The nominal interest rate represents the percentage increase in money you pay or earn without adjusting for inflation, reflecting the stated rate on loans or investments. The real interest rate accounts for inflation, providing a clearer measure of purchasing power changes over time. Understanding the difference helps investors and policymakers make informed decisions about savings, borrowing, and economic growth.

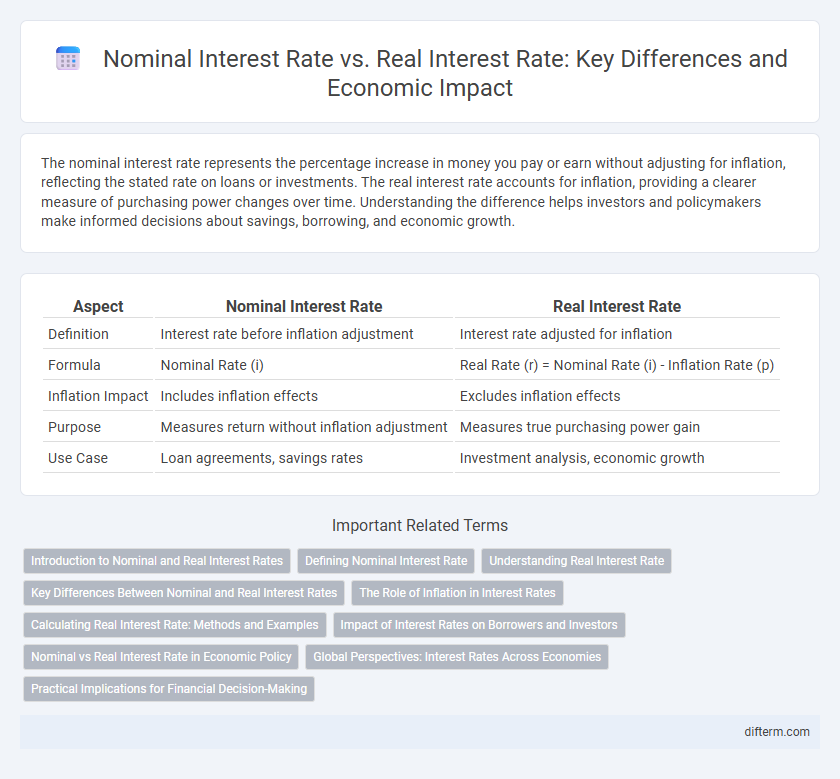

Table of Comparison

| Aspect | Nominal Interest Rate | Real Interest Rate |

|---|---|---|

| Definition | Interest rate before inflation adjustment | Interest rate adjusted for inflation |

| Formula | Nominal Rate (i) | Real Rate (r) = Nominal Rate (i) - Inflation Rate (p) |

| Inflation Impact | Includes inflation effects | Excludes inflation effects |

| Purpose | Measures return without inflation adjustment | Measures true purchasing power gain |

| Use Case | Loan agreements, savings rates | Investment analysis, economic growth |

Introduction to Nominal and Real Interest Rates

Nominal interest rates represent the percentage increase in money you pay or earn, not accounting for inflation, which can erode actual purchasing power. Real interest rates adjust nominal rates by inflation, providing a more accurate measure of the true cost or yield of borrowing and lending. Understanding the difference aids businesses and investors in evaluating the profitability of investments and the real returns on savings.

Defining Nominal Interest Rate

The nominal interest rate represents the percentage increase in money that a borrower pays to a lender, not adjusting for inflation effects. It reflects the stated interest rate on loans or investments, serving as a basic measure before considering changes in purchasing power. Understanding nominal interest rates is essential for evaluating the apparent cost of borrowing and the yield on savings without accounting for inflation's erosion of value.

Understanding Real Interest Rate

The real interest rate measures the true cost of borrowing by adjusting the nominal interest rate for inflation, providing a clearer picture of purchasing power changes over time. Understanding the real interest rate is essential for investors and policymakers to evaluate the actual returns on investments and the affordability of loans. Unlike the nominal interest rate, which is reported without inflation adjustments, the real interest rate reflects the economy's inflation dynamics and helps predict economic behavior.

Key Differences Between Nominal and Real Interest Rates

Nominal interest rates represent the stated interest without adjusting for inflation, reflecting the actual percentage charged or earned over a period. Real interest rates, however, account for inflation and indicate the true purchasing power of the interest earned or paid. Understanding the distinction helps investors and policymakers evaluate loan costs, investment returns, and economic health more accurately.

The Role of Inflation in Interest Rates

Nominal interest rates reflect the stated percentage return on loans or investments without adjusting for inflation, while real interest rates account for the inflation rate to measure the true purchasing power of returns. Inflation erodes the value of money over time, making it crucial to consider real interest rates for accurate economic analysis and investment decisions. Central banks monitor inflation closely to adjust nominal rates, aiming to maintain stable real interest rates that support sustainable economic growth.

Calculating Real Interest Rate: Methods and Examples

Calculating the real interest rate involves adjusting the nominal interest rate by the inflation rate to reflect the true cost of borrowing or the real yield on investment. The most common method uses the Fisher equation: Real Interest Rate Nominal Interest Rate - Inflation Rate, which provides an approximate real rate by subtracting expected inflation from the nominal rate. For example, if the nominal interest rate is 6% and inflation is 2%, the real interest rate is approximately 4%, guiding investors and policymakers in making informed economic decisions.

Impact of Interest Rates on Borrowers and Investors

Nominal interest rates represent the stated rate without adjusting for inflation, directly influencing borrowers' cost of loans and investors' returns. Real interest rates, calculated by subtracting inflation from nominal rates, provide a clearer measure of purchasing power impact on debt servicing and investment profitability. Higher nominal rates increase borrowing costs, reducing loan demand, while lower real rates enhance investor gains by preserving investment value against inflation.

Nominal vs Real Interest Rate in Economic Policy

Nominal interest rates represent the stated rate without adjusting for inflation, while real interest rates reflect the inflation-adjusted cost of borrowing or the true yield on investments. Economic policy relies on managing real interest rates to influence consumer spending, investment, and inflation expectations effectively. Central banks use nominal rates as a tool to indirectly control real rates, ensuring monetary stability and sustainable economic growth.

Global Perspectives: Interest Rates Across Economies

Nominal interest rates represent the stated percentage return on investments without adjusting for inflation, while real interest rates reflect the inflation-adjusted return, providing a clearer measure of purchasing power gains. Global disparities in nominal and real interest rates arise from differing inflation expectations, monetary policies, and economic growth rates among countries, influencing international capital flows and investment decisions. Emerging economies often exhibit higher nominal rates due to inflation risk premiums, whereas advanced economies tend toward lower nominal rates but sometimes experience negative real rates amid ultra-loose monetary policies.

Practical Implications for Financial Decision-Making

Nominal interest rates reflect the stated percentage without adjusting for inflation, while real interest rates account for inflation's impact, offering a more accurate measure of purchasing power changes over time. Investors and borrowers should prioritize real interest rates to assess true costs and returns on loans or investments, as nominal rates can be misleading in high inflation environments. Understanding this distinction is crucial for financial decision-making, affecting loan affordability, investment yields, and long-term wealth preservation strategies.

Nominal Interest Rate vs Real Interest Rate Infographic

difterm.com

difterm.com