | 2008 Global Financial Crisis, COVID-19 recession. |

Understanding Stagflation: Definition and Key Features

Stagflation is an economic condition characterized by stagnant growth, high unemployment, and persistent inflation occurring simultaneously, which contrasts sharply with a recession where economic decline is accompanied by falling prices. Key features of stagflation include a rise in consumer prices despite sluggish economic output and deteriorating labor market conditions, making traditional monetary policies less effective. Understanding stagflation is crucial for policymakers as it requires balancing inflation control without further suppressing economic growth or increasing unemployment.

Recession Explained: Causes and Indicators

Recession occurs when economic output declines for two consecutive quarters, driven by factors such as reduced consumer spending, high unemployment rates, and decreased business investment. Key indicators include a drop in GDP, rising job losses, lower industrial production, and declining retail sales. Central banks may respond with monetary policy adjustments to stimulate economic activity and mitigate prolonged downturns.

Core Differences Between Stagflation and Recession

Stagflation is characterized by simultaneous high inflation, stagnant economic growth, and rising unemployment, whereas a recession involves a significant decline in economic activity across the economy lasting more than a few months. Inflation rates typically soar during stagflation, contrasting with recessions where inflation often slows or turns into deflation. The core difference lies in stagflation's unique combination of slow growth and high inflation, making monetary policy responses more complex compared to the primarily growth-focused challenges of a recession.

Economic Impacts of Stagflation vs. Recession

Stagflation combines stagnant economic growth with high inflation, leading to decreased consumer purchasing power and rising unemployment simultaneously, which complicates monetary policy responses. Recession typically involves a decline in GDP and employment but is often accompanied by low inflation or deflation, allowing central banks to stimulate growth through lower interest rates. The economic impacts of stagflation are more severe as it erodes real wages and business profits while limiting policymakers' ability to address inflation without worsening unemployment.

Historical Examples: Stagflation and Recession in the Past

The 1970s stagflation in the United States was marked by soaring inflation rates above 10%, stagnant economic growth, and unemployment exceeding 7%, driven by oil shocks and monetary policy challenges. In contrast, the Great Recession of 2007-2009 featured a severe economic contraction of nearly 4% GDP decline, skyrocketing unemployment above 10%, and deflationary pressures triggered by the housing market collapse and financial crisis. Historical data reveal stagflation combines high inflation with stagnating growth, while recessions typically involve negative GDP growth and rising unemployment without sustained inflation.

Policy Responses to Stagflation and Recession

Policy responses to stagflation involve tightening monetary policy to combat inflation while implementing fiscal measures to stimulate supply and productivity. In contrast, recession policies prioritize monetary easing and increased government spending to boost demand and reduce unemployment. Balancing inflation control with economic growth remains a central challenge in addressing stagflation compared to straightforward stimulus approaches used during recessions.

Labor Market Effects: Unemployment in Stagflation vs. Recession

Stagflation uniquely features rising unemployment alongside persistent inflation, creating a labor market where job losses coincide with eroded purchasing power, hindering wage growth. In contrast, recessions typically see unemployment surge due to decreased economic output, but inflation often eases, allowing real wages to stabilize or improve marginally. The persistence of stagflation challenges policymakers by compounding labor market distress and complicating efforts to stimulate employment without exacerbating inflation.

Inflation Trends During Stagflation and Recession

Inflation during stagflation remains persistently high despite slowing economic growth, driven by supply shocks and rising energy prices, causing a simultaneous rise in unemployment and inflation rates. In contrast, recessions typically see a decline in inflation as demand decreases and consumer spending contracts, leading to lower price pressures across most sectors. Central banks face distinct challenges in each scenario, with stagflation requiring policies to curb inflation without worsening unemployment, while recessions often necessitate stimulus to boost demand and prevent deflation.

Investor Strategies: Navigating Stagflation and Recession

Investors facing stagflation should prioritize assets like inflation-protected securities, commodities, and dividend-paying stocks to combat rising prices and stagnant growth. During a recession, defensively positioned portfolios with high-quality bonds, cash equivalents, and sectors like consumer staples tend to preserve capital and provide stability. Diversification across asset classes tailored to economic conditions enhances resilience and potential returns in both stagflationary and recessionary environments.

Future Outlook: Preparing for Stagflation or Recession

Navigating the future economic landscape requires robust strategies to address the divergent challenges posed by stagflation and recession. Policymakers must balance inflation control with stimulating growth, emphasizing fiscal discipline and targeted monetary policies to mitigate prolonged stagnation and rising prices. Businesses and investors are advised to diversify portfolios, enhance operational efficiency, and closely monitor inflation indicators and employment data to prepare for fluctuating economic conditions.

stagflation vs recession Infographic

difterm.com

difterm.com