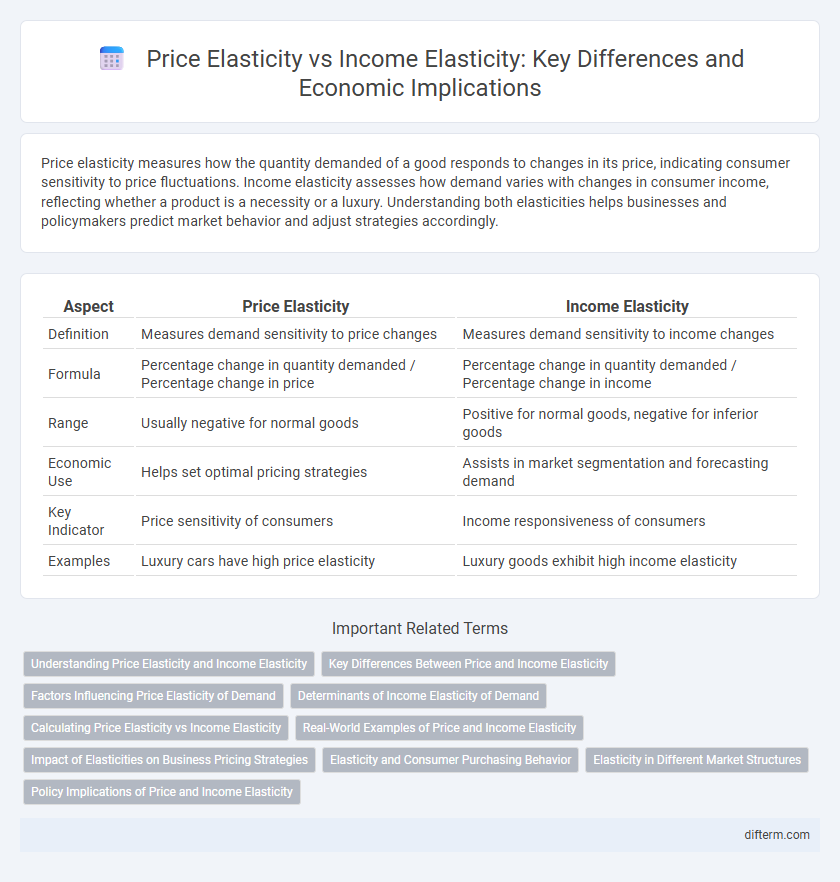

Price elasticity measures how the quantity demanded of a good responds to changes in its price, indicating consumer sensitivity to price fluctuations. Income elasticity assesses how demand varies with changes in consumer income, reflecting whether a product is a necessity or a luxury. Understanding both elasticities helps businesses and policymakers predict market behavior and adjust strategies accordingly.

Table of Comparison

| Aspect | Price Elasticity | Income Elasticity |

|---|---|---|

| Definition | Measures demand sensitivity to price changes | Measures demand sensitivity to income changes |

| Formula | Percentage change in quantity demanded / Percentage change in price | Percentage change in quantity demanded / Percentage change in income |

| Range | Usually negative for normal goods | Positive for normal goods, negative for inferior goods |

| Economic Use | Helps set optimal pricing strategies | Assists in market segmentation and forecasting demand |

| Key Indicator | Price sensitivity of consumers | Income responsiveness of consumers |

| Examples | Luxury cars have high price elasticity | Luxury goods exhibit high income elasticity |

Understanding Price Elasticity and Income Elasticity

Price elasticity measures how the quantity demanded of a good responds to changes in its price, reflecting consumer sensitivity to price fluctuations, while income elasticity gauges demand variation in response to changes in consumer income levels, revealing whether a good is a normal or inferior product. Analyzing price elasticity helps businesses set optimal pricing strategies, whereas understanding income elasticity assists in forecasting demand shifts driven by economic growth or recession. Both elasticities provide critical insights for market segmentation, product positioning, and revenue forecasting within economic frameworks.

Key Differences Between Price and Income Elasticity

Price elasticity measures the responsiveness of quantity demanded to changes in the price of a good, indicating how consumer purchasing adapts to price fluctuations. Income elasticity captures how demand varies with consumer income changes, reflecting shifts in consumption patterns based on economic prosperity. Key distinctions include price elasticity typically being negative for normal goods, while income elasticity can be positive or negative depending on whether the good is normal or inferior.

Factors Influencing Price Elasticity of Demand

Price elasticity of demand is influenced by factors such as the availability of substitutes, necessity versus luxury status, and the proportion of income spent on the good. Products with close substitutes tend to have higher price elasticity because consumers can easily switch if prices rise. Items that constitute a large share of a consumer's budget typically exhibit greater sensitivity to price changes, leading to higher elasticity.

Determinants of Income Elasticity of Demand

Income elasticity of demand depends primarily on the nature of the good, consumer preferences, and the proportion of income spent on that good, with necessities generally showing lower income elasticity compared to luxury items. Changes in consumer income levels influence demand differently based on how essential or discretionary the product is, reflecting varying degrees of responsiveness. Understanding factors such as the availability of substitutes and long-term consumption habits also plays a crucial role in determining income elasticity of demand.

Calculating Price Elasticity vs Income Elasticity

Price elasticity of demand is calculated by dividing the percentage change in quantity demanded by the percentage change in price, indicating how sensitive consumer demand is to price fluctuations. Income elasticity of demand measures the responsiveness of quantity demanded to changes in consumer income, calculated by the percentage change in quantity demanded divided by the percentage change in income. Both elasticities provide critical insights for businesses and policymakers to predict market behavior and adjust pricing or production strategies accordingly.

Real-World Examples of Price and Income Elasticity

Price elasticity measures how the quantity demanded of a good responds to changes in its price, exemplified by gasoline, which has relatively inelastic demand due to limited substitutes. Income elasticity gauges how demand shifts with consumer income changes, as seen in luxury products like high-end electronics, where demand rises significantly with income growth. Understanding both elasticities helps businesses and policymakers predict consumer behavior and adjust strategies amid economic fluctuations.

Impact of Elasticities on Business Pricing Strategies

Price elasticity measures how sensitive the quantity demanded is to changes in price, guiding businesses to adjust prices to maximize revenue without losing customers. Income elasticity reveals how demand varies with consumer income, helping companies tailor pricing strategies for luxury or necessity goods in different economic conditions. Understanding both elasticities enables firms to optimize pricing tactics, targeting market segments effectively and anticipating demand shifts during economic fluctuations.

Elasticity and Consumer Purchasing Behavior

Price elasticity measures how the quantity demanded of a good responds to changes in its price, reflecting consumer sensitivity to price fluctuations. Income elasticity gauges how demand varies with consumer income changes, indicating whether a product is a necessity or luxury. Understanding both elasticities helps businesses forecast consumer purchasing behavior and adjust pricing or marketing strategies to optimize revenue.

Elasticity in Different Market Structures

Price elasticity measures consumer responsiveness to price changes, varying significantly across market structures such as perfect competition, monopoly, and oligopoly. Income elasticity, reflecting demand shifts due to income fluctuations, tends to be higher in luxury markets and lower in essential goods sectors. Understanding these elasticities aids firms in setting optimal pricing and production strategies tailored to market-specific demand sensitivities.

Policy Implications of Price and Income Elasticity

Price elasticity measures consumer responsiveness to price changes, guiding policymakers in designing effective taxation and subsidy policies to either discourage harmful consumption or promote essential goods. Income elasticity reflects variations in demand as consumer income fluctuates, enabling governments to tailor social welfare programs and forecast economic growth impacts on different sectors. Understanding both elasticities helps optimize fiscal policies for balanced economic stability and equitable resource distribution.

Price elasticity vs Income elasticity Infographic

difterm.com

difterm.com