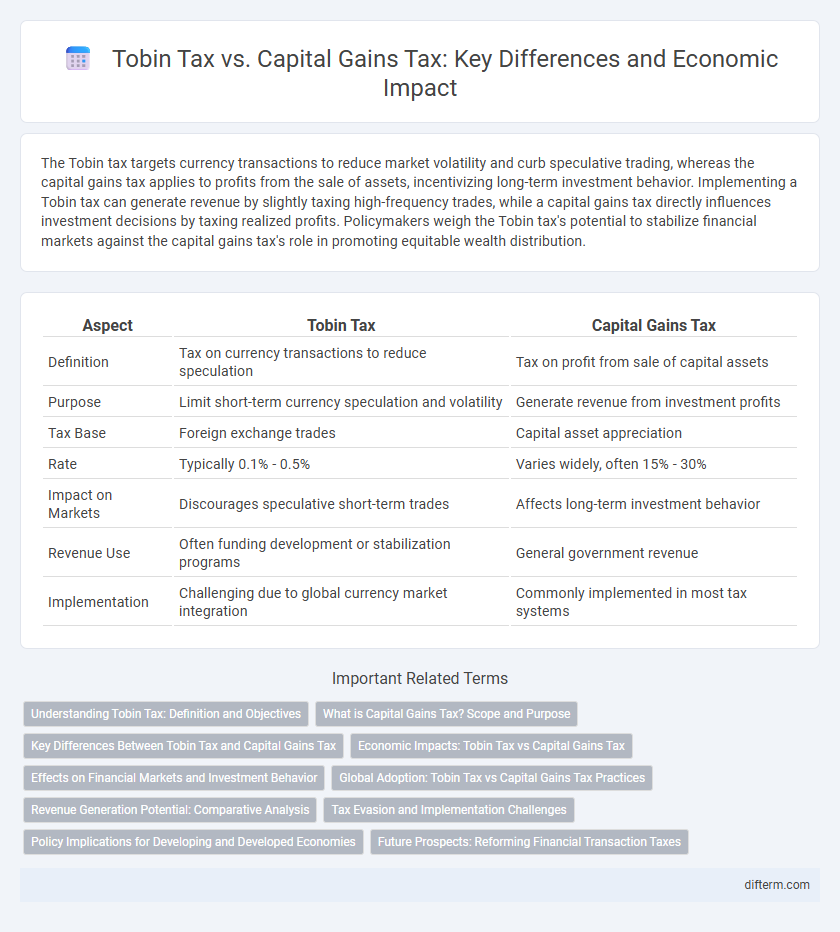

The Tobin tax targets currency transactions to reduce market volatility and curb speculative trading, whereas the capital gains tax applies to profits from the sale of assets, incentivizing long-term investment behavior. Implementing a Tobin tax can generate revenue by slightly taxing high-frequency trades, while a capital gains tax directly influences investment decisions by taxing realized profits. Policymakers weigh the Tobin tax's potential to stabilize financial markets against the capital gains tax's role in promoting equitable wealth distribution.

Table of Comparison

| Aspect | Tobin Tax | Capital Gains Tax |

|---|---|---|

| Definition | Tax on currency transactions to reduce speculation | Tax on profit from sale of capital assets |

| Purpose | Limit short-term currency speculation and volatility | Generate revenue from investment profits |

| Tax Base | Foreign exchange trades | Capital asset appreciation |

| Rate | Typically 0.1% - 0.5% | Varies widely, often 15% - 30% |

| Impact on Markets | Discourages speculative short-term trades | Affects long-term investment behavior |

| Revenue Use | Often funding development or stabilization programs | General government revenue |

| Implementation | Challenging due to global currency market integration | Commonly implemented in most tax systems |

Understanding Tobin Tax: Definition and Objectives

The Tobin tax is a levy on short-term currency transactions aimed at reducing market volatility and curbing speculative trading. It seeks to stabilize foreign exchange markets by discouraging rapid, high-frequency currency trades that contribute to financial instability. This tax differs from capital gains tax, which is applied to profits from the sale of assets over longer periods, targeting wealth accumulation rather than market speculation.

What is Capital Gains Tax? Scope and Purpose

Capital gains tax is a levy on the profit realized from the sale of non-inventory assets such as stocks, bonds, real estate, and other investments. Its scope includes both short-term and long-term capital gains, with rates varying based on holding periods and income levels, designed to tax the appreciation in asset value. The primary purpose of capital gains tax is to generate government revenue while encouraging investment and mitigating speculative trading behavior in financial markets.

Key Differences Between Tobin Tax and Capital Gains Tax

The Tobin tax targets currency transactions to reduce short-term speculation and stabilize exchange rates, while capital gains tax applies to profits from the sale of assets like stocks and real estate, aimed at generating government revenue. Tobin tax is typically a small percentage levied on foreign exchange trades, whereas capital gains tax rates vary based on income levels and holding periods. The mechanisms differ: Tobin tax discourages volatility in currency markets, whereas capital gains tax influences investment behavior across diverse asset classes.

Economic Impacts: Tobin Tax vs Capital Gains Tax

The Tobin tax targets short-term currency speculation, aiming to reduce market volatility and stabilize exchange rates, potentially fostering long-term investment and economic resilience. Conversely, capital gains tax directly affects profits from asset sales, influencing investor behavior by discouraging quick profits and encouraging holding periods, which can impact market liquidity and investment dynamics. Both taxes generate government revenue but differ in their economic impacts on financial market behavior and macroeconomic stability.

Effects on Financial Markets and Investment Behavior

The Tobin tax, a small levy on currency transactions, aims to reduce short-term speculative trading by increasing transaction costs, thereby promoting market stability and reducing volatility in foreign exchange markets. In contrast, capital gains tax directly impacts investor behavior by taxing profits from asset sales, which can discourage frequent trading and encourage longer-term investment horizons. While the Tobin tax primarily targets currency market inefficiencies and speculative capital flows, capital gains tax influences broader investment decisions across various asset classes, affecting portfolio allocation and overall market liquidity.

Global Adoption: Tobin Tax vs Capital Gains Tax Practices

The Tobin tax, primarily aimed at curbing speculative currency trading, has seen limited global adoption with only a few countries experimenting or proposing implementation, such as the European Union discussions and some Latin American nations. In contrast, the capital gains tax enjoys widespread adoption across most developed and developing economies, serving as a key revenue source by taxing profits from asset sales including stocks, real estate, and businesses. This disparity reflects differing policy priorities, with the Tobin tax focusing on financial market stability and the capital gains tax emphasizing wealth taxation and fiscal sustainability.

Revenue Generation Potential: Comparative Analysis

The Tobin tax, targeting currency transactions, offers a steady revenue stream by imposing a small levy on high-frequency trades, potentially generating billions annually in global markets. Capital gains tax, levied on profits from asset sales, produces substantial revenue depending on asset market activity and tax rates, significantly influencing investor behavior and market dynamics. Comparative studies indicate that while the Tobin tax provides broader applicability and consistent inflows, capital gains tax yields higher revenues during bullish market cycles, highlighting their complementary roles in fiscal policy.

Tax Evasion and Implementation Challenges

Tobin tax faces significant tax evasion risks due to its application on currency transactions, prompting traders to circumvent through offshore accounts and complex financial instruments. Capital gains tax implementation challenges include accurately tracking asset sales and distinguishing between short-term speculation and long-term investments, often leading to underreporting and loopholes. Both taxes encounter enforcement difficulties, requiring robust regulatory frameworks and international cooperation to minimize avoidance and ensure effective revenue collection.

Policy Implications for Developing and Developed Economies

Tobin tax targets short-term currency speculation, aiming to reduce financial market volatility and stabilize exchange rates, which can benefit developing economies by safeguarding their fragile financial systems. Capital gains tax, levied on profits from asset sales, primarily affects investment behaviors in developed markets, influencing wealth accumulation and income distribution. Policymakers in developing countries may prioritize Tobin tax to control speculative flows, while developed economies often use capital gains tax adjustments to stimulate long-term investment and address inequality.

Future Prospects: Reforming Financial Transaction Taxes

Reforming financial transaction taxes like the Tobin tax and capital gains tax aims to enhance market stability and generate sustainable revenue streams amid growing global economic volatility. The Tobin tax, targeting currency transactions, offers potential to reduce speculative trading and currency fluctuations, while capital gains tax reforms focus on ensuring fair taxation of investment profits without discouraging long-term investment. Future prospects involve balancing efficient tax structures to support economic growth, improve market transparency, and fund public goods amid evolving financial technologies.

Tobin tax vs capital gains tax Infographic

difterm.com

difterm.com