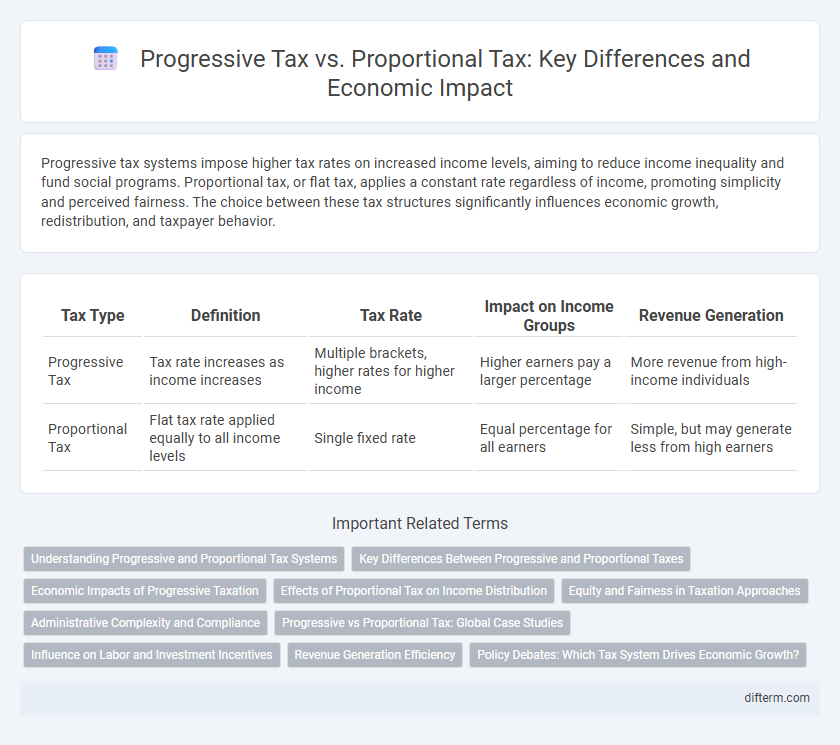

Progressive tax systems impose higher tax rates on increased income levels, aiming to reduce income inequality and fund social programs. Proportional tax, or flat tax, applies a constant rate regardless of income, promoting simplicity and perceived fairness. The choice between these tax structures significantly influences economic growth, redistribution, and taxpayer behavior.

Table of Comparison

| Tax Type | Definition | Tax Rate | Impact on Income Groups | Revenue Generation |

|---|---|---|---|---|

| Progressive Tax | Tax rate increases as income increases | Multiple brackets, higher rates for higher income | Higher earners pay a larger percentage | More revenue from high-income individuals |

| Proportional Tax | Flat tax rate applied equally to all income levels | Single fixed rate | Equal percentage for all earners | Simple, but may generate less from high earners |

Understanding Progressive and Proportional Tax Systems

Progressive tax systems impose higher tax rates on increased income levels, ensuring that individuals with greater earnings contribute a larger percentage of their income, which helps reduce income inequality. Proportional tax systems charge a fixed tax rate regardless of income, providing simplicity and predictability but potentially placing a heavier burden on lower-income earners. Analyzing the impact on income distribution and government revenue is essential to determine the most effective taxation approach for economic equity and growth.

Key Differences Between Progressive and Proportional Taxes

Progressive tax imposes higher rates on increased income brackets, effectively redistributing wealth by charging the wealthy a larger percentage, while proportional tax applies a fixed rate across all income levels, maintaining uniformity regardless of earnings. Progressive taxation typically reduces income inequality by scaling tax burden according to ability to pay, contrasting proportional tax's simplicity and predictability without adjusting for economic disparity. Key differences include rate structure, impact on income distribution, and administrative complexity, with progressive tax requiring more nuanced brackets and adjustments compared to the flat percentage of proportional tax.

Economic Impacts of Progressive Taxation

Progressive taxation, where tax rates increase with income levels, reduces income inequality by redistributing wealth from higher earners to fund social programs and public services. This system can stimulate economic growth by increasing the purchasing power of lower-income households, which tends to boost consumption and demand. However, excessively high progressive tax rates may discourage investment and work incentives among top earners, potentially impacting overall economic productivity.

Effects of Proportional Tax on Income Distribution

A proportional tax, often called a flat tax, applies the same tax rate to all income levels, which can lead to a less progressive effect on income distribution compared to progressive tax systems. This uniform rate may place a relatively heavier burden on lower-income earners, potentially exacerbating income inequality by limiting their disposable income and consumption capacity. While simple to administer, proportional taxes often lack mechanisms to redistribute wealth, influencing the overall equity and effectiveness of tax policy in addressing social disparities.

Equity and Fairness in Taxation Approaches

Progressive tax systems enhance equity by imposing higher tax rates on individuals with greater income, ensuring wealthier taxpayers contribute a fairer share to public revenue. Proportional tax systems apply a uniform tax rate to all income levels, which may be simpler but can disproportionately burden low-income earners, raising concerns about fairness. Addressing tax equity involves balancing the redistributive effects of progressive taxes against the simplicity and perceived neutrality of proportional taxation.

Administrative Complexity and Compliance

Progressive tax systems tend to have higher administrative complexity due to multiple tax brackets, deductions, and credits that require detailed income assessment and record-keeping. Proportional tax systems are simpler to administer and comply with because a flat tax rate applies uniformly, reducing the need for extensive calculations and paperwork. Lower complexity in proportional taxes generally leads to higher compliance rates and reduced enforcement costs.

Progressive vs Proportional Tax: Global Case Studies

Progressive tax systems, such as those in Sweden and Canada, impose higher tax rates on increased income brackets, aiming to reduce income inequality while ensuring government revenue grows with economic capacity. Proportional tax models, exemplified by countries like Russia and Estonia, apply a flat tax rate to all income levels, promoting simplicity and efficiency but potentially exacerbating income disparity. Global case studies reveal that progressive taxation often supports greater social equity, whereas proportional taxes enhance administrative ease and attract investment through predictable tax burdens.

Influence on Labor and Investment Incentives

Progressive tax systems impose higher rates on increased income levels, often reducing labor supply incentives and discouraging high earnings due to diminished after-tax returns. Proportional taxes maintain a constant rate regardless of income, preserving stronger incentives for labor participation and investment by ensuring consistent marginal returns. Empirical studies indicate that proportional taxation can enhance capital accumulation and economic growth by fostering favorable investment environments and motivating workforce engagement.

Revenue Generation Efficiency

Progressive tax systems generate higher revenue by imposing increasing rates on higher income brackets, enhancing redistribution and funding for public services. Proportional tax structures apply a constant rate regardless of income, often leading to stable but potentially lower revenue growth during economic expansions. Empirical studies indicate progressive taxes more effectively capture revenue from wealth concentration, improving fiscal capacity in economies with significant income disparities.

Policy Debates: Which Tax System Drives Economic Growth?

Progressive tax systems impose higher rates on higher income brackets, aiming to reduce income inequality while funding public services, but critics argue they may discourage investment and entrepreneurship. Proportional tax systems, charging a flat rate regardless of income, are praised for simplicity and potential to stimulate economic growth by providing uniform incentives. Policy debates center on balancing equitable revenue generation with fostering a business environment conducive to innovation and expansion.

Progressive tax vs Proportional tax Infographic

difterm.com

difterm.com