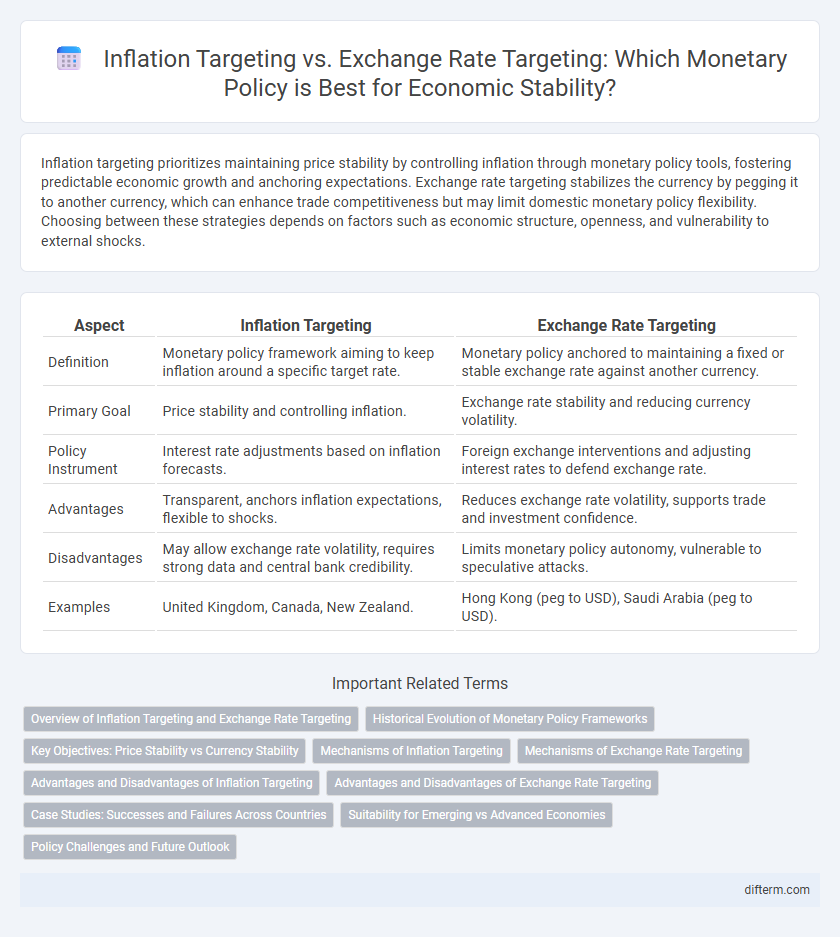

Inflation targeting prioritizes maintaining price stability by controlling inflation through monetary policy tools, fostering predictable economic growth and anchoring expectations. Exchange rate targeting stabilizes the currency by pegging it to another currency, which can enhance trade competitiveness but may limit domestic monetary policy flexibility. Choosing between these strategies depends on factors such as economic structure, openness, and vulnerability to external shocks.

Table of Comparison

| Aspect | Inflation Targeting | Exchange Rate Targeting |

|---|---|---|

| Definition | Monetary policy framework aiming to keep inflation around a specific target rate. | Monetary policy anchored to maintaining a fixed or stable exchange rate against another currency. |

| Primary Goal | Price stability and controlling inflation. | Exchange rate stability and reducing currency volatility. |

| Policy Instrument | Interest rate adjustments based on inflation forecasts. | Foreign exchange interventions and adjusting interest rates to defend exchange rate. |

| Advantages | Transparent, anchors inflation expectations, flexible to shocks. | Reduces exchange rate volatility, supports trade and investment confidence. |

| Disadvantages | May allow exchange rate volatility, requires strong data and central bank credibility. | Limits monetary policy autonomy, vulnerable to speculative attacks. |

| Examples | United Kingdom, Canada, New Zealand. | Hong Kong (peg to USD), Saudi Arabia (peg to USD). |

Overview of Inflation Targeting and Exchange Rate Targeting

Inflation targeting involves central banks setting explicit inflation rate goals to stabilize prices and anchor inflation expectations, typically around a 2% target. Exchange rate targeting requires maintaining the domestic currency's value within a specific band relative to a foreign currency, often to promote trade stability and control imported inflation. Both monetary policy regimes influence economic stability, but inflation targeting emphasizes price stability while exchange rate targeting prioritizes currency value stability.

Historical Evolution of Monetary Policy Frameworks

Inflation targeting emerged in the 1990s as central banks, notably the Reserve Bank of New Zealand and the Bank of England, shifted focus towards maintaining price stability through explicit inflation goals. Exchange rate targeting dominated earlier regimes, particularly in the 1980s and 1990s, where countries fixed or closely managed currency values to stabilize trade and control inflation indirectly. The historical evolution reflects a transition from external currency anchors to more autonomous frameworks prioritizing inflation control to enhance economic stability.

Key Objectives: Price Stability vs Currency Stability

Inflation targeting prioritizes maintaining stable consumer prices by setting explicit inflation rate goals, often around 2%, to anchor public expectations and guide monetary policy decisions. Exchange rate targeting focuses on stabilizing the domestic currency's value against a foreign currency or basket of currencies to promote trade competitiveness and reduce exchange rate volatility. Central banks using inflation targeting emphasize long-term price stability, while those adopting exchange rate targeting prioritize currency stability to support economic growth through external balance.

Mechanisms of Inflation Targeting

Inflation targeting stabilizes the economy by setting explicit inflation rate goals, typically around 2%, and adjusting monetary policy tools like interest rates to control inflation expectations. Central banks use forward guidance and inflation forecasts to influence wage-setting behavior and price adjustments, thereby anchoring long-term inflation expectations. This mechanism contrasts with exchange rate targeting by focusing on domestic price stability instead of fixed currency values, allowing greater flexibility in responding to economic shocks.

Mechanisms of Exchange Rate Targeting

Exchange rate targeting stabilizes domestic prices by pegging the national currency to a stable foreign currency or a basket of currencies, reducing exchange rate volatility and anchoring inflation expectations. Central banks maintain this peg by actively intervening in foreign exchange markets, using foreign reserves to buy or sell their own currency to counteract fluctuations. This mechanism constrains monetary policy autonomy but enhances credibility, especially in economies with a history of high inflation or volatile exchange rates.

Advantages and Disadvantages of Inflation Targeting

Inflation targeting provides a clear and transparent framework for monetary policy, anchoring inflation expectations and enhancing macroeconomic stability. It allows central banks to respond flexibly to economic shocks without being constrained by exchange rate fluctuations, promoting long-term growth. However, rigid inflation targets may limit policy tools during supply shocks and can lead to higher volatility in exchange rates, affecting trade competitiveness.

Advantages and Disadvantages of Exchange Rate Targeting

Exchange rate targeting stabilizes a country's currency value by pegging it to another stable currency, fostering predictability in international trade and investment while curbing inflation through external discipline. However, it reduces monetary policy autonomy, limiting a central bank's ability to respond to domestic economic shocks and potentially leading to currency misalignment if the anchor currency faces volatility. Exchange rate pegs can create vulnerability to speculative attacks and require substantial foreign reserves to maintain the fixed rate, posing risks during global financial turbulence.

Case Studies: Successes and Failures Across Countries

Countries adopting inflation targeting like New Zealand and Canada have achieved greater price stability and economic growth by anchoring inflation expectations through transparent monetary policies. In contrast, exchange rate targeting, exemplified by Argentina's currency board in the 1990s, initially curbed hyperinflation but eventually led to economic rigidity and crisis due to loss of monetary policy flexibility. Comparative case studies demonstrate that inflation targeting generally provides more sustainable macroeconomic stability, while exchange rate targeting risks external shocks and sudden devaluations.

Suitability for Emerging vs Advanced Economies

Emerging economies often benefit more from exchange rate targeting due to their higher vulnerability to capital flow volatility and external shocks, which exchange rate stability helps to mitigate. Advanced economies typically prefer inflation targeting as it provides greater flexibility in monetary policy and supports long-term price stability aligned with well-developed financial markets. The choice between inflation targeting and exchange rate targeting depends on factors such as financial market development, economic openness, and the credibility of monetary institutions.

Policy Challenges and Future Outlook

Inflation targeting offers flexibility in monetary policy but faces challenges from external shocks and supply-side disruptions that can destabilize price stability. Exchange rate targeting provides nominal anchor credibility but risks importing inflation and limiting monetary policy autonomy amidst global financial volatility. Future outlooks suggest hybrid approaches and enhanced macroprudential tools to balance inflation control with exchange rate stability while adapting to evolving economic uncertainties.

Inflation Targeting vs Exchange Rate Targeting Infographic

difterm.com

difterm.com