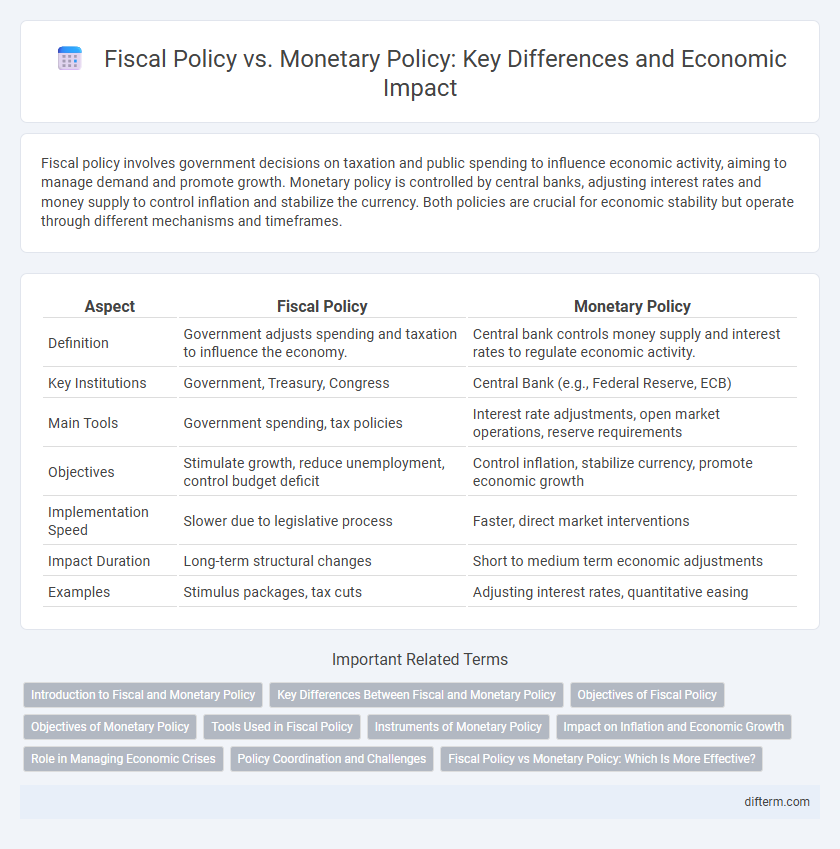

Fiscal policy involves government decisions on taxation and public spending to influence economic activity, aiming to manage demand and promote growth. Monetary policy is controlled by central banks, adjusting interest rates and money supply to control inflation and stabilize the currency. Both policies are crucial for economic stability but operate through different mechanisms and timeframes.

Table of Comparison

| Aspect | Fiscal Policy | Monetary Policy |

|---|---|---|

| Definition | Government adjusts spending and taxation to influence the economy. | Central bank controls money supply and interest rates to regulate economic activity. |

| Key Institutions | Government, Treasury, Congress | Central Bank (e.g., Federal Reserve, ECB) |

| Main Tools | Government spending, tax policies | Interest rate adjustments, open market operations, reserve requirements |

| Objectives | Stimulate growth, reduce unemployment, control budget deficit | Control inflation, stabilize currency, promote economic growth |

| Implementation Speed | Slower due to legislative process | Faster, direct market interventions |

| Impact Duration | Long-term structural changes | Short to medium term economic adjustments |

| Examples | Stimulus packages, tax cuts | Adjusting interest rates, quantitative easing |

Introduction to Fiscal and Monetary Policy

Fiscal policy involves government decisions on taxation and public spending to influence economic activity, targeting growth, inflation, and employment levels. Monetary policy is managed by central banks, controlling the money supply and interest rates to stabilize prices and support economic growth. Both policies serve as essential tools for managing economic performance and mitigating fluctuations in the business cycle.

Key Differences Between Fiscal and Monetary Policy

Fiscal policy involves government decisions on taxation and public spending to influence economic activity, while monetary policy is managed by central banks to regulate money supply and interest rates. Fiscal policy directly affects government budget deficits and surpluses, whereas monetary policy targets inflation control, employment levels, and currency stability. The key difference lies in fiscal policy's reliance on legislative action versus monetary policy's implementation through financial institutions and market mechanisms.

Objectives of Fiscal Policy

Fiscal policy aims to regulate economic activity by adjusting government spending and taxation to achieve stable growth, low unemployment, and controlled inflation. It targets redistributing income to reduce inequality and providing public goods that stimulate economic development. Effective fiscal policy balances budgetary discipline with economic stimulus to support sustainable macroeconomic stability.

Objectives of Monetary Policy

Monetary policy primarily aims to stabilize prices, control inflation, and maintain employment levels by regulating money supply and interest rates. Central banks use tools such as open market operations, reserve requirements, and discount rates to influence economic activity and achieve stable economic growth. Ensuring financial market stability and fostering investor confidence are also critical objectives of monetary policy.

Tools Used in Fiscal Policy

Fiscal policy primarily utilizes government spending and taxation as tools to influence economic activity, aiming to manage aggregate demand and achieve economic stability. By adjusting tax rates, the government can either increase disposable income to stimulate consumption or decrease it to curb inflation. Government expenditure on infrastructure, education, and social programs directly injects money into the economy, driving growth and employment.

Instruments of Monetary Policy

Instruments of monetary policy primarily include open market operations, reserve requirements, and the discount rate, each influencing money supply and interest rates to stabilize the economy. Central banks use open market operations to buy or sell government securities, adjusting liquidity and controlling inflation. Changing reserve requirements alters the amount banks must hold, impacting lending capacity and credit flow in the financial system.

Impact on Inflation and Economic Growth

Fiscal policy influences inflation and economic growth through government spending and taxation decisions, directly affecting aggregate demand and public investment. Monetary policy, managed by central banks via interest rate adjustments and control of the money supply, primarily targets inflation stability and long-term economic expansion by influencing borrowing and spending behaviors. Both policies interplay to stabilize the economy, with fiscal policy often providing immediate stimulus while monetary policy shapes inflation expectations and financial conditions.

Role in Managing Economic Crises

Fiscal policy employs government spending and tax adjustments to directly influence aggregate demand and stimulate economic growth during downturns, playing a crucial role in providing immediate relief and supporting public services. Monetary policy, managed by central banks through interest rate adjustments and money supply control, aims to stabilize inflation and encourage investment by affecting borrowing costs and liquidity. Both policies coordinate to balance short-term economic stabilization with long-term growth, mitigating the impacts of recessions and financial shocks.

Policy Coordination and Challenges

Fiscal policy, involving government spending and taxation, must be carefully coordinated with monetary policy, which controls money supply and interest rates, to achieve economic stability and growth. Challenges in policy coordination arise from differing time horizons, political constraints, and potential conflicts between stimulating demand and controlling inflation. Effective collaboration between finance ministries and central banks is essential to balance economic objectives and respond to shocks efficiently.

Fiscal Policy vs Monetary Policy: Which Is More Effective?

Fiscal policy, involving government spending and taxation, directly influences aggregate demand and can target specific sectors or social outcomes, making it effective during recessions or economic crises. Monetary policy, controlled by central banks through interest rates and money supply, adjusts overall liquidity and inflation but may face effectiveness limits during liquidity traps or near-zero interest rates. Empirical studies suggest fiscal policy tends to have a stronger short-term impact on economic growth and employment, while monetary policy is more suitable for managing inflation and long-term stability.

Fiscal policy vs Monetary policy Infographic

difterm.com

difterm.com