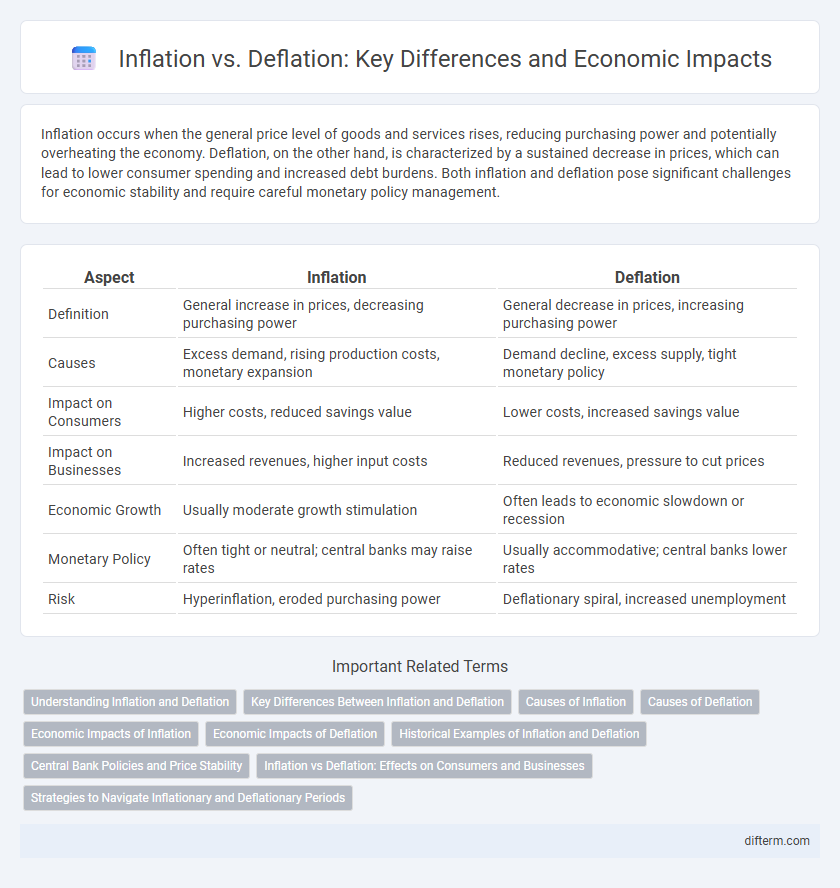

Inflation occurs when the general price level of goods and services rises, reducing purchasing power and potentially overheating the economy. Deflation, on the other hand, is characterized by a sustained decrease in prices, which can lead to lower consumer spending and increased debt burdens. Both inflation and deflation pose significant challenges for economic stability and require careful monetary policy management.

Table of Comparison

| Aspect | Inflation | Deflation |

|---|---|---|

| Definition | General increase in prices, decreasing purchasing power | General decrease in prices, increasing purchasing power |

| Causes | Excess demand, rising production costs, monetary expansion | Demand decline, excess supply, tight monetary policy |

| Impact on Consumers | Higher costs, reduced savings value | Lower costs, increased savings value |

| Impact on Businesses | Increased revenues, higher input costs | Reduced revenues, pressure to cut prices |

| Economic Growth | Usually moderate growth stimulation | Often leads to economic slowdown or recession |

| Monetary Policy | Often tight or neutral; central banks may raise rates | Usually accommodative; central banks lower rates |

| Risk | Hyperinflation, eroded purchasing power | Deflationary spiral, increased unemployment |

Understanding Inflation and Deflation

Inflation represents the rise in general price levels, reducing purchasing power and often triggered by increased demand or cost-push factors. Deflation, characterized by falling prices, can lead to reduced consumer spending and economic stagnation, often caused by decreased demand or excess supply. Understanding inflation and deflation requires analyzing monetary policy, supply chain dynamics, and consumer behavior to anticipate their impact on economic growth.

Key Differences Between Inflation and Deflation

Inflation refers to the general increase in prices and decrease in purchasing power, whereas deflation signifies a decline in prices and an increase in money value. Inflation erodes consumer purchasing power and can lead to higher interest rates, while deflation risks reduced consumer spending and potential economic stagnation. Central banks often respond to inflation with tightening monetary policy, while deflation may prompt stimulus measures to encourage demand.

Causes of Inflation

Rising consumer demand, increased production costs, and excessive money supply are primary causes of inflation. Supply chain disruptions and wage hikes further drive prices upward. Central banks' monetary policies and fiscal stimulus measures can also contribute to sustained inflationary pressures.

Causes of Deflation

Deflation primarily occurs due to a significant drop in consumer demand, often triggered by economic recessions, high unemployment rates, or a decline in consumer confidence. Technological advancements and increased productivity can also drive prices down by reducing production costs. Additionally, tight monetary policies and reduced money supply contribute to deflation by limiting the amount of currency circulating in the economy.

Economic Impacts of Inflation

Inflation leads to a general increase in prices, reducing consumers' purchasing power and raising the cost of living, which can distort spending and saving behavior. Businesses face higher input costs that may compress profit margins, potentially slowing investment and economic growth. Central banks often respond to inflation by tightening monetary policy, increasing interest rates to control price rises, which can dampen borrowing and overall economic activity.

Economic Impacts of Deflation

Deflation leads to decreased consumer spending as individuals delay purchases anticipating lower prices, which reduces overall demand and slows economic growth. Business revenues decline, causing layoffs and higher unemployment rates that further suppress income and consumption. Persistent deflation increases real debt burdens, discouraging investment and credit expansion, ultimately exacerbating economic contraction.

Historical Examples of Inflation and Deflation

Historical examples of inflation include the Weimar Republic in the 1920s, where hyperinflation caused prices to skyrocket, and Zimbabwe in the late 2000s, experiencing runaway inflation that destabilized its economy. Deflationary periods are exemplified by the Great Depression in the 1930s United States, marked by falling prices, reduced consumer spending, and widespread unemployment. Understanding these events highlights the severe economic consequences inflation and deflation can impose on national stability and growth.

Central Bank Policies and Price Stability

Central bank policies play a crucial role in managing inflation and deflation to ensure price stability. By adjusting interest rates and using open market operations, central banks influence money supply and demand, aiming to keep inflation within a target range, typically around 2%. Maintaining price stability fosters economic growth, minimizes uncertainty, and preserves the purchasing power of currency.

Inflation vs Deflation: Effects on Consumers and Businesses

Inflation erodes purchasing power, leading consumers to spend more on everyday goods while businesses face rising input costs that may reduce profit margins unless prices rise accordingly. Deflation increases the value of money over time, prompting consumers to delay purchases and causing businesses to struggle with declining revenues and excess inventory. Both inflation and deflation create uncertainty in financial planning, impacting investment decisions and economic growth.

Strategies to Navigate Inflationary and Deflationary Periods

During inflationary periods, businesses and consumers should prioritize cost control, diversify investments, and seek assets that typically appreciate, such as real estate and commodities. In deflationary environments, strategies include increasing liquidity, reducing debt levels, and focusing on high-quality investments that maintain value despite falling prices. Central banks often adjust monetary policy by raising rates to combat inflation or lowering them to stimulate deflationary economies.

Inflation vs Deflation Infographic

difterm.com

difterm.com